Share the post "Are Index Funds Risky for Corporate Governance?"Here’s a provocative piece in today’s WSJ about index funds and how they are bad for corporate governance. This is one of many articles in a long line of attacks on index funds in recent years. The other arguments, generally trotted out by high fee active managers getting crushed by the rise of indexing, aren’t all that convincing and at times totally wrong, but this one is intriguing so I wanted to explore it some more.¹The basic argument is that index fund companies will gain so much market share that they control the voting rights for the companies in the index. But index funds have passive investors who don’t really care about corporate governance at the entity specific level so these index fund owners aren’t actually

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Are Index Funds Risky for Corporate Governance?"

Here’s a provocative piece in today’s WSJ about index funds and how they are bad for corporate governance. This is one of many articles in a long line of attacks on index funds in recent years. The other arguments, generally trotted out by high fee active managers getting crushed by the rise of indexing, aren’t all that convincing and at times totally wrong, but this one is intriguing so I wanted to explore it some more.¹

The basic argument is that index fund companies will gain so much market share that they control the voting rights for the companies in the index. But index funds have passive investors who don’t really care about corporate governance at the entity specific level so these index fund owners aren’t actually influencing corporate governance in the same way that individual stock pickers and corporate activists do. This is bad because it could result in our corporations behaving badly or being run less efficiently.

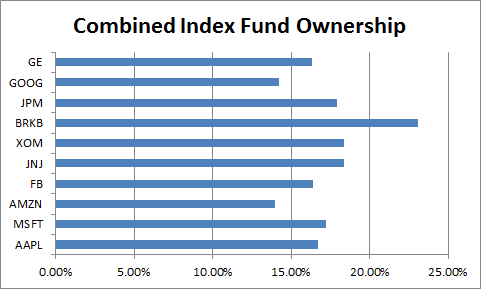

That makes perfect sense. But let’s look a little closer. The article cites Vanguard, BlackRock and State Street as the three big problems in the index world. They are the ones gobbling up all the market share. But when you look at the amount of ownership these companies have it’s not actually that much. For instance, here’s their combined ownership stakes in the 10 largest entities in the USA:

The amounts range from 14-23%. Not nothing. But it’s also not like they’re majority owners or even anything close. But there’s a more interesting point at work here – the index funds are actually doing exactly what their shareholders want. That is, they don’t believe in the idea that a small number of controlling voters are very good at predicting the future and steering corporate governance. So let’s say that index funds ate the whole world and no one else could own the individual shares of these companies. Well, in that case the corporations would simply be run by their executives and they wouldn’t be influenced all that much by what outside secondary market investors think. Whether this is good or bad is up for debate, but it’s wholly in-line with what the indexing shareholders basically believe.

This point is further reinforced by the performance of activist hedge funds. Since HFRI established the Event Driven Activist Index in November of 2007 the total return of the activist index has been 30.7%. That compares with a 110% total return in the S&P 500. These activists don’t seem to be influencing their portfolios in such a great way. So we have to ask ourselves if all this corporate governance influence by outside investors is even a good thing in the first place? Based purely on the last 10 years of performance the evidence points to a resounding no.

This further meshes with my general view that secondary market investors are simply savers and not investors. That is, secondary market participants are generally professionals at something other than understanding the companies they own in their savings portfolio. And even the professionals, who get paid to understand these companies, have a long track record of failing to outperform the market. So it has to make us wonder if it’s even a good idea to have secondary market investors so involved in the first place? Maybe we should spend more time doing what we do best and letting the established executives, boards and leaders at these firms focus on what they do best?

In any case, I see this as another “problem” that is being greatly exaggerated in the name of index fund hatred.

¹ – I guess I’ve become somewhat of an apologist for the index community. You can read some of my greatest hits on this topic below:

Share the post "Are Index Funds Risky for Corporate Governance?"