This note is intended to provide some perspective on what appears to be turning into an increasingly speculative fervor in residential real estate. I hope it provides some practical views on the current environment. It was just a year ago that I was here saying residential real estate is not a bubble and that hyperbolic narratives were going too far. And then in my 2022 annual outlook I said that speculating on residential real estate looked increasingly dangerous. Today, I feel bearish and I think new buyers need to be extremely prudent in navigating their home purchasing decision. To be clear, I am not here to declare a “housing bubble 2.0” or an imminent crash, but my baseline expected return is flat to modestly negative in the coming 3-5 years in an environment that could mirror

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

This note is intended to provide some perspective on what appears to be turning into an increasingly speculative fervor in residential real estate. I hope it provides some practical views on the current environment.

It was just a year ago that I was here saying residential real estate is not a bubble and that hyperbolic narratives were going too far. And then in my 2022 annual outlook I said that speculating on residential real estate looked increasingly dangerous. Today, I feel bearish and I think new buyers need to be extremely prudent in navigating their home purchasing decision. To be clear, I am not here to declare a “housing bubble 2.0” or an imminent crash, but my baseline expected return is flat to modestly negative in the coming 3-5 years in an environment that could mirror the 1991 real estate recession. There are still many positive long-term trends in place, but the surge in prices combined with the surge in interest rates will create some headwinds in the coming years.

First some perspective on housing as an asset class – I focus on asset liability matching in my approach to asset management. In my research I like to highlight that residential real estate is a 13 year instrument and so it should always be viewed as an inherently long-term asset unless you have some expertise in constructing and managing real estate in the short-term. For most residential real estate owners it should be viewed as an expensive way to put a roof over your head that might appreciate modestly in value after accounting for taxes, fees, maintenance and weed pulling.

That said, I understand that life and financial management isn’t a nice neat little series of predictable time horizons. And we need to consider some short-term trends even around long-term assets. In my view there are three increasingly worrisome short-term trends in this real estate market:

- Affordability due to surging mortgage rates.

- A potential demand issue coinciding with new supply.

- The reliance on the buoyancy of other financial markets.

A Local Story – I know, I know, San Diego isn’t the Country.¹

What triggered this note is some disconcerting recent trends I see in local San Diego real estate. In recent months I’ve noticed a consistent trend – benign houses that were $1MM in 2016 are now selling for $2MM. Back in 2016 that $1MM house required a $200,000 down payment and a $4,300 monthly payment with a 3.5% 30 year fixed rate loan. If you made about $250,000 that annual payment was 20% of your pre-tax income. Today that same house is $2,000,000 and interest rates are over 5%. This means that a new buyer is putting down $400,000 and THEN paying $10,200 per month. To have the same relative annual cost your new income has to be $600,000 (keep in mind this assumes you just have $400K sitting around collecting dust). Median household income in North County San Diego county is currently $110,000 and has increased 30% over this period.

On paper this appears workable especially given the huge gains in stocks, bonds and crypto in the last few years which account for a substantial amount of the down payments we’re seeing. But if  we get more granular and add all these parts together some red flags start to crop up.

we get more granular and add all these parts together some red flags start to crop up.

1) Affordability due to surging mortgage rates.

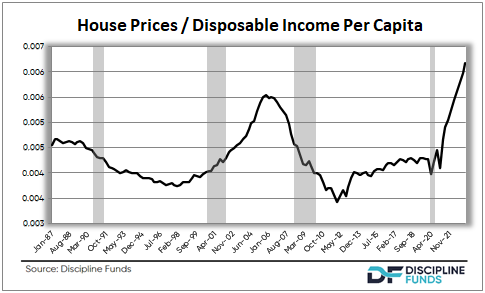

My first big concern is that aforementioned ratio of income as a percentage of home value. The recent surge in prices has already pushed many people out of the market. And so we’re going to see disposable income per capita as a percentage of house prices continue to shoot up in the coming quarters.

Figure 1 shows how the trend will look in the coming quarters.² It’s well documented that households are in much better condition today than they were in 2006, but the new demand has to come from people who are willing to meaningfully impair their overall balance sheet going forward as the interest rate and price dynamic force them into a new paradigm.

Another perspective on this is an updated NAR affordability chart from Dom White. After 10 years of record high affordability the price changes and rate hikes are about to collapse that figure back down to levels last seen in 2006.

Now, this alone might not be a problem. Perhaps people are just choosing to spend more of their income on housing because the pandemic exposed how important our primary residence is. That’s fine. Spend more on housing, spend less on other stuff. No big deal on its own. Moving on.

2) A potential demand issue coinciding with new supply.

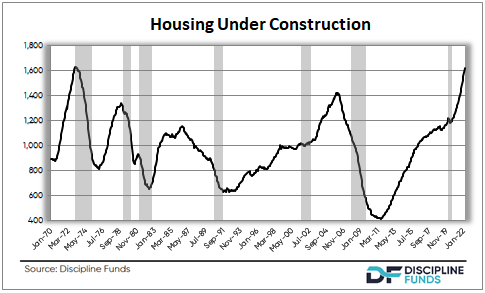

We consistently hear that there’s a shortage of housing. Which is true. Except there’s also a record setting glut of soon to be finished construction. So there is more supply coming at a time when the Fed is making it increasingly difficult to fund all this new housing.

The problem is that all of that new housing is going to be financed at the higher rates AND into the surging price trend. Again, maybe this isn’t an issue because the new buyers are simply choosing to spend more of their income on housing, but it’s hard to see how this won’t have a meaningful impact on demand.

More importantly, we have to consider the rising risks within the context of affordability. Mortgage is Latin for “death contract” for a reason – if you lock yourself into the wrong contract it will slowly bleed you. And just because something is “affordable” does not mean you should buy it. A house with a large mortgage that has to be funded is an incredibly burdensome asset/liability mix. So, the buyer of our $2MM house above might be able to afford it on a household income of $300,000, but it doesn’t mean they should. They need to consider all of this in the broader context of their financial plan and well-being and ask themselves:

- Do I want to burden myself with a mortgage that is 60% of my after tax income?

- Will this payment allow me to have enough disposable income to enjoy myself?

- Does the current price environment include recession/income risk that could expose me to the potential of defaulting on this loan or losing my job and compounding the added financial stress?

- Am I chasing prices and getting caught up in the madness of the crowd?

- How would I feel if the price of this house fell by 10% over the course of the next 3-5 years?

These are prudent financial planning questions that more people should be asking themselves given recent trends. And maybe it’s all good. Maybe you can take that 13+ year time horizon and it’s no problem. But I have a feeling these questions are increasingly important to an increasing number of people who might not really need to take on this risk.

3) The reliance on the buoyancy of other financial markets.

The third factor is perhaps most worrisome. This is the lynchpin in the down payment issue and makes the income issue a non-factor if it becomes a serious problem. In fact, if I had to pick a recession risk it would be falling asset prices so all of this has the unique potential to compound on itself as all developed financialized economies are uniquely dependent on asset price stability.

In short, households are wealthier than they’ve ever been because of the surge in stocks, bonds and crypto resulting from the COVID stimulus response. This explains why that $400,000 down payment isn’t such a big problem at present. But Bitcoin is already down 30%. Bonds are down 10%. And stocks are down 8%. These losses amount to $19T of lost global market value in just the first few months of 2022. So, what happens if stocks fall another 20%, 30%, 40%? The answer is that the the global financial markets will lose $30-$50T of collateral that is essential to real estate values.

Our economy has become unusually dependent on buoyant financial markets to sustain household balance sheets and broader economic trends. Booms are great and balance sheets always look healthy during them, but the numbers don’t always go up and in this environment the real estate market is unusually dependent on stable stock/bond/crypto prices. If that reverses it could create a feedback loop that exaggerates headwinds for housing.

All of this added together means that current real estate pricing is riskier than it is on average and exposes the buyer to an unusually high financial burden. Buyers need to sit down and do some real financial planning around new purchases to ensure that they’re not taking on more risk than they need to.

Conclusion – I don’t want to sound hyperbolic and of course we’re making some guesses about the future. I know I am sounding very bearish for the first time in what probably seems like forever to regular readers of the blog. But this confluence of risks seems meaningful in my view and I think home buyers need to be increasingly prudent about how much they’re willing to chain themselves to elevated house prices. And to be clear – I am NOT saying a crash is around the corner or that 2008 is coming again. I should be clear that the dynamics are not nearly as speculative today as they were in 2005. Consumer balance sheets are much healthier today. So you won’t get the forced selling and banking crisis that made 2008 so unique. But could we see flat real estate prices for 5 years, a 1991 style 5% downturn in prices or something more prolonged? I think that’s absolutely possible and should be a base case for anyone jumping into residential real estate today.

Be prudent, that’s the message here. Good luck.

¹ – I live in an unusual part of the country where these trends tend to be exaggerated, but these trends are broadly similar across the entire country and places like San Diego just magnify the broad trends.

² – I can hear some people saying “this is a stock/flow chart crime!” I don’t think so. In fact, I’d argue that flows (income) are the core component of house prices (the stock component).