Share the post "Three Things I Think I Think – Bubbles Edition"Here are some things I think I am thinking about:1) Is there an emerging global housing bubble? Here’s a nice perspective from UBS on the state of the global housing market. They provide a Global Real Estate Bubble Index that puts the highest risk markets in perspective. Their conclusions – there isn’t widespread sign of a bubble as there was in 2006, but there are pockets and cities that are unusually risky. The top names on the list include Toronto, Stockholm, Munich, Vancouver, Sydney, London and Hong Kong. Awesome places to live. Err, rent?2) Speaking of housing bubbles – here’s an interesting paper from 2015 on the causes of housing bubbles. Their most interesting conclusion – they find almost no correlation

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Three Things I Think I Think – Bubbles Edition"

Here are some things I think I am thinking about:

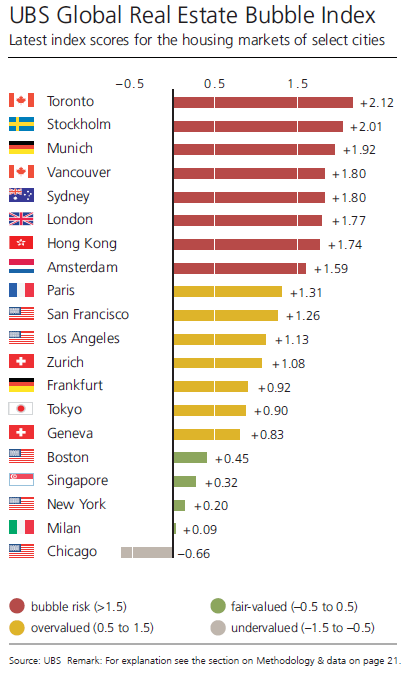

1) Is there an emerging global housing bubble? Here’s a nice perspective from UBS on the state of the global housing  market. They provide a Global Real Estate Bubble Index that puts the highest risk markets in perspective. Their conclusions – there isn’t widespread sign of a bubble as there was in 2006, but there are pockets and cities that are unusually risky. The top names on the list include Toronto, Stockholm, Munich, Vancouver, Sydney, London and Hong Kong. Awesome places to live. Err, rent?

market. They provide a Global Real Estate Bubble Index that puts the highest risk markets in perspective. Their conclusions – there isn’t widespread sign of a bubble as there was in 2006, but there are pockets and cities that are unusually risky. The top names on the list include Toronto, Stockholm, Munich, Vancouver, Sydney, London and Hong Kong. Awesome places to live. Err, rent?

2) Speaking of housing bubbles – here’s an interesting paper from 2015 on the causes of housing bubbles. Their most interesting conclusion – they find almost no correlation between Monetary Policy and housing bubbles. I find this a little hard to believe. Yes, interest rates are just one variable in the decision to purchase a home, but they’re a relatively important one. So it would make sense that very low rates spur housing demand and high rates reduce housing demand. Monetary Policy might not be the primary driver of house price changes, but no impact? No way.

I’ve always thought of it like this – a mortgage is an implicit short bet on the interest rate (bond) market. Houses, stocks and bonds are our biggest assets. In an environment where rates are rising the real price of houses is likely to decline because that short bet becomes a lot less attractive in relative terms. That is, the higher rates add demand from investors into the bond market looking for a safe nominal return. And some investors actually get pushed out of their mortgage (bond short) in many cases such as variable rate loans. The inverse happens in a falling rate environment. This means that non-financial assets like homes become a much more attractive relative asset class as rates fall and much less attractive as rates rise. So the changes in interest rates create a portfolio rebalancing effect. And the long-term real house price data meshes perfectly with this data.

Then again, as I often note, the Fed doesn’t really control all interest rates. They control the overnight rate and basically just chase the other market rates trying to predict where they will go. And they use the overnight rate to try to impact all those other rates. But this isn’t a case where the person is always walking the dog. The dog mostly walks the person. The Fed can’t control the rate of inflation even if they can influence it to some degree. So I guess you could say that the state of the economy will drive rates and the Fed can do things that will tinker with bank and household balance sheets that might make them more inclined to borrow or not. But maybe it is a mistake to overstate the impact of the Central Bank on housing….

3) Trump’s Big Tax Cut. Here’s the first broad analysis of the Trump tax plan from TPC:

“His proposal would cut taxes at all income levels, although the largest benefits, in dollar and percentage terms, would go to the highest-income households. Federal revenues would fall by $6.2 trillion over the first decade before accounting for added interest costs. Including interest costs, the federal debt would rise by $7.2 trillion over the first decade and by $20.9 trillion by 2036.”

I can’t say I am surprised. I’ve been saying all along that Trump would cut taxes and bust the deficit wide open. This is good in that the US economy probably needs a bigger deficit to satisfy the demand for safe assets, but this really isn’t the best way to run a bigger deficit. As Noah Smith notes over at Bloomberg, the evidence on this is pretty well established – cutting taxes for the super wealthy doesn’t trickle down to the rest of the economy like some people think. Oh well. I guess it’s better than nothing….

Share the post "Three Things I Think I Think – Bubbles Edition"