Hooray! We did it folks. We raised the debt ceiling again and averted a self imposed default on US government debt. And to celebrate this joyous occasion I wanted to write my 3,589th article explaining some of the never-ending misconceptions about government debt and borrowing.¹ And to do that I found this David Stockman interview from last week. Stockman was Reagan’s budget director in the 80’s and seems like a good guy from everything I’ve read. But he’s also become the poster-child for government debt fear mongering. So let’s dive into this interview because he hits on lots of persistent myths: “The Fed has accommodated the Congress over and over again…” [~2:20] I don’t like this reasoning. The Fed hasn’t been “funding” the US government via QE. It’s better to think of QE as pure

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Hooray! We did it folks. We raised the debt ceiling again and averted a self imposed default on US government debt. And to celebrate this joyous occasion I wanted to write my 3,589th article explaining some of the never-ending misconceptions about government debt and borrowing.¹ And to do that I found this David Stockman interview from last week. Stockman was Reagan’s budget director in the 80’s and seems like a good guy from everything I’ve read. But he’s also become the poster-child for government debt fear mongering. So let’s dive into this interview because he hits on lots of persistent myths:

“The Fed has accommodated the Congress over and over again…” [~2:20]

I don’t like this reasoning. The Fed hasn’t been “funding” the US government via QE. It’s better to think of QE as pure monetary policy. After all, the Fed doesn’t set the rate of inflation and the rate of inflation is the effective cost of funding for a government. So it’s better to say that low inflation has accommodated the US government and demand for US government assets is high not because of Fed policy but because of low inflation. After all, the whole purpose of QE is to raise inflation and inflation expectations. So if the Fed had achieved its goal via QE then the government’s cost of funding would rise as inflation would rise and interest rates would follow.

“Artificially low interest rates… [~2:30]

As I’ve written about before, I hate the term “artificially low interest rates”. First of all, the existence of the Fed puts downward pressure on overnight rates because the Fed forces banks to hold reserves they don’t want to hold thereby resulting in the banks trying to lend out reserves to one another which they can’t lend out in aggregate (because the Fed system is a closed system). This drives rates to 0%. That’s why the Fed pays interest on reserves. They have to artificially RAISE rates from 0% or the rate falls below their target. But even ignoring this fact, the Fed mostly just pegs the overnight rate near the rate of inflation. In other words, they’re basically chasing an inflation target and trying to guess what future inflation will look like. And they set rates as a way to front-run inflation. When people say rates are artificially low, they’re really saying that the rate of inflation is artificially low. This narrative doesn’t even make sense at the most basic level.

“The least informed member of Congress” [~6:20]

Sir, that wasn’t nice, but I admit that I laughed a little.

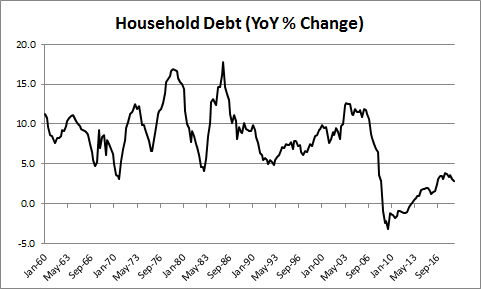

“Households are borrowing too much” [8:00]

Okay, this has nothing to do with government debt, but it still triggered me anyhow. This has been one of the weakest consumer borrowing recoveries ever. In fact, we’re still below recessionary levels when compared to any past recovery.

There’s a bigger point of recurring confusion in the Stockman interview – balance sheets have two sides. We like to focus on the debt side because it’s the scary sounding side. We know that too much debt can get us into trouble. But we have to keep things in perspective here. Debt becomes worrisome when:

- The private sector uses debt in a procyclical manner to finance unsustainable operations (like, lending to 22 year old strippers who are buying 10 homes).

- Governments use debt in a procyclical manner to finance spending leading to or during high inflations.

Private sector debt booms are inevitable in a capitalist economy. After all, there will always be irrational people chasing a profit in some sector that looks sustainable in the short-term thereby resulting in an unsustainable boom that is often supported by debt. This story is as old as the US economy and it will repeat itself once every 10-20 years as long as we’re all alive. Basically, people are impatient and stupid in the short-term.

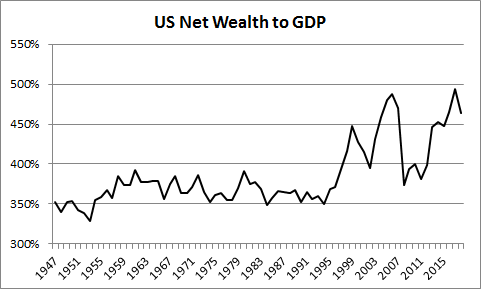

The thing about the US borrowing boom in the last 20 years is that there’s actually been a boom in both the right hand side of the balance sheet AND the left hand side. In other words, US net wealth relative to GDP has skyrocketed in large part because the debt has coincided with a substantial build-up of equity.

This is crucial to understand in the context of the last 20 years. Yes, the tech boom resulted in a short-term boom in unsustainable corporate debt issuance, but ultimately resulted in massive value creation. And the housing boom was just an irrational short-term boom that reflected a long-term demand for housing. But in the long-run the equity build-up has supported the short-term debt issuance even though it got highly disaggregated in the near-term and resulted in two huge asset bubbles. In other words, the short-term price booms were irrational in the short-term but have actually been validated in the long-term.

In any case, I am not making excuses for endless government and private sector debt. But when you look at the bigger picture these worries seem overblown. Yes, there are pockets of unsustainable housing booms in places like San Francisco and the Pacific Northwest. And yes, there have been pockets of unsustainable corporate debt issuance to finance silly tech companies (as well as many innovative tech companies). And yes, there’s been an explosion in public debt. But one of the reasons that the explosion in public debt hasn’t been inflationary is because the boom in private debt has ultimately resulted in an explosion in equity creation. In other words, while our public sector might be getting less productive it has been more than offset by the rise in productive output by the private sector. That is clearly reflected in the surge in US net wealth relative to GDP.

The key point is, this isn’t all a big conspiracy theory. Inflation really is low. US net wealth really has surged. The liability side of the balance sheet has really grown at a slower rate than the asset side. And in fairness, I think Stockman makes some reasonable points on the efficiency of government spending and the sustainability of things like entitlements. There are reasonable arguments to be made for a smaller federal government. But conspiracy theories about the Fed and inflation are not among them.

¹ – Here are some Roche classics on this topic: