Why Bayesianism has not resolved a single fundamental scientific dispute Bayesian reasoning works, undeniably, where we know (or are ready to assume) that the process studied fits certain special though abstract causal structures, often called ‘statistical models’ … However, when we choose among hypotheses in important scientific controversies, we usually lack such prior knowledge of causal structures, or it is irrelevant to the choice. As a consequence, such Bayesian inference to the preferred alternative has not resolved, even temporarily, a single fundamental scientific dispute. Mainstream economics nowadays usually assumes that agents that have to make choices under conditions of uncertainty behave according to Bayesian rules (preferably the ones

Topics:

Lars Pålsson Syll considers the following as important: Economics, Theory of Science & Methodology

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

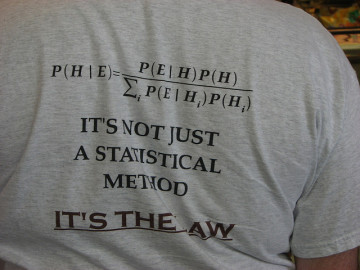

Why Bayesianism has not resolved a single fundamental scientific dispute

Bayesian reasoning works, undeniably, where we know (or are ready to assume) that the process studied fits certain special though abstract causal structures, often called ‘statistical models’ … However, when we choose among hypotheses in important scientific controversies, we usually lack such prior knowledge of causal structures, or it is irrelevant to the choice. As a consequence, such Bayesian inference to the preferred alternative has not resolved, even temporarily, a single fundamental scientific dispute.

Mainstream economics nowadays usually assumes that agents that have to make choices under conditions of uncertainty behave according to Bayesian rules (preferably the ones axiomatized by Ramsey (1931), de Finetti (1937) or Savage (1954)) — that is, they maximize expected utility with respect to some subjective probability measure that is continually updated according to Bayes theorem. If not, they are supposed to be irrational, and ultimately — via some “Dutch book” or “money pump” argument — susceptible to being ruined by some clever “bookie”.

Bayesianism reduces questions of rationality to questions of internal consistency (coherence) of beliefs, but — even granted this questionable reductionism — do rational agents really have to be Bayesian? However, there are no strong warrants for believing so.

Bayesianism reduces questions of rationality to questions of internal consistency (coherence) of beliefs, but — even granted this questionable reductionism — do rational agents really have to be Bayesian? However, there are no strong warrants for believing so.

In many of the situations that are relevant to economics, one could argue that there is simply not enough of adequate and relevant information to ground beliefs of a probabilistic kind, and that in those situations it is not really possible, in any relevant way, to represent an individual’s beliefs in a single probability measure.

Say you have come to learn (based on own experience and tons of data) that the probability of you becoming unemployed in the US is 10%. Having moved to another country (where you have no own experience and no data) you have no information on unemployment and a fortiori nothing to help you construct any probability estimate on. A Bayesian would, however, argue that you would have to assign probabilities to the mutually exclusive alternative outcomes and that these have to add up to 1 if you are rational. That is, in this case — and based on symmetry — a rational individual would have to assign probability 10% to become unemployed and 90% to become employed.

That feels intuitively wrong though, and I guess most people would agree. Bayesianism cannot distinguish between symmetry-based probabilities from information and symmetry-based probabilities from an absence of information. In these kinds of situations, most of us would rather say that it is simply irrational to be a Bayesian and better instead to admit that we “simply do not know” or that we feel ambiguous and undecided. Arbitrary an ungrounded probability claims are more irrational than being undecided in face of genuine uncertainty, so if there is not sufficient information to ground a probability distribution it is better to acknowledge that simpliciter, rather than pretending to possess a certitude that we simply do not possess.

That feels intuitively wrong though, and I guess most people would agree. Bayesianism cannot distinguish between symmetry-based probabilities from information and symmetry-based probabilities from an absence of information. In these kinds of situations, most of us would rather say that it is simply irrational to be a Bayesian and better instead to admit that we “simply do not know” or that we feel ambiguous and undecided. Arbitrary an ungrounded probability claims are more irrational than being undecided in face of genuine uncertainty, so if there is not sufficient information to ground a probability distribution it is better to acknowledge that simpliciter, rather than pretending to possess a certitude that we simply do not possess.

We live in a world permeated by unmeasurable uncertainty – not quantifiable stochastic risk – which often forces us to make decisions based on anything but rational expectations. Sometimes we ‘simply do not know.’ There are no strong reasons why we should accept the Bayesian view of modern mainstream economists, according to whom expectations “tend to be distributed, for the same information set, about the prediction of the theory.” As argued by Keynes, we rather base our expectations on the confidence or “weight” we put on different events and alternatives. Expectations are a question of weighing probabilities by ‘degrees of belief,’ beliefs that standardly have preciously little to do with the kind of stochastic probabilistic calculations made by the rational agents modelled by mainstream economists.