Share the post "What is the Worst Case Scenario for Bonds?" Bonds are a very confusing financial instrument for most investors. This is especially true for individuals. As I’ve explained before, one of the main reasons why individual investors have performed so poorly over the last 30 years is the result of not owning bonds and instead either being too bearish about stocks (at the wrong times) or holding too much cash (all of the time). The result is that many investors have missed out on the greatest risk adjusted bull market in history. We can’t blame individual investors for this though. In fact, the professional investment community probably owes you an apology for reinforcing the myth that rising rates mean negative bond returns. We know this is categorically false and yet we continue to see professional investment managers and pundits argue that bonds are very scary. For instance, we know that interest rates rose from 2% to 15% from 1940-1980 and that the 10 year T-Bond generated an average annual return of 2.85%. The investor who owned a portfolio of constant maturity 10 year T-Bonds did not lose money during this period. In fact, they more than doubled their money! In addition, we know that the 1970’s are not a good proxy for today’s environment yet this scar continues to scare many people out of bonds.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

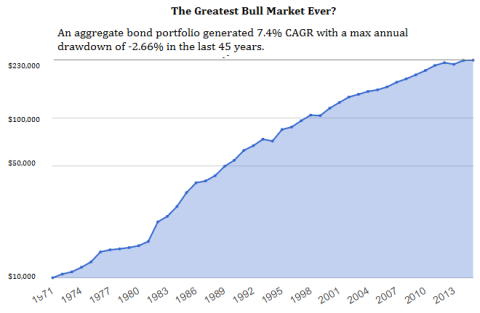

Bonds are a very confusing financial instrument for most investors. This is especially true for individuals. As I’ve explained before, one of the main reasons why individual investors have performed so poorly over the last 30 years is the result of not owning bonds and instead either being too bearish about stocks (at the wrong times) or holding too much cash (all of the time). The result is that many investors have missed out on the greatest risk adjusted bull market in history.

We can’t blame individual investors for this though. In fact, the professional investment community probably owes you an apology for reinforcing the myth that rising rates mean negative bond returns. We know this is categorically false and yet we continue to see professional investment managers and pundits argue that bonds are very scary. For instance, we know that interest rates rose from 2% to 15% from 1940-1980 and that the 10 year T-Bond generated an average annual return of 2.85%. The investor who owned a portfolio of constant maturity 10 year T-Bonds did not lose money during this period. In fact, they more than doubled their money!

In addition, we know that the 1970’s are not a good proxy for today’s environment yet this scar continues to scare many people out of bonds. First, as I’ve emphasized in the past, this environment does not resemble the 1970’s in many ways. But even if rates rise like they did in the 1970’s this will still not resemble today’s environment because an environment of high and rising rates is very different from an environment of low and rising rates.¹

This brings us to the confusing topic of the day – bond convexity. Without getting too deep in the weeds, we should recognize something about bonds – as interest rates rise bond duration declines (bond duration is the bond’s price sensitivity to interest rate changes so, a 1% rise in rates will result in a 5% loss for a bond with a duration of 5). In English, that basically means that a 1% rise in interest rates has a bigger impact on long maturity low interest rate bonds than it does on than it does on long maturity high interest rate bonds. Let’s look at an example here for more clarity.

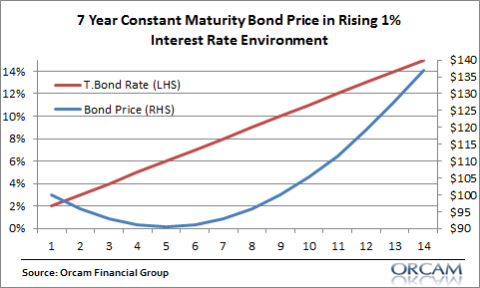

Let’s say you buy a 7 year constant maturity bond portfolio yielding 2% in year one.² Each year interest rates rise by 1% until they reach 15 % like they did in 1981. Remember, this is a crazy extreme example, but useful for illustrative purposes. The image below shows interest rates (the red line) rising from 2% to 15% in increments of 1% per year. The blue line shows the cumulative price (yield plus price change due to interest rate increase) of the 7 year bond portfolio.

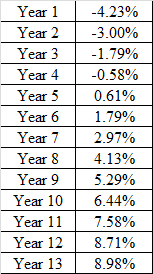

What happens here is really important because the constant maturity bond portfolio gets dinged pretty bad at first. I’ve shown  the annual price changes at the right. Because the bond is more sensitive to rising rates when rates are low the 1% increase in rates has a big impact upfront, but then it actually has a positive impact as rates rise. In other words, as rates rise a medium duration constant maturity bond portfolio does not necessarily fall in price. It actually rises in price because the higher interest rate more than offsets the impact of the price decline. This should seem obvious to everyone, but it’s not what we tend to think of when we hear that rising interest rates mean falling bond prices.

the annual price changes at the right. Because the bond is more sensitive to rising rates when rates are low the 1% increase in rates has a big impact upfront, but then it actually has a positive impact as rates rise. In other words, as rates rise a medium duration constant maturity bond portfolio does not necessarily fall in price. It actually rises in price because the higher interest rate more than offsets the impact of the price decline. This should seem obvious to everyone, but it’s not what we tend to think of when we hear that rising interest rates mean falling bond prices.

The point of this exercise is to put the risk of bonds in the right perspective. Yes, if rates rise sharply you’ll almost certainly lose purchasing power in your bonds, however, you will also earn a nominal return better than cash if held to maturity. But we should also remember that an aggregate bond portfolio with a constant maturity of about 7 years will not necessarily experience traumatic losses. In fact, even in our worst case scenario the 7 year bond only declines by a total amount of 9.6% at its low point.³ Over the course of our entire 14 years that constant maturity bond portfolio actually generated 2.85% per year. Not bad for a worst case scenario!

Anyhow, this has gotten long and if you’ve made it this far then congratulations. You must be very bored today or you have too much time on your hands. I personally would have clicked over for an update on how many stupid things Donald Trump said today. Or perhaps you have been enjoying this story about the gorilla and his 4 year old friend. Me personally, I am exploring the Taylor Swift break-up because, well, you just never know.

Any anyhow, here are the key takeaways:

- Rising rates do not necessarily mean negative returns for bonds!

- The 1970’s are not a good proxy for the current environment. My guess (and I am a very good guesser) is that interest rates are likely to remain lower for longer, but that any increase in rates will be gradual and likely look more like the 1940’s, 50’s and 60’s than a sharp hyperinflationary rising rate environment.

- The fact that interest rates are low does not mean they can’t go lower and generate higher returns for bonds. In fact, investors in Europe buying negative yielding bonds are expecting this.

- A Medium duration bond portfolio (such as a bond aggregate) should not expose you to significant loss of principal even in the case of a sharply rising interest rate environment.

- Bonds are unlikely to generate the same level of returns they did in the last 45 years rendering them an inferior, but still sufficient portfolio hedge.

- The 60/40 of the future will not look much like the 60/40 of the past.

- If you insist on holding very long duration bonds for the next few decades then everything I’ve said above is out the window, may the Lord have mercy on your soul and I wish you the very best of luck because you will need it to sleep at night.

¹ – See, “The 1970’s Are Not a Good Proxy for a Bond Bear Market”

² – I used a 7 year constant maturity bond because that’s pretty close to the Barclays Aggregate Bond Index. Of course, if you own a longer duration bond portfolio these numbers will not look nearly as friendly. I also assumed you were buying and holding this portfolio which is not realistic given that many investors will be contributing or reinvesting interest payments.

³ – Some people might argue that this is a good argument in favor of holding individual bonds, however, I would disagree and argue that this is not a flaw in bond funds, but rather a misunderstanding of how they reflect an investor’s goals. The individual bond holder would have to repurchase new individual bonds every year in order to maintain the same constant maturity portfolio. This would result in greater single entity risk, higher costs and lower average returns. It should also be noted that the 7 year individual bond purchaser only holds a 7 year bond for a brief instant in time. After all, as time goes on that bond slowly becomes a 6 year bond, 5 year bond, 4 year bond, etc.

Did you have a comment or question about this post, finance, economics or your love life? Feel free to use the discussion forum here to continue the discussion.*

*We take no responsibility for bad relationship advice.