This website exists in large part because our government is extremely bad at communicating complex topics to the general public. I’ve tried to fill that void by explaining some of these more complex topics over the years. So I dedicate yet another post to our government, whose communication skills continue to leave something to be desired…. TRANSITORY – adjective 1: OF BRIEF DURATION : TEMPORARY 2: A GENERALLY POOR WAY TO DESCRIBE INFLATION The Fed keeps saying inflation will be “transitory” so they’re willing to keep rates low and keep pumping their balance sheet because they’re not worried about sustained high inflation. This has become a bit of a joke online because your Average Joe knows that none of this will actually be “transitory”. This is a significant communication

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

This website exists in large part because our government is extremely bad at communicating complex topics to the general public. I’ve tried to fill that void by explaining some of these more complex topics over the years. So I dedicate yet another post to our government, whose communication skills continue to leave something to be desired….

TRANSITORY – adjective

1: OF BRIEF DURATION : TEMPORARY

2: A GENERALLY POOR WAY TO DESCRIBE INFLATION

The Fed keeps saying inflation will be “transitory” so they’re willing to keep rates low and keep pumping their balance sheet because they’re not worried about sustained high inflation. This has become a bit of a joke online because your Average Joe knows that none of this will actually be “transitory”. This is a significant communication problem that discredits what the Fed is trying to achieve. My view is that they should stop using this term entirely and try to more accurately communicate inflation and its likely future paths.

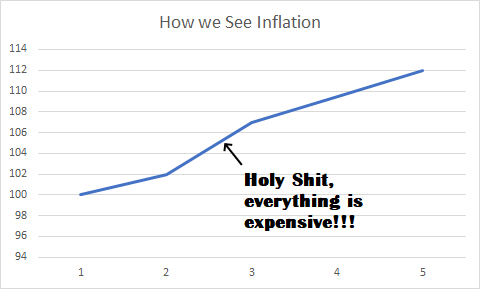

So, here’s the problem. Inflation pretty much always goes up. This isn’t shocking because resources are scarce, money demand is infinite, money creation is endogenous and lots of other factors. So there’s pretty much always an upward trend in inflation (and no, Bitcoin doesn’t fix this this, in fact, fixed money systems make this worse) over long periods of time. Most people know this. And this is how we actually perceive inflation. So, for instance, in a year like 2020, when prices jump by 5% we notice the nominal change. When your local bar starts charging $5.25 for a beer that used to cost $5 you notice that. And you know that that $5 price is never coming back. The following graphic is how we actually experience a change in inflation over time:

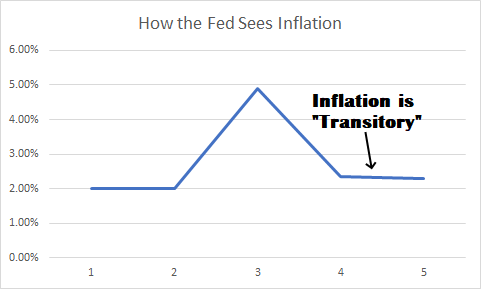

Economists at the Fed know this. But they also don’t communicate inflation changes this way. They communicate inflation as a rate of change. So, when prices jump 5% in year 3 you see a $0.25 increase in the price of a beer. But the Fed is currently saying that that 5% rate of change will be temporary. In essence, they’re saying that the rate of change of a price of a beer will moderate in growth in the future back to something like 2%. So, even if a beer costs $5.35 in year 4 they will call that change “transitory” whereas we just see a permanent increase in beer prices from $5 to $5.35.

The key fact is that the price change isn’t really temporary. There’s nothing about inflation that is transitory. Inflation is mostly a one way trend that occurs at a fairly low rate of growth in a healthy economy. So it ends up being counterproductive to describe things as transitory when there’s nothing transitory about the actual price changes.

This sort of terminology might be fine for a more wonky research paper and economist talk, but the general public doesn’t perceive inflation as transitory and the Fed hurts its own credibility by making a very clear topic less clear than it could be.