Warren Buffett has become a big advocate of index funds in the last decade or so. Which is interesting because he does not eat his own cooking when it comes to this advice. Instead, Berkshire continues to own a huge amount of public companies. It’s especially odd in the wake of his index fund bet since Berkshire Hathaway also undperformed the index fund. I’ve called this a contradiction over the years and it has angered a lot of Buffett’s stock picking disciples. But I think it’s a topic that is increasingly important as Berkshire grows and looks more like an index fund. In his most recent shareholder letter Buffett argued that he’s having a hard time finding companies that are reasonably priced. But this “overvalued” market has been an issue for well over a decade as valuations have

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Warren Buffett has become a big advocate of index funds in the last decade or so. Which is interesting because he does not eat his own cooking when it comes to this advice. Instead, Berkshire continues to own a huge amount of public companies. It’s especially odd in the wake of his index fund bet since Berkshire Hathaway also undperformed the index fund. I’ve called this a contradiction over the years and it has angered a lot of Buffett’s stock picking disciples. But I think it’s a topic that is increasingly important as Berkshire grows and looks more like an index fund.

In his most recent shareholder letter Buffett argued that he’s having a hard time finding companies that are reasonably priced. But this “overvalued” market has been an issue for well over a decade as valuations have soared and remained elevated. It’s been a rather horrific period for value investors.

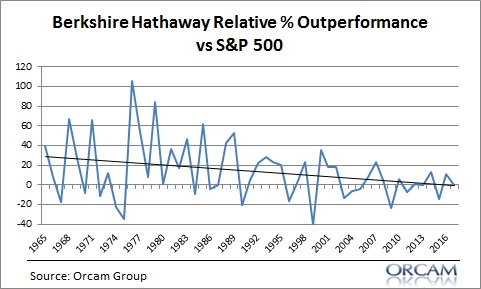

Buffett is not immune to this underperformance. In the last ten years there has been a marked change in the relative outperformance of Berkshire stock compared to the S&P 500:

By my calculations this decline in performance is at least partially due to the public company holdings which have underperformed the S&P 500 by 2% per year over the last decade.

This is nothing new. Berkshire stock has underperformed the S&P 500 since 2008. If I am right that the public companies are dragging relative performance then it means that the rest of the business is doing relatively well. In other words, he should continue picking private companies the way he always has. But it makes one wonder if the public markets haven’t become too competitive or too small in a relative sense for Buffett to generate the same outperformance he once could.

Of course, this is something Buffett has mentioned in the past – Berkshire is so large that they can’t reasonably expect to generate a lot of outperformance. But the uneven performance of the public stock positions beg the question – if it’s harder to find outperforming companies of a meaningful size then why isn’t Buffett just pouring the extra cash into the S&P 500 index like he recommends for everyone else?

NB – I know I am guilty of high financial crimes here with my criticism of Warren Buffett’s stock picking prowess. I do not mean to anger the stock picking Gods, but…wait, yes, that’s exactly what I am trying to do. I want to anger the stock picking Gods because, as a firm believer in indexing, I don’t believe in stock picking Gods. Can I get an Amen?