A post-election autopsy of what just happened and whether it matters…. 1) What Happened to the “Blue Wave”? As of this morning it looks like the Republicans will retain the Senate and the White House will likely go to Biden. The blue wave turned into more of a blue ripple. What’s going on here? I think the big takeaway from this election is that the country is much more moderate than most people assume. There’s no need to over-complicate this. While there are clearly two tribes the majority of people don’t associate entirely with one tribe or the other. Most people don’t want extremism from either side so you end up with something that, statistically speaking, ends up looking very close on average. 2) Why is the stock market surging? I mentioned last week that a blue wave might be bad

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

A post-election autopsy of what just happened and whether it matters….

1) What Happened to the “Blue Wave”?

As of this morning it looks like the Republicans will retain the Senate and the White House will likely go to Biden. The blue wave turned into more of a blue ripple. What’s going on here?

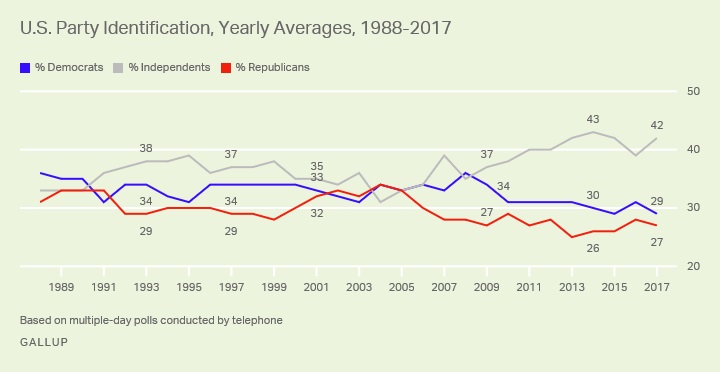

I think the big takeaway from this election is that the country is much more moderate than most people assume. There’s no need to over-complicate this. While there are clearly two tribes the majority of people don’t associate entirely with one tribe or the other. Most people don’t want extremism from either side so you end up with something that, statistically speaking, ends up looking very close on average.

2) Why is the stock market surging?

I mentioned last week that a blue wave might be bad for stocks in the short-term because that could mean higher capital gains rates and corporate taxes. If Biden wins and the Senate remains Republican then that ain’t happening. So, again, no need to over-complicate this. The stock market likes gridlock because it means that the Democrats can’t swing policy too far along the class spectrum.

Speaking of which, I mentioned on Twitter that gridlock isn’t bad (it’s not necessarily good either). The stock market doesn’t really care who is in power. On a social level, the gridlock makes me feel pretty bullish about America because I have this hopelessly naïve view that it will make us work together. Regardless, people tend to have this view that, if their side doesn’t control everything, then nothing will get done and the world will end. But this is factually wrong. In the last 75 years our government has been divided over 60% of the time. Over this period living standards exploded higher by most measures. So, don’t let gridlock get you down because the stock market and the economy don’t really care about your political biases and which political party is in control. There’s a good likelihood, over long enough time periods, that the stock market and the economy will do just fine regardless of what Washington is doing (often in spite of what Washington is doing). And after all, gridlock is a feature of this system, not a bug.

3) How did the pollsters get it so wrong?

Pollsters broadly expected a “blue wave”. For instance, 538 predicted that Biden would win the popular vote by 8% and the electoral college by 158 votes. They expected Pennsylvania (4.7% for Biden), Nevada (6.1% for Biden), Michigan (8% for Biden) and Wisconsin (8.3% for Biden) to be solidly blue. All 4 of these states are still too close to call and well outside of the margin of error. Even accounting for a margin of error, the results are not that good.

Of course, we need to think of the world in probabilities. So it’s reasonable to make a forecast like this and say something like “Biden has an 80% change of getting between 275 and 425 electoral college votes” (which is roughly what 538 predicted). But when reality starts to fall nearer to the fatter end of the tail across a whole range of predictions then it becomes clear that your model isn’t nearly as useful as you expected. And this seems to have been a fairly wide ranging problem across political polls. What’s going on here?

- Polling is inherently inefficient. The financial markets require an excruciating level of information transparency. Being a public company is like walking around with your pants off half the time. Regulators and companies create incentives for investors to obtain accurate information that can create smoother operating financial markets. This makes financial markets somewhat efficient in the sense that there’s a lot of information to help establish prices. Polling is much more opaque. Not only are the samples smaller, but the data from those samples is not incentivized in any meaningful way because the people being polled have no incentive to provide accurate data. In other words, polling is based on relatively low quality information.

- Undecided voters create higher variance. A 2017 paper found that undecided voters can result in greater statistical variance in polling. The number of independents has consistently increased since 2003. So, polling hasn’t gotten worse in the last 10 years. It’s just that the number of independent and undecided voters has increased which makes polling that much harder.

- Predicting the future is always hard. This is true with most things in life, but probably more true of polling given points 1 & 2.

In short, political polls are a lot like reading annual stock market forecasts. They’re useful to some degree, but also likely to be very wrong at times. Or, as statistician George Box once said: “all models are wrong, but some are useful”. Political polls and stock market forecasts are very likely to be wrong to some degree and at times wrong to a very large degree. But that doesn’t mean they don’t provide some useful perspective that might help you better understand/navigate what’s going on in the world.