There’s a lot of chatter out there about rising interest rates and “normalizing” rates. As I’ve written about before, I think most of these fears are a case of short-termism being way overblown.¹ But I want to put things in some perspective and show you a scenario analysis of how things might look if bond yields do jump a bit and “normalize”.² To run this scenario analysis I want to look back at the period from 1956 to 1970 when rates jumped from 2.9% to 7.78%. With the 10 year t-note yield at 2.85% as I type this is a perfect starting point and an actual representation of rising rates. Now, I think rates rising to 7.8% would be shocking, but you never know. While I think the 1970s are a bad proxy for this environment the risk can’t be entirely discounted.³ So let’s dive in. If you own

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

There’s a lot of chatter out there about rising interest rates and “normalizing” rates. As I’ve written about before, I think most of these fears are a case of short-termism being way overblown.¹ But I want to put things in some perspective and show you a scenario analysis of how things might look if bond yields do jump a bit and “normalize”.²

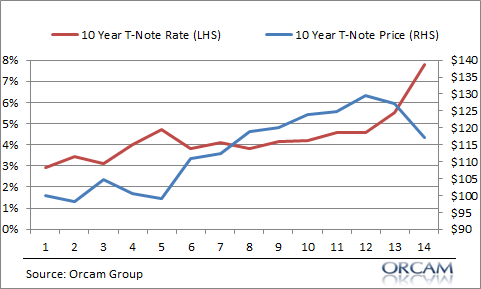

To run this scenario analysis I want to look back at the period from 1956 to 1970 when rates jumped from 2.9% to 7.78%. With the 10 year t-note yield at 2.85% as I type this is a perfect starting point and an actual representation of rising rates. Now, I think rates rising to 7.8% would be shocking, but you never know. While I think the 1970s are a bad proxy for this environment the risk can’t be entirely discounted.³ So let’s dive in.

If you own a bond ETF as most bond investors increasingly should then you basically own a less organized version of a bond ladder because the whole portfolio is diversified across varying maturities. That means the bond portfolio is constantly maturing and evolving across time. As yields rise the maturing bonds will be reinvested at higher rates so you are effectively holding the portfolio’s underlying bonds to maturity. This means there is very little long-term principal risk assuming you are actually holding the instrument across its average effective maturity.

Of course, in the short-term the bond ETF’s price will be volatile because its underlying holdings will fall in value in the short-term while it waits to accrue its interest income. But here’s some perspective on how this played out in a 10 year T-Note portfolio during this period. Had you bought a constant maturity 10 year T-Note ETF in 1956 your portfolio grew to $116 by 1970. Not great, but also not the nightmare that many investors portray rate increases to be.

But you should never own just bonds in a portfolio. As I explained in my white paper on portfolio construction you own bonds for a specific reason – to hedge your stock market risk. They’re not there to generate high returns or real returns. They are just a cheap form of insurance around your equity slice. That’s it! So let’s change the scenario here because I actually think that bonds are increasingly important to investors when stock valuations are high.

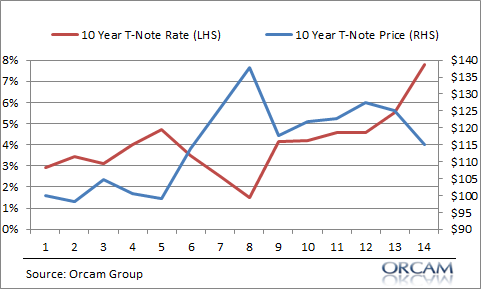

What I’ve done in the second scenario analysis is take a 10 year T-Note and show what happens if yields collapse in years 5-8 to 1.5%. Keep in mind we’re still ending up in the same place at 7.8% yields in 1970. But this simulates a deflationary economic decline in year 5. You’ll notice that bond prices rise temporarily and then fall again as rates rise. Again, not a great result, but not a nightmare either.

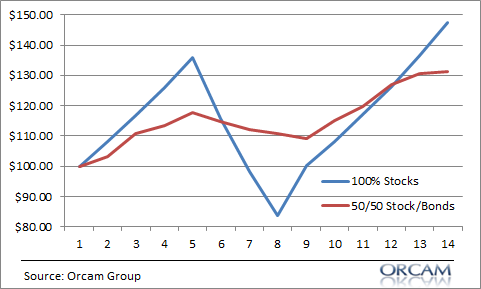

Let’s assume that the stock market does 8% per year over this same period, but falls 15% in years 5, 6 and 7 and then rises 20% in year 8 before continuing its 8% growth. We’re trying to simulate a brief deflationary scare kind of like a blend of the tech bust and the financial crisis.

First let’s look at this scenario as if you hate bonds and you’ve totally bought into the idea that rates must rise and bonds are doomed so you go 100% stocks. In that case your portfolio rises to $147 by 1970. That’s a 2.8% annualized return with a pretty brutal bear market in the middle. Not bad all things considered.

But if you’d diversified across the bonds you’d have grown the portfolio to $131, but you’d have substantially reduced the volatility of the portfolio. So your reduced anualized return of 2% comes with a much lower degree of behavioral risk because you largely avoid the brutal decline in the stock market along the way. In other words, your bonds hedged your equity risk very nicely.

Of course, the all stock portfolio is the one that most people will say they want to own here because the end result is better. But the all stock portfolio is also the one that exposes you to a lot more behavioral risk. And I know from decades of experience seeing people’s behavior in the markets that it’s the bear markets that do the most damage to people’s portfolios because that’s when they make all the big mistakes. In other words, portfolio 2 will generate a marginally worse result, but it’s the portfolio you’re likely to stay invested in when things go south. And that’s why you diversify even if you are worried that rates are going to rise.

¹ – See, “Rising Rates Don’t Necessarily Mean Falling Bond Prices”

² – See, “What is the Worst Case Scenario for Bonds” if you want an even more extreme scenario analysis for the bond market.

³ – See, “5 Reasons Today’s Environment isn’t Like the 1970s” and also “Why the 1970s are a Bad Proxy for the Bond bear Market”.

NB – This scenario assumes inflation is rising which is obviously bad for stocks and bonds in real terms. Oh well.