The Keynes-Ramsey-Savage debate on probability Neoclassical economics nowadays usually assumes that agents that have to make choices under conditions of uncertainty behave according to Bayesian rules, axiomatized by Ramsey (1931) and Savage (1954) – that is, they maximize expected utility with respect to some subjective probability measure that is continually updated according to Bayes theorem. If not, they are supposed to be irrational, and ultimately – via some “Dutch book” or “money pump”argument – susceptible to being ruined by some clever “bookie”. Bayesianism reduces questions of rationality to questions of internal consistency (coherence) of beliefs, but – even granted this questionable reductionism – do rational agents really have to be Bayesian? As I have been arguing elsewhere (e. g. here, here and here) there is no strong warrant for believing so. In many of the situations that are relevant to economics one could argue that there is simply not enough of adequate and relevant information to ground beliefs of a probabilistic kind, and that in those situations it is not really possible, in any relevant way, to represent an individual’s beliefs in a single probability measure. Say you have come to learn (based on own experience and tons of data) that the probability of you becoming unemployed in Sweden is 10 %.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

The Keynes-Ramsey-Savage debate on probability

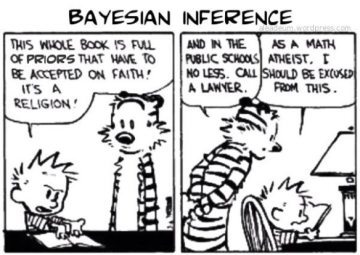

Neoclassical economics nowadays usually assumes that agents that have to make choices under conditions of uncertainty behave according to Bayesian rules, axiomatized by Ramsey (1931) and Savage (1954) – that is, they maximize expected utility with respect to some subjective probability measure that is continually updated according to Bayes theorem. If not, they are supposed to be irrational, and ultimately – via some “Dutch book” or “money pump”argument – susceptible to being ruined by some clever “bookie”.

Bayesianism reduces questions of rationality to questions of internal consistency (coherence) of beliefs, but – even granted this questionable reductionism – do rational agents really have to be Bayesian? As I have been arguing elsewhere (e. g. here, here and here) there is no strong warrant for believing so.

Bayesianism reduces questions of rationality to questions of internal consistency (coherence) of beliefs, but – even granted this questionable reductionism – do rational agents really have to be Bayesian? As I have been arguing elsewhere (e. g. here, here and here) there is no strong warrant for believing so.

In many of the situations that are relevant to economics one could argue that there is simply not enough of adequate and relevant information to ground beliefs of a probabilistic kind, and that in those situations it is not really possible, in any relevant way, to represent an individual’s beliefs in a single probability measure.

Say you have come to learn (based on own experience and tons of data) that the probability of you becoming unemployed in Sweden is 10 %. Having moved to another country (where you have no own experience and no data) you have no information on unemployment and a fortiori nothing to help you construct any probability estimate on. A Bayesian would, however, argue that you would have to assign probabilities to the mutually exclusive alternative outcomes and that these have to add up to 1, if you are rational. That is, in this case – and based on symmetry – a rational individual would have to assign probability 10% to becoming unemployed and 90% of becoming employed.

That feels intuitively wrong though, and I guess most people would agree. Bayesianism cannot distinguish between symmetry-based probabilities from information and symmetry-based probabilities from an absence of information. In these kinds of situations most of us would rather say that it is simply irrational to be a Bayesian and better instead to admit that we “simply do not know” or that we feel ambiguous and undecided. Arbitrary an ungrounded probability claims are more irrational than being undecided in face of genuine uncertainty, so if there is not sufficient information to ground a probability distribution it is better to acknowledge that simpliciter, rather than pretending to possess a certitude that we simply do not possess.

I think this critique of Bayesianism is in accordance with the views of John Maynard Keynes’ A Treatise on Probability (1921) and General Theory (1937). According to Keynes we live in a world permeated by unmeasurable uncertainty – not quantifiable stochastic risk – which often forces us to make decisions based on anything but rational expectations. Sometimes we “simply do not know.” Keynes would not have accepted the view of Bayesian economists, according to whom expectations “tend to be distributed, for the same information set, about the prediction of the theory.” Keynes, rather, thinks that we base our expectations on the confidence or “weight” we put on different events and alternatives. To Keynes expectations are a question of weighing probabilities by “degrees of belief”, beliefs that have preciously little to do with the kind of stochastic probabilistic calculations made by the rational agents modeled by Bayesian economists.

Stressing the importance of Keynes’ view on uncertainty John Kay writes in Financial Times:

Keynes believed that the financial and business environment was characterised by “radical uncertainty”. The only reasonable response to the question “what will interest rates be in 20 years’ time?” is “we simply do not know” …

For Keynes, probability was about believability, not frequency. He denied that our thinking could be described by a probability distribution over all possible future events, a statistical distribution that could be teased out by shrewd questioning – or discovered by presenting a menu of trading opportunities. In the 1920s he became engaged in an intellectual battle on this issue, in which the leading protagonists on one side were Keynes and the Chicago economist Frank Knight, opposed by a Cambridge philosopher, Frank Ramsey, and later by Jimmie Savage, another Chicagoan.

Keynes and Knight lost that debate, and Ramsey and Savage won, and the probabilistic approach has maintained academic primacy ever since. A principal reason was Ramsey’s demonstration that anyone who did not follow his precepts – anyone who did not act on the basis of a subjective assessment of probabilities of future events – would be “Dutch booked” … A Dutch book is a set of choices such that a seemingly attractive selection from it is certain to lose money for the person who makes the selection.

I used to tell students who queried the premise of “rational” behaviour in financial markets – where rational means are based on Bayesian subjective probabilities – that people had to behave in this way because if they did not, people would devise schemes that made money at their expense. I now believe that observation is correct but does not have the implication I sought. People do not behave in line with this theory, with the result that others in financial markets do devise schemes that make money at their expense.

Although this on the whole gives a succinct and correct picture of Keynes’s view on probability, I think it’s necessary to somewhat qualify in what way and to what extent Keynes “lost” the debate with the Bayesians Frank Ramsey and Jim Savage.

In economics it’s an indubitable fact that few mainstream neoclassical economists work within the Keynesian paradigm. All more or less subscribe to some variant of Bayesianism. And some even say that Keynes acknowledged he was wrong when presented with Ramsey’s theory. This is a view that has unfortunately also been promulgated by Robert Skidelsky in his otherwise masterly biography of Keynes. But I think it’s fundamentally wrong. Let me elaborate on this point (the argumentation is more fully presented in my book John Maynard Keynes (SNS, 2007)).

In economics it’s an indubitable fact that few mainstream neoclassical economists work within the Keynesian paradigm. All more or less subscribe to some variant of Bayesianism. And some even say that Keynes acknowledged he was wrong when presented with Ramsey’s theory. This is a view that has unfortunately also been promulgated by Robert Skidelsky in his otherwise masterly biography of Keynes. But I think it’s fundamentally wrong. Let me elaborate on this point (the argumentation is more fully presented in my book John Maynard Keynes (SNS, 2007)).

It’s a debated issue in newer research on Keynes if he, as some researchers maintain, fundamentally changed his view on probability after the critique levelled against his A Treatise on Probability by Frank Ramsey. It has been exceedingly difficult to present evidence for this being the case.

Ramsey’s critique was mainly that the kind of probability relations that Keynes was speaking of in Treatise actually didn’t exist and that Ramsey’s own procedure (betting) made it much easier to find out the “degrees of belief” people were having. I question this both from a descriptive and a normative point of view.

What Keynes is saying in his response to Ramsey is only that Ramsey “is right” in that people’s “degrees of belief” basically emanates in human nature rather than in formal logic.

Patrick Maher, former professor of philosophy at the University of Illinois, even suggests that Ramsey’s critique of Keynes’s probability theory in some regards is invalid:

Keynes’s book was sharply criticized by Ramsey. In a passage that continues to be quoted approvingly, Ramsey wrote:

“But let us now return to a more fundamental criticism of Mr. Keynes’ views, which is the obvious one that there really do not seem to be any such things as the probability relations he describes. He supposes that, at any rate in certain cases, they can be perceived; but speaking for myself I feel confident that this is not true. I do not perceive them, and if I am to be persuaded that they exist it must be by argument; moreover, I shrewdly suspect that others do not perceive them either, because they are able to come to so very little agreement as to which of them relates any two given propositions.” (Ramsey 1926, 161)

I agree with Keynes that inductive probabilities exist and we sometimes know their values. The passage I have just quoted from Ramsey suggests the following argument against the existence of inductive probabilities. (Here P is a premise and C is the conclusion.)

P: People are able to come to very little agreement about inductive proba- bilities.

C: Inductive probabilities do not exist.P is vague (what counts as “very little agreement”?) but its truth is still questionable. Ramsey himself acknowledged that “about some particular cases there is agreement” (28) … In any case, whether complicated or not, there is more agreement about inductive probabilities than P suggests.

Ramsey continued:

“If … we take the simplest possible pairs of propositions such as “This is red” and “That is blue” or “This is red” and “That is red,” whose logical relations should surely be easiest to see, no one, I think, pretends to be sure what is the probability relation which connects them.” (162)

I agree that nobody would pretend to be sure of a numeric value for these probabilities, but there are inequalities that most people on reflection would agree with. For example, the probability of “This is red” given “That is red” is greater than the probability of “This is red” given “That is blue.” This illustrates the point that inductive probabilities often lack numeric values. It doesn’t show disagreement; it rather shows agreement, since nobody pretends to know numeric values here and practically everyone will agree on the inequalities.

Ramsey continued:

“Or, perhaps, they may claim to see the relation but they will not be able to say anything about it with certainty, to state if it ismore or less than 1/3, or so on. They may, of course, say that it is incomparable with any numerical relation, but a relation about which so little can be truly said will be of little scientific use and it will be hard to convince a sceptic of its existence.” (162)

Although the probabilities that Ramsey is discussing lack numeric values, they are not “incomparable with any numerical relation.” Since there are more than three different colors, the a priori probability of “This is red” must be less than 1/3 and so its probability given “This is blue” must likewise be less than 1/3. In any case, the “scientific use” of something is not relevant to whether it exists. And the question is not whether it is “hard to convince a sceptic of its existence” but whether the sceptic has any good argument to support his position …

Ramsey concluded the paragraph I have been quoting as follows:

“Besides this view is really rather paradoxical; for any believer in induction must admit that between “This is red” as conclusion and “This is round” together with a billion propositions of the form “a is round and red” as evidence, there is a finite probability relation; and it is hard to suppose that as we accumulate instances there is suddenly a point, say after 233 instances, at which the probability relation becomes finite and so comparable with some numerical relations.” (162)

Ramsey is here attacking the view that the probability of “This is red” given “This is round” cannot be compared with any number, but Keynes didn’t say that and it isn’t my view either. The probability of “This is red” given only “This is round” is the same as the a priori probability of “This is red” and hence less than 1/3. Given the additional billion propositions that Ramsey mentions, the probability of “This is red” is high (greater than 1/2, for example) but it still lacks a precise numeric value. Thus the probability is always both comparable with some numbers and lacking a precise numeric value; there is no paradox here.

I have been evaluating Ramsey’s apparent argument from P to C. So far I have been arguing that P is false and responding to Ramsey’s objections to unmeasurable probabilities. Now I want to note that the argument is also invalid. Even if P were true, it could be that inductive probabilities exist in the (few) cases that people generally agree about. It could also be that the disagreement is due to some people misapplying the concept of inductive probability in cases where inductive probabilities do exist. Hence it is possible for P to be true and C false …

I conclude that Ramsey gave no good reason to doubt that inductive probabilities exist.

Ramsey’s critique made Keynes more strongly emphasize the individuals’ own views as the basis for probability calculations, and less stress that their beliefs were rational. But Keynes’s theory doesn’t stand or fall with his view on the basis for our “degrees of belief” as logical. The core of his theory – when and how we are able to measure and compare different probabilities – he doesn’t change. Unlike Ramsey he wasn’t at all sure that probabilities always were one-dimensional, measurable, quantifiable or even comparable entities.

Keynes’s analysis of the practical relevance of probability and weight to decision-making provides the basis for a theory of decision under uncertainty that, in its critique of mathematical expectations in the TP, constitutes the grounds on which Benthamite calculation is deemed to be ill-suited to deal with uncertainty in the GT. In his last letter to Townshend, this aspect clearly emerges … As already noted, Keynes reminds Townshend that he is inclined to associate “risk premium with probability strictly speaking, and liquidity premium with what in my Treatise on Probability I called ‘weight’”. Also, the correspondence shows that significant technical aspects of the TP survived Ramsey’s critique and Keynes did not endorse the subjective probability viewpoint suggested by Ramsey … Had he yielded to Ramsey’s on the possibility to derive point probabilities from action in every instances, Keynes would not refer to non-numerical probabilities as such strong an objection to received analysis of decision-making under uncertainty … Keynes’s analogy in his last letter to Townshend, associating the liquidity premium with “an increased sense of comfort and confidence”, cannot be accommodated with Ramsey’s subjectivist perspective, in which there is no room for a measure representing the degree of reliance on a probability assessment. So he may have been perplexed, in the assessment of his early beliefs, about the significance of defending the epistemological underpinnings of his theory of probability … But the correspondence shows that Keynes never stopped thinking of possible uses of his theory of probability.