Axiomatic economics — the Bourbaki-Debreu delusion By the time that we have arrived at the peak first climbed by Arrow and Debreu, the central question boils down to something rather simple. We can phrase the question in the context of an exchange economy, but producers can be, and are, incorporated in the model. There is a rather arid economic environment referred to as a purely competitive market in which individuals receive signals as to the prices of all goods. All the individuals have preferences over all bundles of goods. They also have endowments or incomes defined by the prices of the goods, and this determines what is feasible for them, and the set of feasible bundles constitutes their budget set. Choosing the best commodity bundle within their budget set determines their demand at each price vector. Under what assumptions on the preferences will there be at least one price vector that clears all markets, that is, an equilibrium? Put alternatively, can we find a price vector for which the excess demand for each good is zero? The question as to whether a mechanism exists to drive prices to the equilibrium has become secondary, and Herb Scarf’s famous example (1960) had already dealt that discussion a blow.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Axiomatic economics — the Bourbaki-Debreu delusion

By the time that we have arrived at the peak first climbed by Arrow and Debreu, the central question boils down to something rather simple. We can phrase the question in the context of an exchange economy, but producers can be, and are, incorporated in the model. There is a rather arid economic environment referred to as a purely competitive market in which individuals receive signals as to the prices of all goods. All the individuals have preferences over all bundles of goods. They also have endowments or incomes defined by the prices of the goods, and this determines what is feasible for them, and the set of feasible bundles constitutes their budget set.

Choosing the best commodity bundle within their budget set determines their demand at each price vector. Under what assumptions on the preferences will there be at least one price vector that clears all markets, that is, an equilibrium? Put alternatively, can we find a price vector for which the excess demand for each good is zero? The question as to whether a mechanism exists to drive prices to the equilibrium has become secondary, and Herb Scarf’s famous example (1960) had already dealt that discussion a blow.

The warning bell was sounded by such authors as Donald Saari and Carl Simon (1978), whose work gave an indication, but one that has been somewhat overlooked, as to why the stability problem was basically unsolvable in the context of the general equilibrium model. The most destructive results were, of course, already there, those of Hugo Sonnenschein (1974), Rolf Mantel (1974), and Debreu (1974) himself. But those results show the model’s weakness, not where that weakness comes from. Nevertheless, the damage was done. What is particularly interesting about that episode is that it was scholars of the highest reputation in mathematical economics who brought the edifice down. This was not a revolt of the lower classes of economists complaining about the irrelevance of formalism in economics; this was a palace revolution.

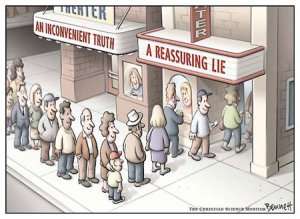

Some of us have for years been urging economists to pay attention to the ontological foundations of their assumptions and models. Sad to say, economists have not paid much attention — and so modern economics has become increasingly irrelevant to the understanding of the real world.

Within mainstream economics internal validity is still everything and external validity nothing. Why anyone should be interested in that kind of theories and models is beyond imagination. As long as mainstream economists do not come up with any export-licenses for their theories and models to the real world in which we live, they really should not be surprised if people say that this is not science, but autism!

Within mainstream economics internal validity is still everything and external validity nothing. Why anyone should be interested in that kind of theories and models is beyond imagination. As long as mainstream economists do not come up with any export-licenses for their theories and models to the real world in which we live, they really should not be surprised if people say that this is not science, but autism!

Studying mathematics and logics is interesting and fun. It sharpens the mind. In pure mathematics and logics we do not have to worry about external validity. But economics is not pure mathematics or logics. It’s about society. The real world. Forgetting that, economics is really in dire straits.

Mathematical axiomatic systems lead to analytic truths, which do not require empirical verification, since they are true by virtue of definitions and logic. It is a startling discovery of the twentieth century that sufficiently complex axiomatic systems are undecidable and incomplete. That is, the system of theorem and proof can never lead to ALL the true sentences about the system, and ALWAYS contain statements which are undecidable – their truth values cannot be determined by proof techniques. More relevant to our current purpose is that applying an axiomatic hypothetico-deductive system to the real world can only be done by means of a mapping, which creates a model for the axiomatic system. These mappings then lead to assertions about the real world which require empirical verification. These assertions (which are proposed scientific laws) can NEVER be proven in the sense that mathematical theorems can be proven …

Many more arguments can be given to explain the difference between analytic and synthetic truths, which corresponds to the difference between mathematical and scientific truths … The scientific method arose as a rejection of the axiomatic method used by the Greeks for scientific methodology. It was this rejection of axiomatics and logical certainty in favour of empirical and observational approach which led to dramatic progress in science. However, this did involve giving up the certainties of mathematical argumentation and learning to live with the uncertainties of induction. Economists need to do the same – abandon current methodology borrowed from science and develop a new methodology suited for the study of human beings and societies.