Efficient Market Hypothesis — an intellectually lazy ideology Both Brad DeLong and Noah Smith have posts up on their blogs commenting on the status of the Efficient Market Hypothesis. As so often the really interesting questions however drown in the usual mumbo jumbo “the model is the message” pseudo science of four-factor models with two mispricing factors being better-performing than three-factor models … Diane Coyle has a much more accurate view of what it’s all about: I would defend using the assumption of rational choice as long as one realises that it is not a description of reality. But there is one area where for 30 years economists – and others – have been making that mistake. That is unfortunately, of course, in the financial markets. Practitioners and policy makers acted as if the strong form of the Efficient Markets Hypothesis held true – in other words that prices instantly reflect all relevant information about the future – even though this evidently defies reality … I think an honest conventionally-trained economist has to at least acknowledge that we grew intellectually lazy about this. Although we all knew at some level that the rational choice assumption was being made to bear too much weight, very few economists openly challenged its everyday use in justifying public policy decisions. Very few of us put this weight on it in our own work.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Both Brad DeLong and Noah Smith have posts up on their blogs commenting on the status of the Efficient Market Hypothesis. As so often the really interesting questions however drown in the usual mumbo jumbo “the model is the message” pseudo science of four-factor models with two mispricing factors being better-performing than three-factor models …

Diane Coyle has a much more accurate view of what it’s all about:

I would defend using the assumption of rational choice as long as one realises that it is not a description of reality.

But there is one area where for 30 years economists – and others – have been making that mistake. That is unfortunately, of course, in the financial markets. Practitioners and policy makers acted as if the strong form of the Efficient Markets Hypothesis held true – in other words that prices instantly reflect all relevant information about the future – even though this evidently defies reality …

I think an honest conventionally-trained economist has to at least acknowledge that we grew intellectually lazy about this. Although we all knew at some level that the rational choice assumption was being made to bear too much weight, very few economists openly challenged its everyday use in justifying public policy decisions. Very few of us put this weight on it in our own work. But not all that many economists challenged its pervasive use in the public policy world …

I think an honest conventionally-trained economist has to at least acknowledge that we grew intellectually lazy about this. Although we all knew at some level that the rational choice assumption was being made to bear too much weight, very few economists openly challenged its everyday use in justifying public policy decisions. Very few of us put this weight on it in our own work. But not all that many economists challenged its pervasive use in the public policy world …

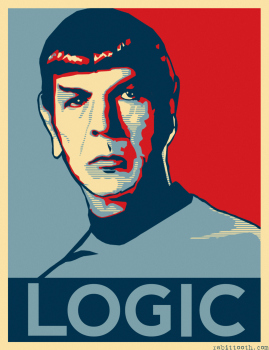

The financial and economic crisis also spells a crisis for certain areas of economics, or approaches to economics. Financial economics and macroeconomics are particularly vulnerable. They are the subject areas where the consequences of the standard assumptions have been most damaging, because they are actually least valid. Financial market traders are not remotely like Star Trek’s Mr Spock, making rational calculations unaffected by emotion or by the decisions of other people. Macroeconomics – the study of how millions of individual decisions aggregate into economy-wide measures – is essentially ideological. How macroeconomists answer a question like ‘What will be the effect of cutting the budget deficit on growth next year?’ depends on their political views. This is not remotely a scientific area of the discipline. The consensus about macroeconomics during what’s been described as ‘the Great Moderation’ of the 1990s has entirely broken down.