Here’s a new filing for leveraged Bitcoin ETFs: Boom–> NYSE files to list leveraged Bitcoin ETFs, many flavors incl 2x and -2x, here’s full list, h/t @fintechfrank pic.twitter.com/XGiX1mzq0O — Eric Balchunas (@EricBalchunas) January 6, 2018 Yikes. Now, some people might be inclined to say “who cares, if people want to gamble and buy crazy speculative assets then so be it!” I understand that mentality, but I loathe so much of what I see on the product development side of ETF products. Let me explain. The financial markets were created for real economic purposes. Stocks and bonds, for instance, were created so that companies could raise capital so they could expand their operations. Stocks and bond also give the public a fairly low risk way to allocate their savings in a public and

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here’s a new filing for leveraged Bitcoin ETFs:

Boom–> NYSE files to list leveraged Bitcoin ETFs, many flavors incl 2x and -2x, here’s full list, h/t @fintechfrank pic.twitter.com/XGiX1mzq0O

— Eric Balchunas (@EricBalchunas) January 6, 2018

Yikes. Now, some people might be inclined to say “who cares, if people want to gamble and buy crazy speculative assets then so be it!” I understand that mentality, but I loathe so much of what I see on the product development side of ETF products. Let me explain.

The financial markets were created for real economic purposes. Stocks and bonds, for instance, were created so that companies could raise capital so they could expand their operations. Stocks and bond also give the public a fairly low risk way to allocate their savings in a public and transparent market. Options and futures contracts were created so that companies could hedge the price volatility of their products and operations. These are necessary and very valuable economic needs.

Over time, the financial markets have become less about serving the real needs of corporations and more about serving the profit needs of Wall Street. And Wall Street pumps this message out every day taking advantage of our behavioral biases selling you the false dream of a get rich quick scheme in the markets. After all, if they told you to diversify, be less active, think more long-term, etc. they would likely make less money. There is an inherent conflict of interest in the profit model of Wall Street and many of the products they offer. The result of all of this is that the financial markets look a lot more like a casino these days than an exchange for raising capital, hedging operations and allocating savings.

As I’ve explained before, investing (or allocating one’s savings) is very different from gambling. Allocating savings in the financial markets is involvement in a positive sum game in which the odds are likely to be in your favor over long periods. Gambling is involvement in a negative sum game in which the odds are not likely in your favor over long periods. We know, empirically, that long-term investing in stocks and bonds is a positive sum game with a positive outcome. Endeavors like roulette or day trading, however, are negative sum games that have probable negative outcomes. In other words, any endeavor in the financial markets that involves short-term trading will tend to look more like gambling than investing because the probability of a negative outcome is increased.

Leveraged ETFs are one of the worst versions of this new reality as they promote short-termism in an inefficient tax and fee vehicle. There are several reasons for this:

- As previously noted here, many leveraged ETFs have an inherent time decay. These instruments are designed to lose value over time.

- Leverage is one of the biggest risks in portfolios as it increases costs and magnifies the behavioral risk in a portfolio.

Let’s explore point two in more detail because it’s the more important one for most of us. When you leverage a portfolio you’re adding risk to your portfolio in two ways: 1) you’re increasing your fees because the product developer (or if you’re the borrower) has the extra cost of borrowing to leverage the product; and 2) you’re magnifying the behavioral risk of the portfolio by increasing the variance of the price movements. This turns an inherently long-term instrument into a short-term instrument.

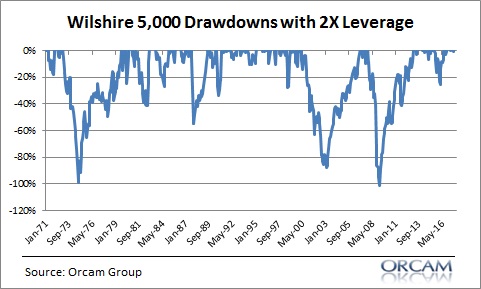

For instance, the Wilshire 5,000 is fairly volatile in the short-term as it’s had three 40%+ drawdowns in the last 50 years. 40% is a heckuva big drawdown to deal with, but if you have a fairly high risk appetite you know that this volatility will smooth out over the long-term. Stocks are inherently long-term instruments, but leverage turns every 40% downturn into a Great Depression. And once every few decades it wipes you out entirely. As a result, you don’t have the positive probable asymmetrical returns that an unlevered indexer has because you’ve turned that index into an instrument that is no longer a long-term instrument. For instance, here are the levered drawdowns in the Wilshire:

(Good luck behaving well through this!)

The average American is already terrible with their finances and prudent investing is hard enough as it is. I know there are plenty of smart people trading these instruments who are perfectly capable of managing the risks, but these sorts of instruments attract hoards of novice investors who are sucked in by the allure of fast gains, but in fact are exposing themselves to higher risks. All of this makes our financial markets appear more and more like casinos as opposed to the beneficial public markets that they were designed to be. And that’s why I can’t stand the development of these types of products.