The headline of this article is something you’ll very rarely, if ever, see in the financial press. You’re much more likely to hear something along the lines of: “Joe Schmo made ,000,000 buying Tesla stock” “Jane Doe retired early buying Bitcoin” “If you’d invested ,000 in Microsoft in 1990….”tual I will not parse words here. THESE ARE ALL HORRIBLE ARTICLES. Most of this is survivorship bias that promotes an imprudent gambler’s mentality. Let me explain. Back in 2015 there was a great study from Longboard called The Capitalism Distribution. They found, unsurprisingly, that roughly 80% of the markets entire gains came from 20% of all stocks from 1989-2015. 80% of stocks had a 0% gain. JP Morgan came to similar conclusions in a research paper titled “The Agony and the Ecstasy – the

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

The headline of this article is something you’ll very rarely, if ever, see in the financial press. You’re much more likely to hear something along the lines of:

“Joe Schmo made $1,000,000 buying Tesla stock”

“Jane Doe retired early buying Bitcoin”

“If you’d invested $1,000 in Microsoft in 1990….”tual

I will not parse words here. THESE ARE ALL HORRIBLE ARTICLES.

Most of this is survivorship bias that promotes an imprudent gambler’s mentality. Let me explain.

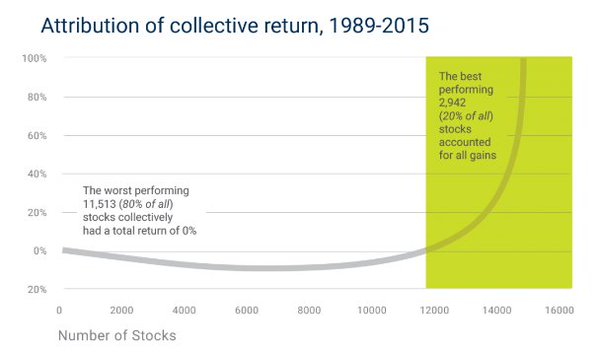

Back in 2015 there was a great study from Longboard called The Capitalism Distribution. They found, unsurprisingly, that roughly 80% of the markets entire gains came from 20% of all stocks from 1989-2015. 80% of stocks had a 0% gain.

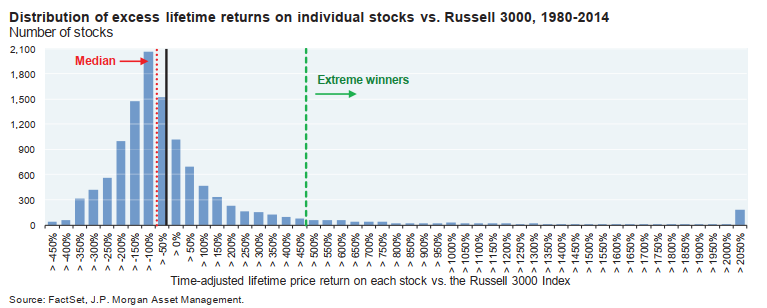

JP Morgan came to similar conclusions in a research paper titled “The Agony and the Ecstasy – the Risks and Rewards of a Concentrated Stock Investing“. In a study ranging from 1980-2013 they found:

- The median stock underperformed the market with an excess lifetime return of -54%. In other

words, in most cases, a concentrated holder would have been better off invested in the market. - Two-thirds of all excess returns vs. the Russell 3000 were negative, and for 40% of all

stocks, returns were negative in absolute terms. - Historically, there were some extreme winners: the right tail is ~7% of the universe and includes

companies that generated lifetime excess returns more than two standard deviations over the mean.

That little blue block on the right hand tail is your Teslas and Microsofts. The thousands of other stocks are to the left. Meaning, 93% of everything else is not Tesla or Microsoft or whatever story stock you might read about in these articles. Said differently, betting your life’s savings on a single stock is more akin to betting it all on black. In fact, you have better odds of picking the right spin of the roulette wheel than you do picking the next Tesla (and actually holding onto it through the ups and downs and timing the entry/exit).

Now, don’t get me wrong. I am perfectly fine with active management and have long debunked the idea that “passive investing” is even a thing. We all have to make active decisions across our lives and as someone who has most of his net worth tied up in his own company I’d be hypocritical if I wasn’t a proponent of concentrated bets. But I think we need to be very specific about this. When I invest money in my company I am investing for future production in a business and industry in which I have a specific expertise. When most of us buy stocks on a secondary market we are allocating some of our savings in companies in which we usually have no involvement and no expertise.

This is why I am a big proponent of treating our “investment portfolios” like “savings portfolios”. What most of us do on the stock market is an allocation of savings as opposed to actual investment, which is technically what a firm does when it spends for future production. Yes, we want to get wealthier when we allocate our assets. But most of us need to do so in a manner that not only optimizes our upside, but does so without haphazardly risking the downside along the way. After all, this is literally our life’s savings. It shouldn’t be treated like money we take to Vegas for a weekend.

That said, there’s nothing wrong with being active in the market. Everyone, by definition, has to be some degree of active. You don’t need to just pile all your money in a Vanguard Index fund and ride the waves. But I think there’s two very important lessons to remember when reading these kinds of articles:

- Stock picking is very, very difficult and most of us benefit from some degree of diversification.

- Given the relatively high potential of catastrophic loss in stocks make sure to never bet more than you can afford to lose.

NB – Here’s the article that triggered me. Read it at your own risk.

Related articles: