Here are some things I think I am thinking about: 1) Inflation has peaked. This morning’s CPI report is more evidence that disinflation is going to become a more prolonged and entrenched trend in the coming years. I said back in January that I thought inflation had peaked and so far we’ve had falling rates of core CPI and PCE inflation since then. It’s still early and it’s not necessarily going to be a quick process because we have a good amount of upward pressure from some important items like rents, but the year over year comps become very high going forward and unless we have some sort of crazy outlier event (like WW3 raging in Taiwan) then I don’t see how the trend can continue anywhere but down. In fact, I’ve recently argued that the more likely outcome in the

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) Inflation has peaked.

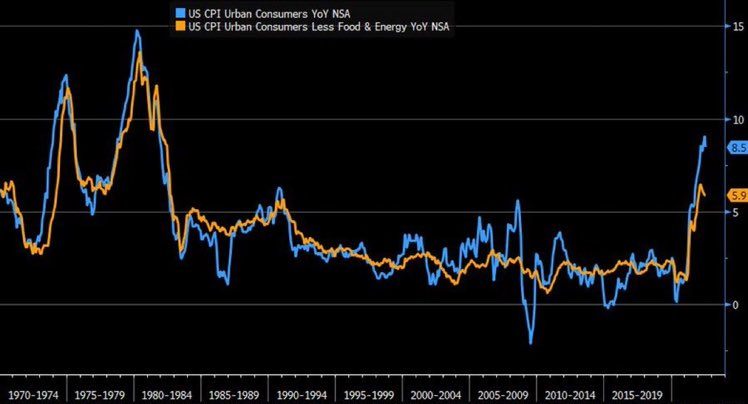

This morning’s CPI report is more evidence that disinflation is going to become a more prolonged and entrenched trend in the coming years. I said back in January that I thought inflation had peaked and so far we’ve had falling rates of core CPI and PCE inflation since then. It’s still early and it’s not necessarily going to be a quick process because we have a good amount of upward pressure from some important items like rents, but the year over year comps become very high going forward and unless we have some sort of crazy outlier event (like WW3 raging in Taiwan) then I don’t see how the trend can continue anywhere but down.

In fact, I’ve recently argued that the more likely outcome in the coming years is deflation relative to hyperinflation. I don’t think either one is a high probability outcome, but the downward pressure on prices is going to become more apparent as we progress through this year.

As of today my inflation model sits at about 4% core PCE as of the end of 2022. That’s down from 4.8% last month. So we’re not talking about a huge decline in prices, but I would argue that the risk of some sort of runaway inflation, or even a prolonged very high inflation like the 1970s is falling dramatically.

Stocks and bonds obviously love all of this, but it will be interesting to see whether disinflation turns into a risk of deflation in the coming year. If that happens the stock market might be celebrating a bit too soon.

2) LIV Golfers Get Rejected.

I love everything about the drama in professional golf right now. If you haven’t been following along – LIV is a Saudi Arabian government funded golf tour that is trying to “compete” with the PGA Tour by offering players guaranteed money to play in their tournaments. The PGA has pushed back by banning players who compete in LIV by claiming that the competing league hurts members of the PGA and golf more broadly.

Earlier this week a bunch of the banned LIV players filed a lawsuit against the PGA arguing that they’re independent contractors who should be allowed to play in both leagues if they want and they’re claiming anti-trust violations as well as “irreparable” financial damages. Yesterday, a temporary restraining order was rejected in favor of the PGA.

I find this whole thing hilarious. First, how can you file a lawsuit claiming financial damages when you left the PGA tour to join a league that is guaranteeing you millions and in some cases, hundreds of millions of dollars?

And second, how can anyone claim this is an anti-trust violation when the LIV tour is funded by one of the wealthiest entities in the world. This isn’t some small private entity claiming that another private entity has too much power. The Saudi government is a bottomless pit of money that is actually putting the PGA, a private entity, at risk. People who defend LIV often claim to be defending the personal freedoms of the players. And yes, the players have total freedom to do what they want. But the people who defend LIV aren’t just defending personal freedoms. They’re defending the misuse of taxpayer funds by a national government in its goal to compete with private entities and manipulate prices in the process. Imagine if the US government started a football league to “compete” with the NFL and started using your taxpayer dollars to pay Tom Brady a billion dollars to play in that league. Everyone would have a meltdown and call it a preposterous misuse of taxpayer money and government manipulation of a private entity.1

And lastly, the idea that there are somehow financial damages in all of this strikes me as even more preposterous since the Saudi government is literally dumping piles of money on these players. Phil Mickelson, for instance, signed a $200MM contract with LIV and is now suing the PGA Tour claiming irreparable financial harm? What are you smoking, because, I am home alone with two kids under two this week and I need some of that stuff.

Personally, I hope LIV loses every court case and the PGA gets more aggressive going forward. This new trend of government funded entities “competing” with private sports leagues is crazy. And sure, maybe the PGA is in violation of anti-trust rules, but the victim there certainly isn’t millionaire golfers or LIV.

3) All Duration Investing.

Here’s a teaser of a new paper I have just finished. It’s called “All Duration Investing” and it’s the first official paper I’ve published in 6 years. It’s one of the few things I’ve written in the last 5+ years that I’ve felt is worthy of these formalities.

In short, what I did was create a simple model to calculate the “duration” of all asset classes and strategies. What this does is specify the proper time horizon over which we should use an asset class. For instance, the bond aggregate is a 5.25 year instrument and the equity market is a 17.75 year instrument in this methodology. And then I did that for every instrument and I can apply it to any strategy that exists with a sufficient historical track record.

The cool thing about this is that it not only gets us away from short-term biases, but you can also use this model to apply a form of a bond laddering approach to every asset in an asset-liability matching approach. So, for instance, if you can estimate your 2, 5, 10, & 20 year liability expectations then you can take all these different instruments and apply them in a very specific asset-liability asset allocation. It’s kind of like bucketing, but much more precise and quantified. And unlike traditional asset management frameworks, it’s not “alpha” focused. We’re not trying to optimize returns per unit of risk. We’re trying to optimize returns across time in a manner that’s much more consistent with financial planning goals. The end result is a quantified bucketing approach that looks a lot like an all weather portfolio. It’s a simple, intuitive and planning based framework that I think will help a lot of people implement more sensible and goals based portfolios. Keep an eye out for it in the next week or so.

1 – Some PGA Tour defenders claim this is bad because it’s specifically the big bad Saudi government. This is a bad argument in my view. No government should be using taxpayer funds to start golf leagues. No government. I don’t care if it’s the nice guys like the Canadians or whatever. No. No government should be doing this.