Sorry for the radio silence here. Real work got in the way of blogging about work. A lot of people seem to think that the bond market is forecasting a recession now that yields are declining again and the curve has completely flattened. Is a recession coming? Do you need to jump in your bunker? Do you need to build your bunker? Let’s explore. I’ve touched on the flattening and inverting curve a number of times in the last few years. Here’s my general view over time: November, 2017 – The curve isn’t inverted, no recession is on the horizon and you don’t need to worry about recession until well after the curve actually inverts. March, 2019 – The curve has finally inverted (by some measures) which increases the odds of recession about 18-24 months out, but don’t go panicking just yet. In

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Sorry for the radio silence here. Real work got in the way of blogging about work.

A lot of people seem to think that the bond market is forecasting a recession now that yields are declining again and the curve has completely flattened. Is a recession coming? Do you need to jump in your bunker? Do you need to build your bunker? Let’s explore.

I’ve touched on the flattening and inverting curve a number of times in the last few years. Here’s my general view over time:

- November, 2017 – The curve isn’t inverted, no recession is on the horizon and you don’t need to worry about recession until well after the curve actually inverts.

- March, 2019 – The curve has finally inverted (by some measures) which increases the odds of recession about 18-24 months out, but don’t go panicking just yet.

In short, don’t shit your pants just because some media outlet is trying to scare you by misrepresenting a fairly well established indicator of recession.

But where are we now? Well, it depends on how you look at it. For instance, the most common curve comparison between 2’s and 10’s doesn’t actually show inversion yet. Other measures do. In any case, this isn’t an on/off switch. It’s not like the curve inverts and some magical thing happens to the economy where recession becomes inevitable. No, you have to think like a bond trader here and you’re in luck because I happen to be a bond trader. In fact, I’d argue that one of the only things I’ve become really good at in finance is understanding and predicting interest rates.

What I see is more of the same that I’ve been predicting for a long time – low inflation for longer. Except that it looks like the economy might be deteriorating marginally as trade worries and a housing slowdown take fairly anemic growth down to anemic growth. So, you have very modest inflation concerns turning into continued low inflation concerns. And so long bond yields have compressed again as bond traders essentially predict low future inflation. The way that shows up in the curve is a modestly rising curve to one that is now flattening. In other words, it is a slow and steady decline in the belief about future growth and inflation, but not necessarily a sign of a quickly deteriorating economy headed for disaster.

What isn’t clear in all of this is whether a recession is on the horizon. In my view, recession cannot be predicted merely by looking at the yield curve. You need more corroborating evidence in the coming 18-24 months (roughly the amount of time we typically see between inversion and recession). We’re not there yet. But growth is definitely slowing and inflation is not a worry at present.

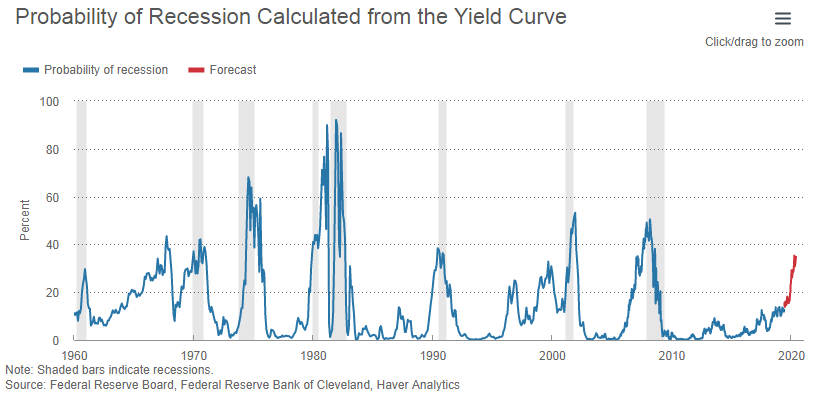

To put this in some perspective, here’s a good chart from the Fed on using the curve as a recession indicator. The current reading is consistent with about a 35% chance of recession, a reading that has been rising steadily in recent years. That’s also consistent with the Orcam Recession Index. Importantly, the ORI is an on/off indicator meaning that a reading under 100% is a “no recession” prediction.

So I wouldn’t read too much into the curve inversions and falling yields just yet. They’re a sign of more muddle through, slowing growth and weak future inflation, but not necessarily a sign that you need to lock yourself in your bunker and plan for the end of the world.¹

NB – Next time I’ll write a bit more detail about yields themselves and how rational this decline in yields appears to me.

¹ – Building a bunker is expensive and probably not a great investment. Besides, don’t you want to die with the rest of us instead of living in a hole in the ground?