Here are some things I think I am thinking about: 1) Are we in a recession? Today’s GDP reading officially shows two quarters of negative GDP. This has been a traditional media measure of “recession”, but the NBER has always been pretty vague about what a recession is. But one thing they’re clear about is that they they do not consider two quarters of negative GDP to be a recession. Instead, they say a recession is when there’s been a significant decline in economic activity. What to make of this whole debate? Defining “recessions” is a lot like defining bull and bear markets. It’s nice for creating some binary clarity around an idea, but it’s necessarily subjective and doesn’t always tell the full story. And that’s where this gets really messy because inflation has been so high that

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) Are we in a recession?

Today’s GDP reading officially shows two quarters of negative GDP. This has been a traditional media measure of “recession”, but the NBER has always been pretty vague about what a recession is. But one thing they’re clear about is that they they do not consider two quarters of negative GDP to be a recession. Instead, they say a recession is when there’s been a significant decline in economic activity.

What to make of this whole debate?

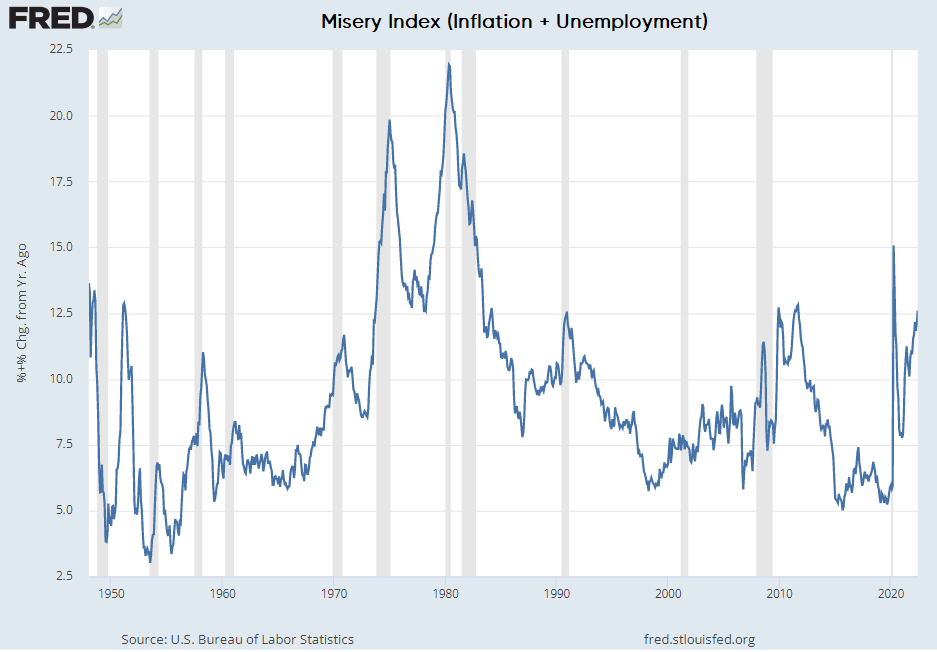

Defining “recessions” is a lot like defining bull and bear markets. It’s nice for creating some binary clarity around an idea, but it’s necessarily subjective and doesn’t always tell the full story. And that’s where this gets really  messy because inflation has been so high that this feels like a recession to a lot of people. Or, at a minimum, it doesn’t feel good. For instance, looking at a traditional measure like the Misery Index we can see that “misery” is pretty elevated and is at levels that you usually see in past recessions. And that’s the problem with inflation. While unemployment and falling GDP hurt some people, inflation hurts all people.

messy because inflation has been so high that this feels like a recession to a lot of people. Or, at a minimum, it doesn’t feel good. For instance, looking at a traditional measure like the Misery Index we can see that “misery” is pretty elevated and is at levels that you usually see in past recessions. And that’s the problem with inflation. While unemployment and falling GDP hurt some people, inflation hurts all people.

The other messy thing about this debate is that there’s always a political aspect to all of this. Republicans will want to peg this as a recession because then they can argue that Joe Biden presided over a recession. And if you’re a Democrat you want to highlight the strength in employment and other factors that refute the recession narrative. This is all just political bias and narrative spinning and highlights the subjective nature of living standards and economic growth.

In reality, this economic environment isn’t that great. Whether we quantify that as a technical recession or not doesn’t matter. There are a lot of people out there hurting under the pressure of inflation and slowing economic growth.

2) The housing downturn is only just beginning.

A lot of this talk about recessions ignores the fact that housing a big slow moving sector. For instance, I remember back in 2006 when the yield curve first inverted and yet housing was still strong. House prices didn’t turn negative on a YoY basis until Q4 2007. And while I am not worried about housing like I was back 2006 my baseline scenario is still for 5-10% house price declines. But that might not occur until 2023 at the earliest.

So, what we’re potentially looking at here is this slow grinding economic hangover following the big COVID boom. And that’s likely to play out primarily through the housing market, which has only just started to soften. This is beginning to show up in the data across the housing market, but it won’t broadly start to show up for several more quarters. This is going to be a process where the economy digests the surge in interest rates and finds an equilibrium with housing prices. It’s not happening quickly and never does in housing.

How deep and prolonged that ends up being will determine whether the Fed remains aggressive and also whether risk assets continue to grind sideways, go lower or, if I am wrong, surge higher as the economy and housing remains more robust than I expect.

3) Is the Fed pivoting to easing?

The Fed appears to be pivoting towards a more dovish stance and that’s part of why stocks have been bouncing. I think the Fed is finally waking up to the reality that inflation isn’t spiraling out of control and that there is real downside risk to the inflation narrative. But that downside inflation risk comes with the upside risk of unemployment. So the Fed is in a real bind here. They want to snuff out inflation, but they don’t want to crash the housing market and cause unemployment to surge. Personally, I think they’ve overreacted to an inflation story that was already peaking back when the Fed started panicking about inflation, but we’ll have to wait and see how that plays out.

In any case, I think the narrative is now shifting and will continue to shift as future inflation reports come in soft and show increasing signs of disinflation as the year goes on. And while that might not result in explicit easing by the Fed it does mean the odds of a very aggressive policy stance are now diminishing.