Donald Trump says the stock market will crash if he is impeached: “I’ll tell you what, if I ever got impeached, I think the market would crash,”¹ Now, I don’t have any superpowers, but if there’s one thing I am really good at it’s avoiding political bias in my analysis. I always try to start with objective and empirical truths when analyzing something. So, let’s see if we can navigate this political minefield and parse this thing out from the ground up. First, it’s important to understand that the US stock market is a big place reflecting millions of independent businesses and millions of consumers. While the President and politics are important factors in influencing these millions of people it would be a mistake to assume that politicians are the main driving force behind the economy.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Donald Trump says the stock market will crash if he is impeached:

“I’ll tell you what, if I ever got impeached, I think the market would crash,”¹

Now, I don’t have any superpowers, but if there’s one thing I am really good at it’s avoiding political bias in my analysis. I always try to start with objective and empirical truths when analyzing something. So, let’s see if we can navigate this political minefield and parse this thing out from the ground up.

First, it’s important to understand that the US stock market is a big place reflecting millions of independent businesses and millions of consumers. While the President and politics are important factors in influencing these millions of people it would be a mistake to assume that politicians are the main driving force behind the economy. It’s better to think of politicians as facilitators and fringe operators who can influence the microeconomy, but don’t steer the macroeconomy.

Thinking in a first principles perspective, you could say that the US economy is like a highway transporting goods back and forth. The governments determines the rules of the road and they influence where we can go and how fast, but they are not the drivers or the vehicles.

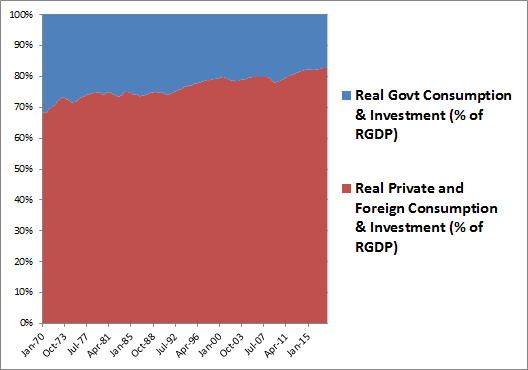

Let’s put some data behind this point. The chart below shows government real consumption and investment as a percentage of US real GDP vs private and foreign consumption and investment as a percentage of US real GDP. The data clearly shows that the government is an important factor, but not the largest contributing factor.

This is the main reason why political bias is so dangerous when assessing economic and financial market performance. Reasoning from a policy change is the equivalent of assuming that the government is the driver. And while they certainly have an impact on outcomes, we shouldn’t confuse the government for the driving force.

Let’s look at some recent history to further support this thinking.

- The stock market crash of 2008. Does anyone believe that George Bush caused the financial crisis? I mean, yes, I know there are politically biased pundits who actually think he contributed to it, but he did not buy millions of homes, issue low quality loans or securitize those loans. He may have influenced policies that contributed to those actions, but he was not the cause.

- The stock market recovery of 2009. Does anyone believe that Barack Obama caused the stock market to rally in 2009? I mean, yes, I know there are politically biased pundits who actually think he alone caused the stock market to recover, but the reality is that the government implemented a lot supportive measures AND, more importantly, people kept getting up in the morning, trudging to work, busting their asses and working hard.²

- The Trump bump of 2017. Does anyone believe that Donald Trump caused the stock market to rally in 2017? I mean, yes, I know that there are politically biased pundits who actually think he alone caused the stock market to rally, but the reality is that corporate America has been on fire for almost a decade and while Trump may have added a little boost in certain ways, he wasn’t the primary factor.

Let’s think about this from a more fundamental portfolio construction perspective. If you’ve got assets to allocate then we know that the data shows that market timing is difficult if not impossible. So we need to take a somewhat long-term perspective (greater than 5-10 years). Now, if you believe that companies will continue to innovate and that people will continue to consume those goods and services then you should be long-term bullish about the stock market. If the stock market worries you because it’s an inherently multi-decade instrument then you need to diversify that position with bonds and shorter-term instruments that reduce the volatility of the aggregate portfolio. When you go through this process literally none of your decisions should hinge on who will be President for the next 4 years. After all, if 4 years is your time horizon then you probably shouldn’t even be investing in risky assets to begin with.

Long story short – the President and politicians generally matter less than people think. This is not to say that the government doesn’t matter at all. But I think we often veer into these extremes when trying to analyze the impact of policies and that tends to be a very bad first principles assumption.

So, would Trump’s impeachment cause the market to crash? I don’t think so. A President Pence is likely to have most, if not all of the same policies that a President Trump had, so even if you believe that the President drives the economy (which he doesn’t) then this wouldn’t be a sea change. And more importantly, if you’re trying to time the market based on political events occurring inside of a very short time horizon then you’re almost certainly doing this all wrong.

¹ – This whole article is about avoiding political bias so if you’ve just read the first sentence and you’re having a politically biased meltdown over inane impeachment discussions and you’re tempted to write nasty emails or comments here then you’ve missed the point of the entire article. Please go directly to political bias jail, do not pass go, do not collect $200 and rejoin the game only when you’ve recovered from your political biases.

² – In fairness, the financial crisis was an unusual event. My general theory is that in good times the government matters little. And in panics they can sometimes be the only entity willing to support the economy when everyone else is too scared to act. So, the government (NOT THE PRESIDENT) including the Federal Reserve probably had a greater impact on these events than normal. Still, it’s not like Congress was the one going to work, inventing the iPhone and producing it.