Here are some things I think I am thinking about: 1) There’s Gonna be a Civil WHAT? Here’s an interesting tweet from Ray Dalio: I really like Ray Dalio. His All Weather portfolio is more or less the kind of permanent portfolio that I think most savers should try to implement (for most of their savings). But I have a hard time figuring out how some of his broader macro views fit into all of this. For instance, he believes that there are long-term debt cycles that create patterns in social and economic behavior. Okay, that makes some sense. But honestly, how could he have enough data to justify a view like this? If a long-term debt cycle is 100 years then we’ve had, what, one or one and half long-term debt cycles in the modern economic age? How could you formulate sound judgments about

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

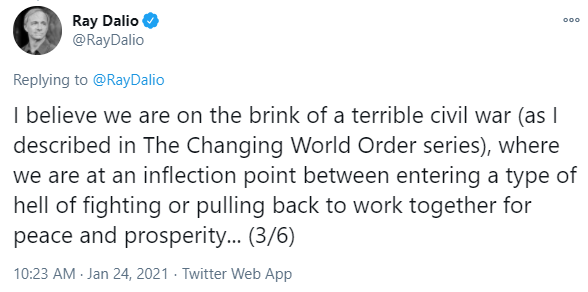

1) There’s Gonna be a Civil WHAT? Here’s an interesting tweet from Ray Dalio:

I really like Ray Dalio. His All Weather portfolio is more or less the kind of permanent portfolio that I think most savers should try to implement (for most of their savings). But I have a hard time figuring out how some of his broader macro views fit into all of this. For instance, he believes that there are long-term debt cycles that create patterns in social and economic behavior. Okay, that makes some sense. But honestly, how could he have enough data to justify a view like this? If a long-term debt cycle is 100 years then we’ve had, what, one or one and half long-term debt cycles in the modern economic age? How could you formulate sound judgments about the future based on such a thin data set?

Personally, I don’t love the idea of “cycles” let alone “long-term” cycles. As I’ve explained before, I think the economy mostly trends along all the while trending or bumping into different equilibria along the way. Things aren’t as cyclical as we like to think. And over any long-term time horizon debt (and assets) just trend higher. In fact, the longer we go the LESS cyclical everything really looks. Yeah, we like to think the cycles will repeat because that gives us confidence about what the future might hold, but no one really knows.

So…coming back to his tweet about Civil Wars. I don’t buy it. Yeah, there’s a lot of unrest. There pretty much always has been. But the level of unrest that leads people to kill their fellow countrymen by the millions is truly extreme. Sure, there was a Civil War due to unrest 160 years ago, but does that mean history will necessarily repeat because of seemingly similar levels of unrest? Methinks not. Besides, most of us are too busy watching Netflix in our jammies to worry about trying to killing other people.

2) Roaring Kitty FTW. That means “for the win”. That’s how the kids talk these days. Or so I’ve been told.

This is actually one of the more interesting stories in a long time. In case you haven’t been paying attention – a bunch of Redditors banded together to drive Gamestop (GME) stock higher by buying far out of the money call options. Meanwhile, a whole bunch of hedge funds were short the stock. This has recently resulted in a short squeeze and a gamma squeeze. Basically, lots of short covering and hedging by market makers in the options market. It got so bad that one hedge fund needed a bailout. And this was all led by a user named “Roaring Kitty”. Yes, Roaring Kitty took out a $12B hedge fund. I shit you not.

There are endless amazing rabbit holes you can find yourself in with this story. Is this legal? Is this now no market for old men? What the hell is a gamma squeeze and how do I get involved in one (on the right side, of course)? Do fundamentals matter? How are seemingly stupid traders destroying pros? But the story I am most interested in is the broader COVID trend of internet users taking to the stock market with their newly found free time. How does that play out in the long-run? Is it 1999-ish? Is it a new normal? I don’t know. But while many are worried this reflects some sort of “bubble” I worry that it reflects the potential for more of a deflating. That is, bubbles imply a popping. The popping of a bubble is a sudden and traumatic event. Whereas a deflating is more of a long and drawn out event. It’s just as painful, but arguably more so because it lasts so much longer. Think, 1970-1977 when the stock market pretty much chopped sideways with a few big bull and bear markets along the way.

Why do I worry about this? Mainly because there’s no underlying macro bubble. You basically just have a lot of excess speculation in the stock market. So, as COVID goes away and people return to their normal lives in the coming years you’ll have a long drawn out return to normalcy. The COVID environment sucked everyone into a rapid adoption of online trading. And the slow return to normal could, I repeat, COULD, result in a long unwind of the rapid COVID trends of 2020….

Anyhow, I am fast becoming an old man, but I guess this is a good excuse to start listening to my nanny for more stock trades, start playing video games again (market research, you know?) and letting my 9 month old daughter man the Orcam Group trading desk.

3) Corporate Cash Ain’t Cash. The GME story is interesting. But I can’t lie. The most interesting thing in finance these days is companies investing their cash in Bitcoin, literally treating it as their “cash reserve”. The leader in this trend is Michael Saylor at Microstrategy. Saylor explained his view in detail on The Odd Lots podcast about a month ago. His basic view could be summarized as follows:

- MSTR generates a lot of a retained earnings.

- It’s expensive for MSTR to reinvest in the company.

- Buybacks aren’t enough.

- Bonds yield nothing.

- The government is destroying cash.

- Stocks are at all-time high valuations.

- BUY BITCOIN.

I’ve often been confused why so many companies leave cash sitting in actual cash. You hear about it all the time. “Record levels of corporate cash”. Corporations are, at least in theory, perpetual entities. If you have excess retained earnings then why not diversify your risk outside of your own entity? Yeah, buybacks are fine, but why not buy some other types of assets? I mean, didn’t Warren Buffett figure this out 50+ years ago? If you actually dig into a Berkshire balance sheet you’ll find a hugely diverse set of assets – Berkshire’s own companies, bonds of all types, public and private equity, etc. It’s a glorious thing to behold when you think about it. And the playbook has been sitting in front of us for decades, but most companies don’t use it.

Of course, you can be extreme about this as well. There’s diversifying your cash and then there’s going all in on Bitcoin like Saylor is essentially doing with his huge position. To be clear, I’ve got nothing against Bitcoin or Crypto. I’ve been very clear, for a long time, that Bitcoin is basically venture capital in an alternative payments system. There’s nothing wrong with high risk venture capital, but you should know that it’s high risk, not cash-like as some Bitcoiners seem to think. But I like the general direction Saylor is thinking. Yeah, I wouldn’t ever invest most of my company’s retained earnings in an asset that regularly falls 80%, but I like his outside the box thinking.

Well…lots of crazy shit going on in the market. Which is honestly terrible because now people are being enticed to do the sorts of things that convince them it’s smart to deviate from a more balanced plan. But don’t worry. I am sure all this craziness will end well. Right? Right?