Here are some things I think I am thinking about: 1) So, not so grande, eh? China Evergrande, the Chinese real estate developer has everyone worried these days about the second coming of Lehman Bros. The company has shrunk by about 90% so they’re not so grande anymore. Get it? Did you catch that joke? Geez, I am hilarious. Maybe they should call themselves Nevergrande? Get it? Did you catch that joke? I’m here all day folks. This sort of thing has happened a few times in the last 10 years with China. Here’s what I have to say about this: If you think China won’t bailout every one of its state run banks to fend off a financial crisis then I don’t know what to say. The supposed “capitalists” in the global economy do that now. So what do we think the Communists will do? Lehman ain’t on the

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) So, not so grande, eh? China Evergrande, the Chinese real estate developer has everyone worried these days about the second coming of Lehman Bros. The company has shrunk by about 90% so they’re not so grande anymore. Get it? Did you catch that joke? Geez, I am hilarious. Maybe they should call themselves Nevergrande? Get it? Did you catch that joke? I’m here all day folks.

This sort of thing has happened a few times in the last 10 years with China. Here’s what I have to say about this:

- If you think China won’t bailout every one of its state run banks to fend off a financial crisis then I don’t know what to say. The supposed “capitalists” in the global economy do that now. So what do we think the Communists will do? Lehman ain’t on the table here because state run banks don’t go through disorderly contagion causing deleveragings.

- 2% of S&P 500 revenues come from China. TWO. PERCENT. We buy stuff from China, not so much vice versa. So if they slow down it isn’t going to sink the US economy. In fact, their economy has been slowing consistently for 5+ years and the US has done fine.

- Lehman was a symptom of a global real estate boom and bust. Remember, the real estate bust had been in place for 2-3 years by the time it ruined Lehman. Maybe, just maybe, we’re on the verge of some sort of cyclical peak in real estate and the economy, but this certainly isn’t 3 years into a globally coordinated slowdown in real estate.

- There are plenty of reasons to be worried about stocks, high valuations, irrational exuberance, etc. But there’s no need to go full Lehman Bros here.

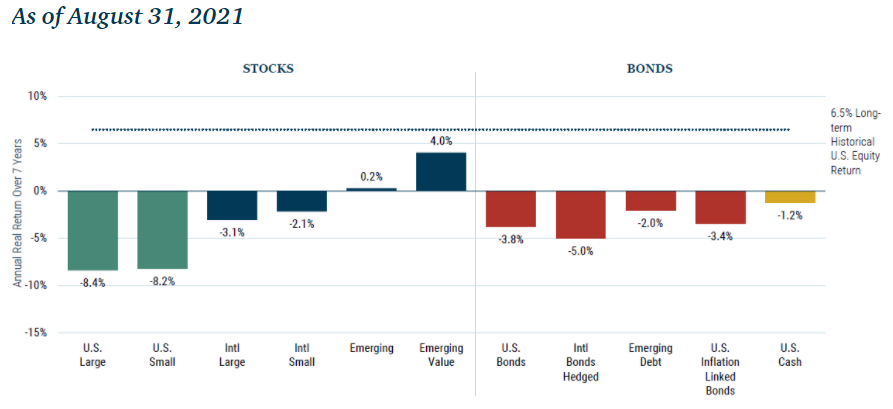

2) Not so grande returns. Here’s the 7 year forecast from GMO:

That’s -8.4% for the S&P 500 and -3.8% for the bond aggregate. I’m not sure how they came up with this. Because this has never happened over a 7 year period. The worst coinciding 7 year period of returns were the 1974 period when you had 7 year -5.3% in S&P 500 and -0.9% bonds and then -2.45% in S&P 500 and -4% in bonds in 1979. I’m on record saying the 1970s aren’t coming back. I still think that’s true. And sure, the S&P 500 appears overvalued in many ways at this time. But if the S&P 500 falls -8.5% per year for the next few years you’re going to seeing deflationary trends in the broader macro economy because the secular trends remain very weak (demographics, globalization, inequality, etc). I don’t think the economy can endure a long stock market decline without it flowing over into the real economy in a deflationary way (think, 2002 style recession). And that would mean that interest rates go…DOWN. In fact, I’d be willing to bet that a protracted stock downturn leads to negative US interest rates. And that would mean that US bonds actually go UP quite a lot.

Anyhow, I am just trying to work through this unprecedented prediction of theirs and put it into perspective. I wouldn’t be shocked if they’re right about one or the other asset class. But both? I would be really shocked by that.

3) The Financial Literacy complex is grande. Here’s Felix Salmon slamming the financial literacy complex. Basically, he says that financial literacy is being taught by financial people who have bad intentions. Which is almost certainly true in some cases. But I also think this is a generalization. For instance, I’ve posted thousands of educational posts on this website. I constantly write about stuff that is largely unrelated to managing money just because I think it’s wrong and I like telling the truth. I also run a financial services company. Do I hope people will hire me if they need my help? Absolutely. Do I also spend 95% of my time here just writing stuff because it genuinely interests me and I enjoy debunking a lot of the financial nonsense out there? Yes.

Anyhow, I am not here trying to scam people for their money and I think most of the people who write about financial literacy also have good intentions. Sure, there are plenty of hucksters and pumpers out there. If you’re getting your financial education from Tik Tok stars then that’s probably a bad idea. But I don’t understand this theory that all financial education is bad just because some people don’t teach it correctly. This would be like saying that all colleges are a waste outside of the Ivy League schools. No.

Anyhow, I think we should be doing everything we can to help people become more financially literate and I don’t think this is an all bad trend even if it’s partially bad.