Over the course of my career I’ve endured endless Federal Reserve conspiracy theories. I’ve known people who stayed away from the stock market for the entirety of the last 20 years because they think the Fed caused the Nasdaq bubble, then inflated the housing bubble and then inflated the stock market with QE. But here’s the problem with that – this is mostly politics masquerading as pseudoscience. I’ve done a tremendous amount of work describing how the Federal Reserve works. The main goal of that work is to separate the ideology from the empirical evidence. I think of the world much like an engineer might look at how a plane flies. First principles rule everything around me. Now, when it comes to the Fed you have to be really careful because these can be the most dangerous narratives

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Over the course of my career I’ve endured endless Federal Reserve conspiracy theories. I’ve known people who stayed away from the stock market for the entirety of the last 20 years because they think the Fed caused the Nasdaq bubble, then inflated the housing bubble and then inflated the stock market with QE. But here’s the problem with that – this is mostly politics masquerading as pseudoscience.

I’ve done a tremendous amount of work describing how the Federal Reserve works. The main goal of that work is to separate the ideology from the empirical evidence. I think of the world much like an engineer might look at how a plane flies. First principles rule everything around me.

Now, when it comes to the Fed you have to be really careful because these can be the most dangerous narratives since they’re so politically charged. People despise the Federal Reserve because it’s viewed as this big money printing manipulation machine. But at its core the Fed is just a big clearinghouse that helps interbank payments settle. They exist because private banks are bad at clearing payments during crises so we used to get recessions that would then turn into depressions (like 1907 or the entire 1800s) just because bankers turn into scaredy pants wimps during financial panics. 2008 was evidence that the Fed is fantastic at this primary role. They kept the payment system working when banks were on the verge of cratering.

This payment clearing role is never talked about in the mainstream media because it gets overshadowed by things like interest rate maintenance and QE. These narratives usually involve the idea that the Fed is “manipulating” interest rates and “printing money” via QE. I’ve done my fair share of griping at the Fed over the years and I certainly don’t like a lot of what they do, but these narratives are usually overblown for reasons I’ve discussed before: 1. The Fed controls the overnight rate on reserves, but doesn’t really control most interest rates; and 2) QE isn’t really money printing in any useful sense.

But there’s been an intermingled dangerous narrative in there as well – this idea that the stock market rally has been driven mainly by QE and the Fed. This one is particularly appealing because it seems logical – the Fed said in 2009 that they wanted to drive asset prices higher by printing money. So they print up a bunch of money, remove T-Bonds and force people into other higher risk assets. It makes total sense.

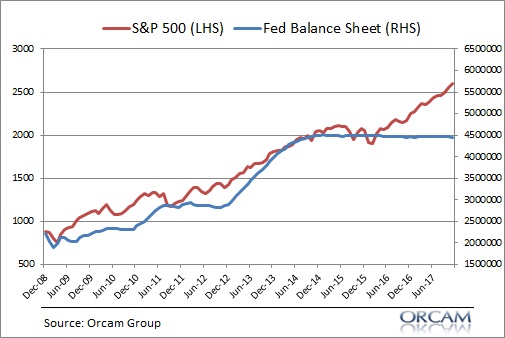

For years this narrative was accompanied by a chart showing the S&P 500 on a manipulated axis relative to the Fed’s balance sheet. It all added up! But then a funny thing happened around 2015 – this relationship started to collapse as the Fed stopped its asset purchases and the market worked higher and higher.²

There’s more to this story though so you might not be convinced yet. So I’ll keep blabbering on here. There’s a few inconsistencies that make the Fed balance sheet and stock correlation narrative hard to believe even if you don’t buy the breakdown in the aforementioned correlation:

- You must believe that interest rates are lower than they otherwise would be. This is the biggie because it drives the whole conclusion around QE and its impact. If rates are indeed lower because of QE then that would lead to a portfolio rebalancing and higher stock prices and bond prices. But the problem with this idea is that inflation is and remains low. If QE had worked inflation would be high which means that rates would be higher. But rates have remained low because inflation has remained low so one has to wonder if rates are low because the Fed is keeping rates low or if rates are low because inflation and growth are low. The latter clearly appears right. So if rates are low because growth is low then there’s no reason to believe the idea that the Fed is manipulating rates lower than they otherwise would be. Rates are low because the stagnant state of the economy says they should be low! This is a bunker buster for the theory that QE drove stock prices higher because if QE worked then rates should actually be LOWER than they are today because the economy would be that much weaker. In other words, the reach for yield would be even stronger without QE!

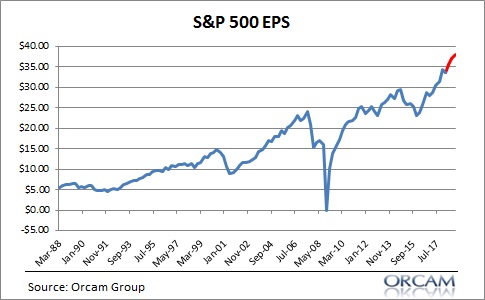

- Earnings Per Share have boomed since 2008. So, in order to believe that the Fed drove the stock market rally you must assume that the Fed caused profits and earnings per share to rise. That is a stretch since the mechanisms through which this occurred are weak. Now, in fairness, I will say that QE1 probably caused a big boost to profits because that substantially altered bank balance sheets. There is no question that this helped improve profits and earnings. But the returns have been diminishing ever since and I would argue that the correlation between stocks and the Feds balance sheet has been overblown for most of the bull market.

The reason this sort of stuff bothers me so much is because it’s mostly politics and ideology leading people to bad decisions. I wonder how many people have completely missed the stock market rally because they thought it was all some fake Fed driven manipulation? Think of how much worse off people are because they’ve been sitting on the sidelines believing in some manipulation conspiracy theory all these years? Meanwhile, some fearmongering newsletter writer is on the fast track to retirement because he sold you a scary story in exchange for your retirement money.

Don’t get me wrong. There are perfectly logical reasons to be skeptical of the huge bull market at this stage (like valuations). And there are plenty of reasons to dislike what the Fed does. Heck, there are almost certainly behavioural impacts here and I am downplaying the Fed’s impact on markets to some degree. But when we’re trying to explain and understand the state of the world we need to be skeptical of politically motivated narratives coming from people who sell fear in exchange for dollars. Sadly, that’s a big part of what Fed narratives are all about.

¹ – This chart shows actual and expected operating EPS for the S&P 500 on a quarterly basis.

² – Here’s a footnote inside a footnote for you. Common responses to this chart will be: “But the ECB and BOJ are also implementing QE!”. Sure, but that doesn’t explain why S&P EPS is surging (see footnote 1). After that response you might be inclined to say: “But it’s all cheap debt financed buybacks driving the EPS.” Buybacks have contributed, but they’re certainly not the only driver or the main driver.³ And let’s circle back to my earlier point on rates – they’d be low whether QE was implemented or not. In fact, if you believe QE worked then rates would have been even lower without Fed intervention!

³ – We’re going deeper into the Matrix. Here’s a footnote inside a footnote inside a footnote. Many people don’t know this, but the S&P 500 actually adjusts for share counts so the buyback effect is muted. See This one by Howard Silverblatt.