Here are some things I think I am thinking about: 1) 2023, the Year of Disinflation? In my annual outlook I said that 2023 was going to be the year of disinflation. My guess is that Core PCE ends the year around 3%. That’s higher than the Fed’s 2% target but it’s all moving in the right direction. I was pretty pleasantly surprised to see that James Bullard from the Fed, has a similar view of things. In a recent presentation he said that 2023 was likely to be a year of disinflation. And like my outlook, he said that a 5% overnight rate would be sufficiently restrictive. This was the key chart from his presentation which shows how the policy rate and Taylor Rule are likely to converge as the year moves on. So, on the one hand I am happy to see that Fed officials have

Topics:

Cullen Roche considers the following as important: Most Recent Stories

This could be interesting, too:

Cullen Roche writes Understanding the Modern Monetary System – Updated!

Cullen Roche writes We’re Moving!

Cullen Roche writes Has Housing Bottomed?

Cullen Roche writes The Economics of a United States Divorce

Here are some things I think I am thinking about:

1) 2023, the Year of Disinflation?

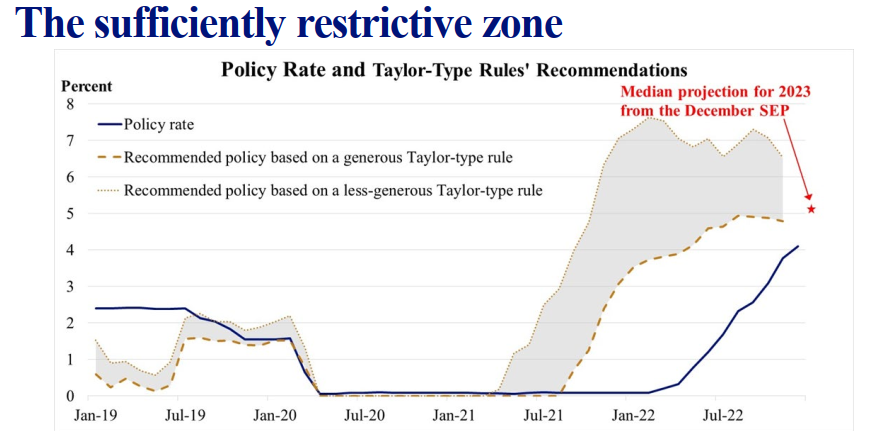

In my annual outlook I said that 2023 was going to be the year of disinflation. My guess is that Core PCE ends the year around 3%. That’s higher than the Fed’s 2% target but it’s all moving in the right direction.

I was pretty pleasantly surprised to see that James Bullard from the Fed, has a similar view of things. In a recent presentation he said that 2023 was likely to be a year of disinflation. And like my outlook, he said that a 5% overnight rate would be sufficiently restrictive. This was the key chart from his presentation which shows how the policy rate and Taylor Rule are likely to converge as the year moves on.

So, on the one hand I am happy to see that Fed officials have similar outlooks to mine. On the other hand, should I be concerned that Fed officials, who were at 0% just a year ago, have the same outlook? Yikes.

2) The Growth Bubble Hasn’t Popped?

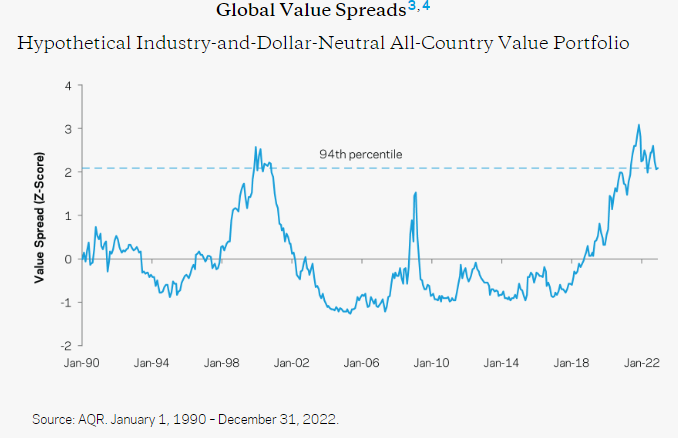

Here’s a somewhat provocative piece from Cliff Asness who says that the bubble in growth stocks still hasn’t popped. He doesn’t actually write anything, but instead just posts this chart. The implication being that value stocks are massively undervalued relative to growth. Even after growth was a disaster in 2022. Cliff’s obvious view is that this relative valuation has a lot further to compress.

What’s my view? I have no idea to be honest. I don’t generally love the idea of “factor” investing because it’s ultimately just another form of stock picking where you’re trying to pick which sectors or segments of the market are “growth” vs “value” (whatever those terms actually mean). So, for instance, using this chart you would have been bearish about growth from 2018 on, suffered through 3 years of brutal underperformance before finally being right in 2022 (when you still lost money). To me it all strengthens the old Bogle argument for “buy the haystack, ignore the needle” approach.

But if we’re looking at the market as whole then yes, I agree with Cliff that the equity market as a whole still looks very risky. So that would lead to the conclusion that higher risk higher growth names are likely to be riskier than lower beta type names. Can you pick which stocks are going to look like growth or value going forward though? That’s a much messier endeavor in my view.

3) Lessons From 2023

I loved this interview with Christine Benz from Morningstar. In one segment she discusses bucketing strategies and the value of understanding the duration of your bond allocation. She specifically discusses the importance of matching durations with cash flow needs so you don’t find yourself in a position where you need something to be principal protected that actually ends up fluctuating a lot.

This is similar to the lessons from 2022 that I discussed late last year and it’s been the main impetus for creating my “All Duration” strategy. But instead of applying the concept of “duration” only to bonds we’ve applied it to all asset classes so that an investor can structure a portfolio in a very specific planning based manner where they bucket segments in accordance with their actual financial planning needs. This helps put things like the stock market or long-term bonds in the proper “bucket” so that people can specifically understand how their assets match with their future expected liabilities.

Go give a listen to the interview with Christine. She’s one of the best around.