The Global Financial Asset Portfolio¹ is a simple approximation of the world’s current financial asset allocation. It is, in my opinion, the logical starting point for anyone trying to build a diversified portfolio because it is the closest reflection of “the market portfolio”. In other words, if you were a true adherent of the Efficient Market Hypothesis this portfolio would be a good reflection of the current market capitalization of the world’s financial assets. One of the nice things about this portfolio is, despite the complexity in accurately quantifying these assets in real-time, the GFAP can be constructed in a fairly simple manner using 4 low cost index funds. Yes, we could make it much more complex in an attempt to make it more accurate, but when it comes to investing I think

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

The Global Financial Asset Portfolio¹ is a simple approximation of the world’s current financial asset allocation. It is, in my opinion, the logical starting point for anyone trying to build a diversified portfolio because it is the closest reflection of “the market portfolio”. In other words, if you were a true adherent of the Efficient Market Hypothesis this portfolio would be a good reflection of the current market capitalization of the world’s financial assets.

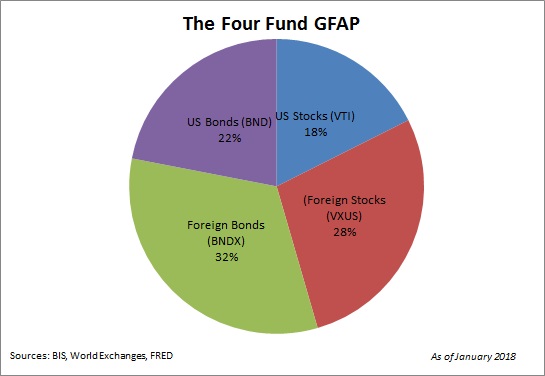

One of the nice things about this portfolio is, despite the complexity in accurately quantifying these assets in real-time, the GFAP can be constructed in a fairly simple manner using 4 low cost index funds. Yes, we could make it much more complex in an attempt to make it more accurate, but when it comes to investing I think we can all agree that simplicity beats complexity.

That said, here’s the 2018 allocation of the GFAP:

That’s 46% stocks and 54% bonds. It’s a bit different from last year’s allocation in large part because the stock allocation is 3% higher thanks to the big move in stocks.

Now, I find this portfolio fascinating (and flawed) for several reasons:

- It tends to be procyclical. In other words, as the stock market expands so too does the size of the stock component relative to the bond market. This means that a EMH believer is procyclically exposed to greater risk as equities become more and more of the aggregate holdings. They are exposed to the greatest amount of equity market risk when they are their absolute riskiest (typically late in a market cycle).

- It is riskier than it appears. As Risk Parity approaches show us, you can be overweight equity market risk even when you’re underweight equities. This is due to the fact that the equity market slice will expose the portfolio to the majority of its negative volatility. This can make the nominal weighting of the GFAP appear like something it is not thereby making it riskier for certain risk profiles than it truly is.

- It owns bonds that look like stocks. The EMH believer owns a ton of high risk bonds which are actually quite a bit like stocks. We want to own bonds in a portfolio because they hedge equity market risk and act as a very cheap form of portfolio insurance during panics. Therefore, owning bonds that act like stocks will tend to be counterproductive. For instance, in 2008 junk bonds and emerging market bonds cratered in value because they are essentially stocks in drag. As I’ve explained before, all bonds are not created equal and even though we call some instruments “stocks” and some instruments “bonds” they can be much more similar than we might think.

I think it’s smart to start any asset allocation process with the GFAP. But every investor is different and because there are obvious flaws in the GFAP that make it inappropriate for certain investors, it’s okay to sin a little and deviate from the GFAP. But if you wanted to keep it really simple and clean it’s hard to go wrong with the GFAP.

¹ – See here for more specifics on the GFAP and its construction.