All I am thinking about is inflation these days. That’s it. 1) How about that CPI report? This morning’s CPI came in at 7.5%, hotter than expected. Not really that surprising. As I’ve been saying, we’re going to see a bunch of these high readings into the Summer. The statistical “topping effect” I’ve been talking about won’t start to really kick in until around June and then it should put a pretty likely top on the year over year data. If some prices fall (commodities and car prices) then the back end of the year is going to see inflation decelerate back into that 3-4% core PCE range pretty quickly. In any case inflation is going to be high all year long. That said, I do think inflation has likely peaked for the year (or we’re very near the peak) and that the major scare is behind us.

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

All I am thinking about is inflation these days. That’s it.

1) How about that CPI report? This morning’s CPI came in at 7.5%, hotter than expected. Not really that surprising. As I’ve been saying, we’re going to see a bunch of these high readings into the Summer. The statistical “topping effect” I’ve been talking about won’t start to really kick in until around June and then it should put a pretty likely top on the year over year data. If some prices fall (commodities and car prices) then the back end of the year is going to see inflation decelerate back into that 3-4% core PCE range pretty quickly. In any case inflation is going to be high all year long.

That said, I do think inflation has likely peaked for the year (or we’re very near the peak) and that the major scare is behind us. And I do think the Fed is doing the right thing by tip-toeing towards higher rates. We’ve already seen a 1% jump in mortgage rates and the 2 year rate and that should dampen demand for credit in the coming quarters. The key is whether they can do so without derailing the economy….

2) The yield curve is starting to reflect some signs of worry….Speaking of tip-toeing. The Fed is really dancing with fire this time around. The long end of the curve has continued to  flatten into the rate hike expectations. The curve is flattening another 10 bps today. We’re only about 50 bps away from an inverted curve at this point. It’s crazy to think about how strong the economy is by many metrics and how the yield curve is indicating this very late cycle high risk environment.

flatten into the rate hike expectations. The curve is flattening another 10 bps today. We’re only about 50 bps away from an inverted curve at this point. It’s crazy to think about how strong the economy is by many metrics and how the yield curve is indicating this very late cycle high risk environment.

I don’t like to assign some causal factor to the yield curve though. My view on an inverted curve is that it reflects the current state of the market and expected risks. My guess for the flattening in this environment is that the current economic environment has become especially financialized and impacted by risk asset price changes. Therefore, the future economy could be more responsive to rate changes and potential Fed errors.

So, is the Fed making a mistake? We don’t know yet, but this doesn’t look great. I tweeted out something this morning which is reflective of how hard investing is:

High inflation increases the odds of higher rates (in the short term) which increases the odds of a policy mistake which increases the odds of…lower rates (in the long term).

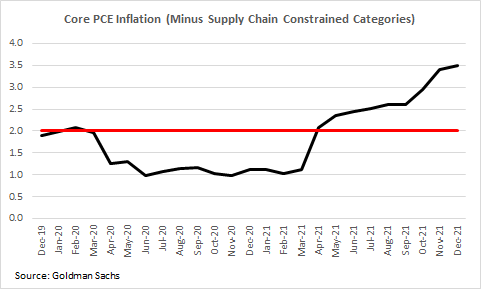

3) Who dunnit? There has been a lot of talk in recent months about the cause of the inflation – was it caused by the supply side issues related to COVID or was it government stimulus? Conservative economists want to say it was all government spending because government spending bad. And Liberal economists and especially MMT advocates want to say it was a supply side  shock because government spending good. The truth is that it’s a lot of both and breaking down the data can give us a rough idea of how much each category impacted the changes. As it turns out, this is mostly a demand side issue and roughly 30% of core PCE increases come from supply side related categories.

shock because government spending good. The truth is that it’s a lot of both and breaking down the data can give us a rough idea of how much each category impacted the changes. As it turns out, this is mostly a demand side issue and roughly 30% of core PCE increases come from supply side related categories.

The fact that this is mostly a demand side inflation is justification of what the Fed is doing and it also justifies peeling back fiscal policy. It also discredits MMT economists who have called for 0% rates and more government spending since more government spending likely would have caused inflation to rise even further than it already has.

The big lesson from the COVID recession was that fiscal policy is the big bazooka. That bazooka can get us out of a deep rut, but it can also cause bigly inflation as we’re seeing now. And more importantly, you also need to know when to put that bazooka away when it looks like you might blow yourself up.