Robert Lucas — an example of macroeconomic quackery In an interview a couple of years ago, Robert Lucas said he now believes that “the evidence on postwar recessions … overwhelmingly supports the dominant importance of real shocks.” So, according to Lucas, changes in tastes and technologies should be able to explain, e.g., the main fluctuations in unemployment that we have seen during the last seven decades. Let’s look at the facts and see if there is any strong evidence for this allegation. Just to take an example, let’s look at the unemployment rate in a couple of European countries: What shocks to tastes and technologies drove the unemployment rate up and down like this in these countries? I guess most would recognise a ‘structural brake’ around 2008–2009 and start to think about financial crises and subprime loans … It’s simply not possible to come up with a warranted and justified explanation solely based on changes in tastes and technologies. Lucas is just making himself ridiculous.

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Robert Lucas — an example of macroeconomic quackery

In an interview a couple of years ago, Robert Lucas said he now believes that “the evidence on postwar recessions … overwhelmingly supports the dominant importance of real shocks.”

So, according to Lucas, changes in tastes and technologies should be able to explain, e.g., the main fluctuations in unemployment that we have seen during the last seven decades.

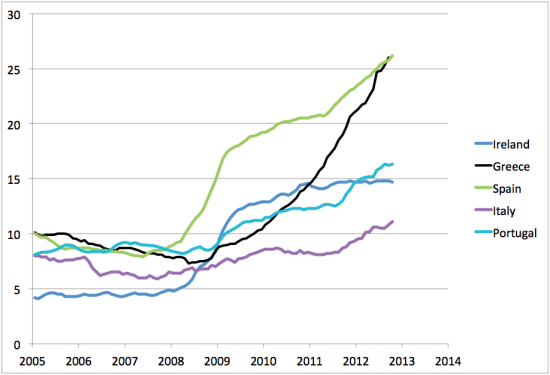

Let’s look at the facts and see if there is any strong evidence for this allegation. Just to take an example, let’s look at the unemployment rate in a couple of European countries:

What shocks to tastes and technologies drove the unemployment rate up and down like this in these countries? I guess most would recognise a ‘structural brake’ around 2008–2009 and start to think about financial crises and subprime loans … It’s simply not possible to come up with a warranted and justified explanation solely based on changes in tastes and technologies. Lucas is just making himself ridiculous.

How do we protect ourselves from this kind of scientific quackery? I think Larry Summers has a suggestion well worth considering:

Modern scientific macroeconomics sees a (the?) crucial role of theory as the development of pseudo world’s or in Lucas’s (1980b) phrase the “provision of fully articulated, artificial economic systems that can serve as laboratories in which policies that would be prohibitively expensive to experiment with in actual economies can be tested out at much lower cost” and explicitly rejects the view that “theory is a collection of assertions about the actual economy” …

[A] great deal of the theoretical macroeconomics done by those professing to strive for rigor and generality, neither starts from empirical observation nor concludes with empirically verifiable prediction …

The typical approach is to write down a set of assumptions that seem in some sense reasonable, but are not subject to empirical test … and then derive their implications and report them as a conclusion. Since it is usually admitted that many considerations are omitted, the conclusion is rarely treated as a prediction …

However, an infinity of models can be created to justify any particular set of empirical predictions … What then do these exercises teach us about the world? … If empirical testing is ruled out, and persuasion is not attempted, in the end I am not sure these theoretical exercises teach us anything at all about the world we live in …

Reliance on deductive reasoning rather than theory based on empirical evidence is particularly pernicious when economists insist that the only meaningful questions are the ones their most recent models are designed to address. Serious economists who respond to questions about how today’s policies will affect tomorrow’s economy by taking refuge in technobabble about how the question is meaningless in a dynamic games context abdicate the field to those who are less timid. No small part of our current economic difficulties can be traced to ignorant zealots who gained influence by providing answers to questions that others labeled as meaningless or difficult. Sound theory based on evidence is surely our best protection against such quackery.