It’s almost the weekend, folks. Hang in there a few more hours. In the meantime, here are some things I think I am thinking about: 1) The Fed did whaaaat? The Fed cut rates for the first time since 2007. Things are a bit different this time. In 2007 the housing market had been screaming higher and was softening quite a bit. GDP was consistently over 6%. Rates were 5.25% and inflation had been consistently close to 4% for years. This time around inflation can barely get over 2% and GDP is lucky to get over 4%. One major similarity between the two environments is that the yield curve was flat or inverted. I don’t like to read into the yield curve too much, but one obvious message from the long end of the curve is, when it refuses to rise as short rates rise, bond traders are basically

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

It’s almost the weekend, folks. Hang in there a few more hours. In the meantime, here are some things I think I am thinking about:

1) The Fed did whaaaat? The Fed cut rates for the first time since 2007. Things are a bit different this time. In 2007 the housing market had been screaming higher and was softening quite a bit. GDP was consistently over 6%. Rates were 5.25% and inflation had been consistently close to 4% for years. This time around inflation can barely get over 2% and GDP is lucky to get over 4%.

One major similarity between the two environments is that the yield curve was flat or inverted. I don’t like to read into the yield curve too much, but one obvious message from the long end of the curve is, when it refuses to rise as short rates rise, bond traders are basically saying “We don’t see the long-term risk of inflation that you nearsighted people at the Fed seem to see.” The lesson from history is that bond traders are better at guessing the future than Fed officials are. So, with a yield curve that is flattening I think Jerome Powell is taking the right cue. He’s cutting rates just enough to reduce the risk of deep inversion and hedge some of the risk. It’s not a bad move in my view. The PCE price index is just 1.4%. So you could argue that rates at 2%+ are slightly too high.

In any case, I don’t think there’s any need to overreact. There’s enough softening in some domestic real estate markets and the global economy to warrant some caution here. And let’s be real, a 0.25% rate cut isn’t going to make or break the economy, but it might be a necessary step in the off chance that this is the beginning of an economic soft patch.

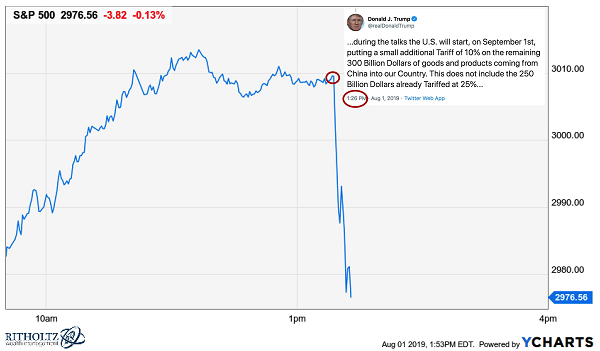

2) One Way to Get a Rate Cut...is to cause a recession. Trump has been extremely critical of Jerome Powell for offsetting some of the fiscal stimulus we’ve seen in recent years. I get where he’s coming from. If you’re the President then you want highly procyclical policy. That is, you want to step on the gas so you can take credit for the car going fast. So when someone keeps stepping on the brakes every few miles it could get irritating. Of course, that’s exactly the right way to drive a car (and try to manage economic growth), but whatever.¹ But one thing that’s weird about Trump is that he keeps stepping on the brakes without realizing it. For instance, here’s the market’s reaction to his new announcement of tariffs (via Barry Ritholtz):

I think I’ve been pretty fair with Trump’s economic agenda over the years, but the trade stance is inexcusable. Tariffs are taxes. Tariffs are bad. Tariffs are the only thing that virtually all economists agree on. I am beginning to think that Trump thinks the global economy is a zero sum game where we win by weakening other countries when in fact the global economy is a positive sum game where we are all better off when we’re all doing better. In any case, take your foot off the brake Mr. President or you’ll get the rate cuts you’ve been begging for for all these years for all the wrong reasons.

3) More on Negative Rates. Here’s an interesting paper from the IMF on negative rates as a policy tool. The basic idea is to set rates negatively to make it unattractive to hold money. This will theoretically boost spending and raise output. I really don’t get this idea. If you implement a negative rate then you are essentially taxing the banking system which ultimately tries to pass on the tax to consumers. You’re just reducing income to the aggregate economy which will reduce spending…But I guess we won’t really know the impact until someone actually implements a deeply negative rate.

¹ – I don’t mean you should literally let someone else step on your brakes. That would be super dumb. Which reminds me that my wife is always telling me how to drive. She thinks I drive like a big weenie and thinks I should step on the gas. She is also always telling me where to turn, how to turn, which lane to drive in, etc. etc. It’s extremely annoying. Can I get an amen?²

² – I sometimes use this blog to test whether or not my wife reads my work. I am fairly certain she doesn’t. So it’s a nice testing ground to see both her level of support for me and whether or not I can safely vent my marital frustrations to you guys on occasion.