Here are some things I think I am thinking about: 1.2.3. The Great Repo “Crisis” of 2019. If you’ve opened the financial section of the newspaper in recent days then you’ve probably been blasted in the face with lots of confusing jargon about a liquidity “crisis” in the repo market. This sort of stuff really bugs me because it’s a market that is relatively opaque and just confusing enough that people can blow it out of proportion and make it sound like something really scary when in fact it isn’t. So let’s drill down here a little bit. First, this all starts in the reserve market. If you haven’t read my primer on bank reserves you might want to go sneak a peak. But the basic lesson is that there are two banking systems in the USA. There is a banking system for the banks and there is a

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1.2.3. The Great Repo “Crisis” of 2019. If you’ve opened the financial section of the newspaper in recent days then you’ve probably been blasted in the face with lots of confusing jargon about a liquidity “crisis” in the repo market. This sort of stuff really bugs me because it’s a market that is relatively opaque and just confusing enough that people can blow it out of proportion and make it sound like something really scary when in fact it isn’t. So let’s drill down here a little bit.

First, this all starts in the reserve market. If you haven’t read my primer on bank reserves you might want to go sneak a peak. But the basic lesson is that there are two banking systems in the USA. There is a banking system for the banks and there is a banking system for the rest of us. The banks use central bank reserves in their banking system. This is how they settle all their payments. They have to hold some quantity of reserves to achieve this and the system is only accessible to banks. The rest of us use deposits. So, for instance, when I buy $100 of goods from you my bank will actually settle the payment in the reserve system by transferring $100 of reserves to your bank which then shows up as a new $100 deposit liability for your bank (a $100 asset for you). Okay, enough about that.

Second, what the heck is a “repo”? A repo is actually a very simple thing – it’s just a repurchase agreement. So, for instance, let’s say you want to borrow $100 from me and you have a safe asset that we can collateralize that loan with. I would buy that asset from you for $100 and you would then agree to repurchase that asset back from me at a later date for a higher price. You get your $100 loan and I am essentially charging you an interest rate (the mark-up on the repo price) with an agreement for you to buy back your asset at a future date. This is a very common way for banks and non-banks to make loans.

Third, why do repos matter? Let’s rewind the tape a little. During the financial crisis this was a big deal because banks were making repo loans using mortgage backed securities. And when the price of houses collapsed this triggered uncertainty in the value of the securities that were collateralizing loans which led to higher and higher repo rates. All of this caused the banking system to seize up which turned a housing price crisis into a banking crisis which then started to spill over into the real economy until the Fed came in and essentially insured everything.

Now, earlier this week the price of repo loans surged because of a lack of supply for safe reserves in the banking system. The most plausible theory for this is the substantial settlement of tax payments by corporations on the 15th. Basically, the rate on repo loans surged because banks were desperately trying to obtain enough reserves that weren’t there. So banks were charging one another an unusually high interest rate on repos to fund their overnight reserve positions. The Fed subsequently had to come into the market to ease the pressure.

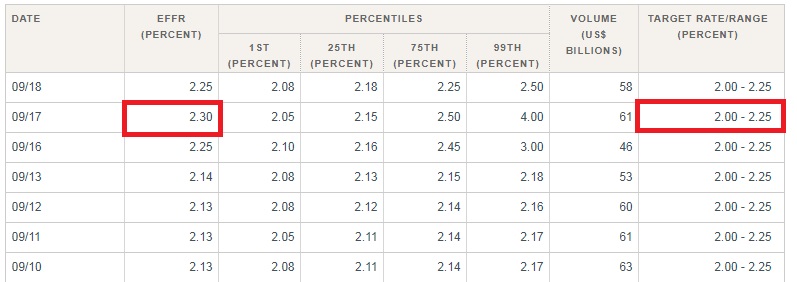

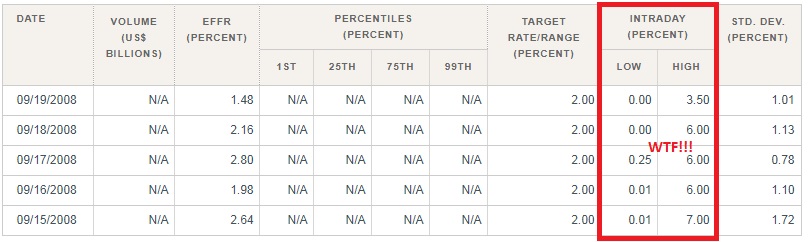

This might sound a little like 2008, but it was actually quite different. First, you didn’t have the same trigger from house prices and MBS. This was just a good old fashioned lack of reserves, something that was actually somewhat common before QE. But some people were making a big deal out of this and even going so far as to compare it to 2008. Hold your horses there. I want to put this into perspective. The following two pieces of data show the difference between a 2008 and a 2019. What the data below shows is the instability in the Fed Funds Market. The key portion is the effective Fed Funds Rate versus the target rate and the intraday highs and lows. In 2008 you had a real liquidity trap for a few months (no Paul Krugman, we haven’t been in a perpetual liquidity trap you big silly goose). The Fed actually lost control of overnight rates. You can see this clearly in the wide deviation in the data.

(2019 – not a crisis)

(2008 – an actual crisis)

Look at that EFFR in 2008. You had an overnight rate that was as far as 40% from its target rate on some days. On the 17th of September, 2019 the rate was a measly 5 bps off. In other words, while the rate was higher than the Fed might have liked, it was actually very close to target. This is not indicative of a panic or a crisis or really anything other than what seems to be a very short-term liquidity squeeze that the Fed resolved in a timely manner. So, for now I wouldn’t overreact to all of this. It sounds fancy and scary, but it’s pretty much a garden variety leak in our financial plumbing. That sort of stuff happens every now and then so don’t let your local financial newspaper scare you into thinking that 2008 is right around the corner.

Well, that’s all I’ve got. I hope you enjoyed this although I doubt you did. I know it’s not really three things, but more like one really confusing thing that has a lot more than three things tangentially related to it. But it seems like an important thing given all the scary articles I’ve been reading.