Here are some things I think I am thinking about: 1) Three Minute Money – What is Money? Here’s the first installment of Three Minute Money, my new YouTube series. My goal is to develop this channel into educational content, current events, myth busting, Q&A and whatever viewers want. The short video content is much more digestible and I think I can communicate these points more succinctly than I do in writing. It also creates a better archived content feed which I think users will appreciate. I love feedback so please let me know what you think or want from the channel as it grows. Here’s the first one – What is Money? Yeah, yeah, I know. Pretty boring and basic, but how can you make a channel about money without first defining what money even is!?!?! [embedded content] 2) It’s not the

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) Three Minute Money – What is Money?

Here’s the first installment of Three Minute Money, my new YouTube series. My goal is to develop this channel into educational content, current events, myth busting, Q&A and whatever viewers want. The short video content is much more digestible and I think I can communicate these points more succinctly than I do in writing. It also creates a better archived content feed which I think users will appreciate. I love feedback so please let me know what you think or want from the channel as it grows.

Here’s the first one – What is Money? Yeah, yeah, I know. Pretty boring and basic, but how can you make a channel about money without first defining what money even is!?!?!

2) It’s not the rates that kill portfolios, it’s the inflation.

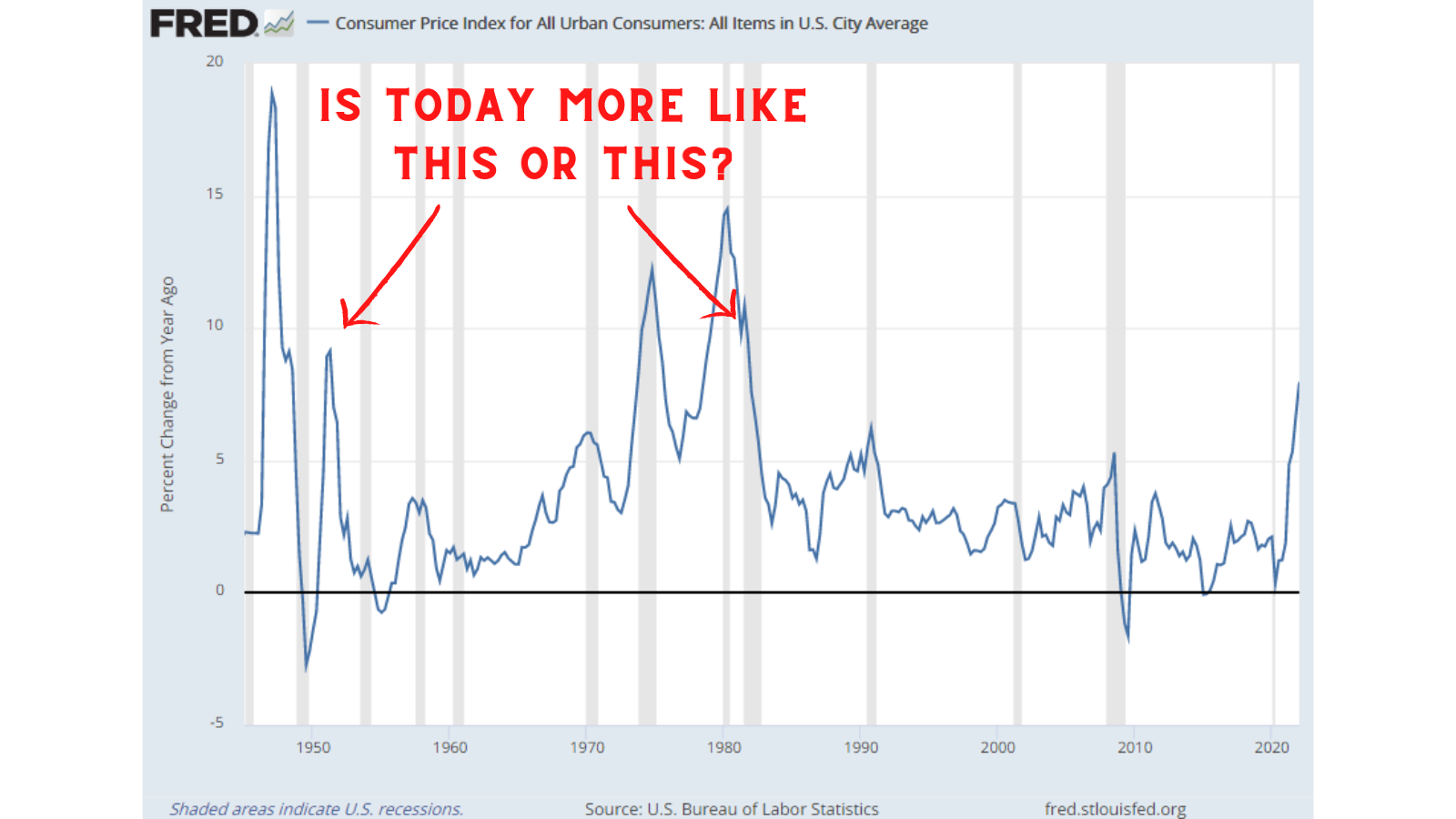

One of my big pet peeves is “reasoning from an interest rate change”. That is, people tend to think that interest rates cause big things to happen. But it’s mostly the opposite in my view. In most cases inflation changes and the interest rate just responds as policymakers change their stance and the market anticipates the change. This doesn’t mean that interest rates don’t have any causal impact. I think they can and I think that’s especially true for raising interest rates. Which is crucial because so often the inflation occurs, then the Fed is reactive, then they raise rates and hurt the economy at a time when the inflation is already starting to subside.

People often say that 40 years of falling rates made investors look smart. But was it falling rates that made investors look smart or was it 40 years of disinflation that made investors looks smart? Because here’s the problem with the idea that it was all rates – a 50/50 stock/bond portfolio generated real returns of 4% per year and 8% nominal from 1940-1970. Interest rates went from 0-7% over this period. Not amazing, but not bad. What really killed investors was the 1970-1980 period of sustained high inflation where real returns were 0%. That’s the difference between meeting your withdrawal rate for 30 years and going backwards for an entire decade.

Anyhow, to me, this is the most important question in portfolio management over the next 10 years. Is the current inflation going to be a period of sustained high inflation like the 1970s? Or does  this look more like the 1940s where we had bouts of high inflation followed by recessionary bouts of deflation? Personally, I feel like this is a lot more like the 40s than the 70s and that the risk of deflation could be lurking around the corner more so than we think. But I also have been preaching about how the ranges of outcomes are wider than they’ve ever been and therefore an all weather strategy makes a lot of sense because you could get this herky-jerky market where people are behaviorally challenged by stocks/bonds/commodities across short periods of time.

this look more like the 1940s where we had bouts of high inflation followed by recessionary bouts of deflation? Personally, I feel like this is a lot more like the 40s than the 70s and that the risk of deflation could be lurking around the corner more so than we think. But I also have been preaching about how the ranges of outcomes are wider than they’ve ever been and therefore an all weather strategy makes a lot of sense because you could get this herky-jerky market where people are behaviorally challenged by stocks/bonds/commodities across short periods of time.

3) Elon Musk buys Twitter. What does it mean?

There’s been a big fuss in the media over the news that Elon Musk is buying Twitter. Conservatives argue that Twitter is the “public square” and that the public square shouldn’t be ruled over by biased corporate entities. Given Elon’s somewhat Conservative tendencies they seem to think Elon will set Twitter free and turn it into a place of free speech. And the Liberals argue that people like Elon will let reckless Conservatives run amok in the town square serving their own needs.

There’s always some truth in both sides of these arguments, but I don’t see what’s new here. All the big media entities are owned by biased billionaires and none of them, let me repeat, none of them are the “town square”. All of these entities are for profit companies run for the benefit of their shareholders. They serve whatever agenda will best benefit their shareholders. And let’s remember that the “town square” is public domain. It is an inherently government owned space and a government regulated space. The idea that there can ever be some sort of fully decentralized town square is naive in my view. Someone has to set the rules in these spaces and someone has to regulate them. Whether that’s a Twitter algorithm created by Jack Dorsey, a Libertarian discretionary algorithm run by Musk or a fully discretionary government run public space. Someone sets the rules and changes them as needed. There is no fully decentralized public square. It does not exist and as I’ve written before, the internet is not a public space. It is a bunch of private locations connected to a public/private infrastructure. When you’re on Twitter you’re using Twitter’s private servers and if you abuse those private servers they can and will remove you. It’s no different than walking into a restaurant without pants on screaming swear words. They don’t let that happen because it’s a private place of business and you’re breaking their rules whether your speech is “free” or not.

Of course, we can argue about how they should regulate their own space and some entities are too caught up in the political correctness movement to be trusted, but let’s not treat this all like it’s the public square because the public square regulated by the government is not necessarily a better solution than the way the internet is already setup.

In any case, I don’t think Elon really wants to change much anyhow. He just wants to own the pipeline so he can write poop emojis without worry while making sure that certain people aren’t congesting/manipulating it in ways he dislikes.¹ And as long as it’s a privately owned company he can do what he wants with it regardless of all the talk about free speech. Twitter is now effectively the Elon Musk square and if you walk around without pants on when you’re on Twitter then he can kick you off. Maybe he won’t, but that’s how free enterprise works.

¹ – Good pun in here. [insert poop emoji]