MMT and the real issue of money and debt Austerity policies throw millions of people out of work … The lower level of output caused by austerity means there are fewer goods and services available to distribute. Society becomes objectively poorer in material production terms. How can that be helpful? … Some readers may object: what if there just isn’t enough money to buy people? If there’s just no money, it’s no good going ever further into debt. Wrong. Money is not actually a limited resource. Money is a scorekeeping tool, nothing more. Governments and central banks can no more run out of money than the scorekeeper of a basketball game can run out of scoring-points … Unless debts are denominated in a foreign currency, a government and the banking system

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

MMT and the real issue of money and debt

Austerity policies throw millions of people out of work … The lower level of output caused by austerity means there are fewer goods and services available to distribute. Society becomes objectively poorer in material production terms. How can that be helpful? …

Some readers may object: what if there just isn’t enough money to buy people? If there’s just no money, it’s no good going ever further into debt.

Wrong. Money is not actually a limited resource. Money is a scorekeeping tool, nothing more. Governments and central banks can no more run out of money than the scorekeeper of a basketball game can run out of scoring-points …

Unless debts are denominated in a foreign currency, a government and the banking system it ultimately controls cannot ‘run out of money’ …

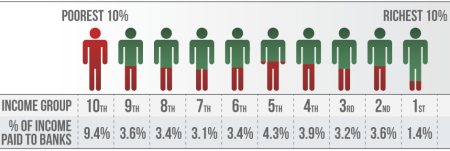

The real issue is the distribution of money and debt — not its inherent availability or quantity.