Rethinking Economics actually gives a pretty good description of the state of modern macroeconomics here. There is a purist streak in economics that wants everything to follow from asumming things like ‘rationality’ and ‘equilibrium.’ That purist streak has given birth to a kind ‘deductivist blindness’ of mainstream economics, something that also to a larger extent explains why it contributes to causing economic crises rather than to solving them. But where does this ‘deductivist blindness’ of mainstream economics come from? To answer that question we have to examine the methodology of mainstream economics. The insistence on constructing models showing the certainty of logical entailment has been central in the development of mainstream economics. Insisting on formalistic

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Rethinking Economics actually gives a pretty good description of the state of modern macroeconomics here.

There is a purist streak in economics that wants everything to follow from asumming things like ‘rationality’ and ‘equilibrium.’ That purist streak has given birth to a kind ‘deductivist blindness’ of mainstream economics, something that also to a larger extent explains why it contributes to causing economic crises rather than to solving them. But where does this ‘deductivist blindness’ of mainstream economics come from? To answer that question we have to examine the methodology of mainstream economics.

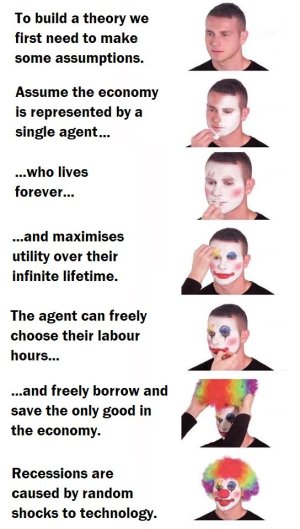

The insistence on constructing models showing the certainty of logical entailment has been central in the development of mainstream economics. Insisting on formalistic (mathematical) modeling has more or less forced the economist to give upon on realism and substitute axiomatics for real world relevance. The price paid for the illusory rigour and precision has been monumentally high.

Real business cycle theory (RBC) is one of the theories that has put macroeconomics on a path of intellectual regress for three decades now. And although there are many kinds of useless ‘post-real’economics held in high regard within mainstream economics establishment today, few — if any — are less deserved than real business cycle theory.

The future is not reducible to a known set of prospects. It is not like sitting at the roulette table and calculating what the future outcomes of spinning the wheel will be. So instead of — as RBC economists do — assuming calibration and rational expectations to be right, one ought to confront the hypothesis with the available evidence. It is not enough to construct models. Anyone can construct models. To be seriously interesting, models have to come with an aim. They have to have an intended use. If the intention of calibration and rational expectations is to help us explain real economies, it has to be evaluated from that perspective. A model or hypothesis without a specific applicability is not really deserving our interest.

Without strong evidence all kinds of absurd claims and nonsense may pretend to be science. We have to demand more of a justification than rather watered-down versions of ‘anything goes’ when it comes to rationality postulates. If one proposes rational expectations one also has to support its underlying assumptions. None is given by RBC economists, which makes it rather puzzling how rational expectations has become the standard modeling assumption made in much of modern macroeconomics. Perhaps the reason is that economists often mistake mathematical beauty for truth.

In the hands of Lucas, Prescott and Sargent, rational expectations has been transformed from an – in principle – testable hypothesis to an irrefutable proposition. Believing in a set of irrefutable propositions may be comfortable – like religious convictions or ideological dogmas – but it is not science.

So where does this all lead us? What is the trouble ahead for economics? Putting a sticky-price DSGE lipstick on the RBC pig sure won’t do. Neither will just looking the other way and pretend it’s raining.