Krugman and Mankiw on loanable funds — so wrong, so wrong A couple of years ago — in a debate with James Galbraith and Willem Buiter — Paul Krugman made it perfectly clear that he was a strong believer of the ‘loanable funds’ theory. Unfortunately, this is not an exception among ‘New Keynesian’ economists. Neglecting anything resembling a real-world finance system, Greg Mankiw — in his intermediate textbook Macroeconomics — more or less equates finance to the neoclassical thought-construction of a ‘market for loanable funds.’ On the subject of financial crises, he admits that perhaps we should view speculative excess and its ramifications as an inherent feature of market economies … but preventing them entirely may be too much to ask given our current

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Krugman and Mankiw on loanable funds — so wrong, so wrong

A couple of years ago — in a debate with James Galbraith and Willem Buiter — Paul Krugman made it perfectly clear that he was a strong believer of the ‘loanable funds’ theory.

A couple of years ago — in a debate with James Galbraith and Willem Buiter — Paul Krugman made it perfectly clear that he was a strong believer of the ‘loanable funds’ theory.

Unfortunately, this is not an exception among ‘New Keynesian’ economists.

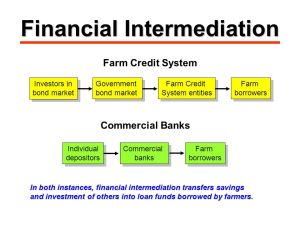

Neglecting anything resembling a real-world finance system, Greg Mankiw — in his intermediate textbook Macroeconomics — more or less equates finance to the neoclassical thought-construction of a ‘market for loanable funds.’

On the subject of financial crises, he admits that

perhaps we should view speculative excess and its ramifications as an inherent feature of market economies … but preventing them entirely may be too much to ask given our current knowledge.

This is, of course, self-evident for all of us who understand that genuine uncertainty makes any such hopes totally unfounded. But it’s rather odd to read this in a book that bases its models on assumptions of rational expectations, representative actors and dynamically stochastic general equilibrium – assumptions that convey the view that markets – give or take a few rigidities and menu costs – are efficient! For being one of many neoclassical economists so proud of their consistent models, Mankiw here certainly is flagrantly inconsistent!

And as if being afraid that all the talk of financial crises might weaken the student’s faith in the financial system, Mankiw, in his concluding remarks, has to add a more Panglossian warning that we

should not lose sight of the great benefits that the system brings … By bringing together those who want to save and those who want to invest, the financial system promotes economic growth and overall prosperity

Really?

Finance has its own dimension, and if taken seriously, its effect on an analysis must modify the whole theoretical system and not just be added as an unsystematic appendage. Finance is fundamental to our understanding of modern economies, and acting like the baker’s apprentice who, having forgotten to add yeast to the dough, throws it into the oven afterwards, simply isn’t enough.

I may be too bold, but I’m willing to take the risk, and so recommend Krugman and Mankiw to make the following addition to their reading lists …

Fallacy 2

Urging or providing incentives for individuals to try to save more is said to stimulate investment and economic growth.

Saving does not create “loanable funds” out of thin air. There is no presumption that the additional bank balance of the saver will increase the ability of his bank to extend credit by more than the credit supplying ability of the vendor’s bank will be reduced. If anything, the vendor is more likely to be active in equities markets or to use credit enhanced by the sale to invest in his business, than a saver responding to inducements such as IRA’s, exemption or deferral of taxes on pension fund accruals, and the like, so that the net effect of the saving inducement is to reduce the overall extension of bank loans. Attempted saving, with corresponding reduction in spending, does nothing to enhance the willingness of banks and other lenders to finance adequately promising investment projects. With unemployed resources available, saving is neither a prerequisite nor a stimulus to, but a consequence of capital formation, as the income generated by capital formation provides a source of additional savings.

Fallacy 3

Government borrowing is supposed to “crowd out” private investment.

The current reality is that on the contrary, the expenditure of the borrowed funds (unlike the expenditure of tax revenues) will generate added disposable income, enhance the demand for the products of private industry, and make private investment more profitable. As long as there are plenty of idle resources lying around, and monetary authorities behave sensibly, (instead of trying to counter the supposedly inflationary effect of the deficit) those with a prospect for profitable investment can be enabled to obtain financing. Under these circumstances, each additional dollar of deficit will in the medium long run induce two or more additional dollars of private investment. The capital created is an increment to someone’s wealth and ipso facto someone’s saving. “Supply creates its own demand” fails as soon as some of the income generated by the supply is saved, but investment does create its own saving, and more. Any crowding out that may occur is the result, not of underlying economic reality, but of inappropriate restrictive reactions on the part of a monetary authority in response to the deficit.

William Vickrey Fifteen Fatal Fallacies of Financial Fundamentalism