Share the post "Is a Taylor Tantrum on the Horizon?"Back in 2013 bond markets were jolted by the potential that the Fed would unwind its balance sheet more quickly than previously believed. The basic thinking was that QE puts downward pressure on interest rates so unwinding QE will put upward pressure on interest rates. That isn’t quite what happened, but markets are gonna market.Fast forward to 2017 and interest rates are only a bit higher than they were before the Taper Tantrum. I’ve been pretty bullish (and right) on bonds since the Trumper Tantrum last year, but I find the current bond market complacency a little bit odd because there’s a very real chance that John Taylor is about to head the Fed. Trump has apparently narrowed his choices down to Jerome Powell and John Taylor. I

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Share the post "Is a Taylor Tantrum on the Horizon?"

Back in 2013 bond markets were jolted by the potential that the Fed would unwind its balance sheet more quickly than previously believed. The basic thinking was that QE puts downward pressure on interest rates so unwinding QE will put upward pressure on interest rates. That isn’t quite what happened, but markets are gonna market.

Fast forward to 2017 and interest rates are only a bit higher than they were before the Taper Tantrum. I’ve been pretty bullish (and right) on bonds since the Trumper Tantrum last year, but I find the current bond market complacency a little bit odd because there’s a very real chance that John Taylor is about to head the Fed. Trump has apparently narrowed his choices down to Jerome Powell and John Taylor. I suspect Yellen is out because, well, Trump is gonna Trump and that means clearing out anything Obama.¹

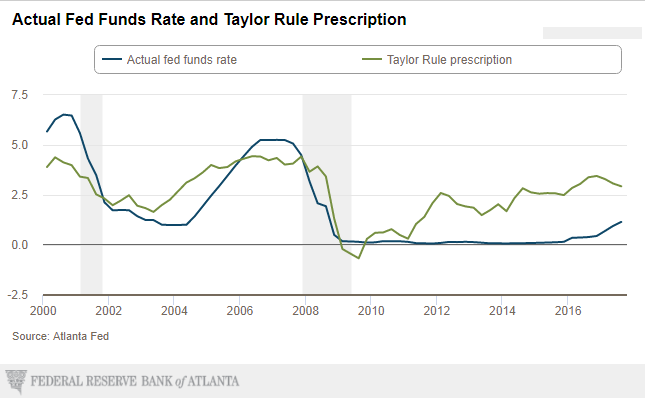

Now, this might not seem that important, but a Taylor Fed could be very different from what we’ve become accustomed to in recent years. You see, Taylor’s most famous for his “Taylor Rule” on interest rates. And the Taylor Rule has consistently called for higher rates than where the Fed has been over the last 10 years. Here’s a quick look at it:

What you’ll notice there is that there’s about a 2% difference between the current Fed Funds Rate and where Taylor’s Rule says the overnight rate should be. So, it’s pretty interesting that bond markets are so ho-hum about the current environment because there’s a very real chance that Taylor will get nominated and his hawkish views could dominate the Fed’s policy moves in the coming years.

It’s an interesting thing to be thinking about from the bond market’s perspective because a sharp rise in future expectations for short-term rates could reverberate through the yield curve in the coming months. It could even cause a “Taylor Tantrum”. Now, I don’t think Taylor’s Rule is necessarily more accurate than the Fed’s current posture.² In fact, I’ve been pretty clear that I think interest rates are low for practical reasons. And I am definitely in the camp that believes inflation and interest rates will be “lower for longer”, but this does appear like a short-term risk that almost no one is talking about….

NB – I know we don’t want to be thinking about financial markets in excessively short time horizons, but the reality of today’s bond market is that we are all necessarily short-term because it’s practically insane to hold a 30 year T-Bond to maturity given the degree of interest rate risk one has to take. So you could say that we’ve all been turned into bond “traders” in a low rate environment where interest rate risk is unusually high. Of course, you could just hold a bond aggregate (which isn’t really an aggregate), but that has its own problems.

¹ – Unless you’re trying to clear out Obamacare. That is apparently much harder to do than some people thought.

² – In fact, one could argue that Taylor’s Rule and his hawkish view were very wrong about the future of inflation as can be seen in this Q&A from 2010 when he predicted that QE would eventually lead to high inflation.

Share the post "Is a Taylor Tantrum on the Horizon?"