I have to put on my flame retardant suit for this one because the Bitcoin community is not going to like this. Here goes nothing. Most definitions of money say that money has to have three properties – unit of account, medium of exchange (MOE) and store of value (SOV). I think this definition is contradictory and the evidence of all financial assets through history bears this out. Stay with me for a few minutes. Money always has to be defined in a unit of account. That could be Bitcoin, USD, whatever. But the last two components are explicitly at odds with one another. Money cannot be a perfect MOE and SOV at the same time. No asset in human history has ever served as a perfect SOV and perfect MOE over long periods of time because there are necessary trade-offs in the temporal

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

I have to put on my flame retardant suit for this one because the Bitcoin community is not going to like this. Here goes nothing.

Most definitions of money say that money has to have three properties – unit of account, medium of exchange (MOE) and store of value (SOV). I think this definition is contradictory and the evidence of all financial assets through history bears this out. Stay with me for a few minutes.

Money always has to be defined in a unit of account. That could be Bitcoin, USD, whatever. But the last two components are explicitly at odds with one another. Money cannot be a perfect MOE and SOV at the same time. No asset in human history has ever served as a perfect SOV and perfect MOE over long periods of time because there are necessary trade-offs in the temporal structure of these items that give them different benefits.

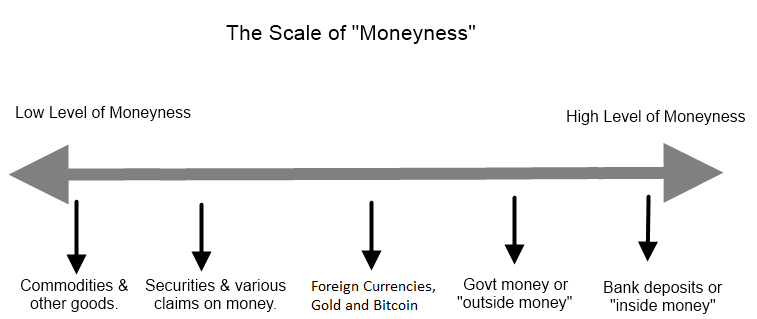

I’ve argued that the defining feature of “money” is that you should be able to pay for things with it. It is necessarily a super short and stable duration instrument. If you can’t walk into WalMart and use it to buy stuff then it’s not money. MOE is the key feature of what gives something moneyness. If you can’t buy stuff with it or it isn’t widely accepted then it doesn’t have a high degree of moneyness.

The property that makes something a very good MOE is its short-term nominal stability because this gives its users short-term predictability. A dollar today is a dollar next month. So, if I have a $1,000 credit card payment due in 30 days I know, with absolute certainty, that my $1,000 will be there if I hold $1,000 of bank deposits or cash. On the other hand, if I decided to hold this $1,000 in Apple Stock I would expose myself to the risk that Apple stock can decline in value and I won’t be able to meet my $1,000 liability in 30 days. This is why Apple Stock is a poor MOE.

There are no free lunches here. What you get in short-term nominal stability you give up in long-term purchasing power. In other words, while a USD is a great MOE it is a horrible store of value because inflation erodes its purchasing power over time. Apple Stock, on the other hand, is best thought of as a long duration instrument that can be a very good SOV over long periods of time. But the trade off for this long-term SOV is that it’s a poor short-term MOE.

In a recent interview I was describing this feature of Bitcoin. It is a lot like Apple Stock in that it has been a wonderful store of value, but also a terrible medium of exchange. The reason it’s a bad form of money is because it is impossible to plan around. Financial planning 101 will teach us that we need to manage our liabilities across time. This is THE key feature of any good financial plan. Bitcoin does not fix this. In fact, its volatility makes short-term planning nearly impossible. You cannot reliably plan for that $1,000 credit card payment due in 30 days if you hold it in Bitcoin.

But again, there are no free lunches. While Bitcoin is a terrible MOE it has been an incredible store of value. This is a feature of Bitcoin, not a bug. And Bitcoin does not have to try to solve both the MOE and SOV problem. Bitcoin is a great long-term SOV while also being constructed on a network that allows its users to access superior MOE like many stablecoins. The crypto system is similar to the fiat system and the way it has developed over time in that there are instruments (like stocks or BTC) that are wonderful SOV and instruments that are superior MOE (like deposits or stablecoins). This is a good thing. No financial instrument can be a perfect short-term MOE and also a perfect long-term SOV. That’s just the simple reality of the temporal trade-off of using any form of money.¹

There’s about 10+ years worth of writing on this topic in my Understanding Money section if you’d like to learn more.

PS – Hey Bitcoin Maxis – try not to get emotional damage from this post. There are lots of great things about Bitcoin. The fact that it isn’t a very good form of money doesn’t detract from those things.

¹ – Many Bitcoin proponents respond to this sort of comment saying “give it some time, it will become less volatile”. Perhaps it will. But you wouldn’t want Bitcoin to be a zero volatility instrument because then it would become a perfect MOE and a terrible SOV. So no, I don’t think Bitcoin will ever grow into a very low vol asset because high vol is its greatest strength as a store of value over the long-term.