SMD theory means that assumptions guaranteeing good behavior at the microeconomic level do not carry over to the aggregate level or to qualitative features of the equilibrium. It has been difficult to make progress on the elaborations of general equilibrium theory that were put forth in Arrow and Hahn 1971 … Fifteen years after General Competitive Analysis, Arrow (1986) stated that the hypothesis of rationality had few implications at the aggregate level. Kirman (1989) held that general equilibrium theory could not generate falsifiable propositions, given that almost any set of data seemed consistent with the theory. These views are widely shared. Bliss (1993, 227) wrote that the “near emptiness of general equilibrium theory is a theorem of the theory.” Mas-Colell, Michael

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

SMD theory means that assumptions guaranteeing good behavior at the microeconomic level do not carry over to the aggregate level or to qualitative features of the equilibrium. It has been difficult to make progress on the elaborations of general equilibrium theory that were put forth in Arrow and Hahn 1971 …

Fifteen years after General Competitive Analysis, Arrow (1986) stated that the hypothesis of rationality had few implications at the aggregate level. Kirman (1989) held that general equilibrium theory could not generate falsifiable propositions, given that almost any set of data seemed consistent with the theory. These views are widely shared. Bliss (1993, 227) wrote that the “near emptiness of general equilibrium theory is a theorem of the theory.” Mas-Colell, Michael Whinston, and Jerry Green (1995) titled a section of their graduate microeconomics textbook “Anything Goes: The Sonnenschein-Mantel-Debreu Theorem.”

And so what? Why should we care about Sonnenschein-Mantel-Debreu?

Because Sonnenschein-Mantel-Debreu ultimately explains why New Classical, Real Business Cycles, Dynamic Stochastic General Equilibrium (DSGE) and New Keynesian microfounded macromodels are such bad substitutes for real macroeconomic analysis!

These models try to describe and analyze complex and heterogeneous real economies with a single rational-expectations-robot-imitation-representative-agent. That is, with something that has absolutely nothing to do with reality. And — worse still — something that is not even amenable to the kind of general equilibrium analysis that they are thought to give a foundation for, since Hugo Sonnenschein (1972), Rolf Mantel (1976) and Gerard Debreu (1974) unequivocally showed that there did not exist any condition by which assumptions on individuals would guarantee neither stability nor uniqueness of the equilibrium solution. A century and a half after Léon Walras founded neoclassical general equilibrium theory, modern mainstream economics hasn’t been able to show that markets move economies to equilibria. This if anything shows that the whole Bourbaki-Debreu project of axiomatizing economics was nothing but a delusion.

You enquire whether or not Walras was supposing that exchanges actually take place at the prices originally proposed when the prices are not equilibrium prices. The footnote which you quote convinces me that he assuredly supposed that they did not take place except at the equilibrium prices … All the same, I shall hope to convince you some day that Walras’ theory and all the others along those lines are little better than nonsense!

Letter from J. M. Keynes to N. Georgescu-Roegen, December 9, 1934

Opting for cloned representative agents that are all identical is of course not a real solution to the fallacy of composition that the Sonnenschein-Mantel-Debreu theorem points to. Representative agent models are — as I have argued at length in my On the use and misuse of theories and models in mainstream economics — rather an evasion whereby issues of distribution, coordination, heterogeneity — everything that really defines macroeconomics — are swept under the rug.

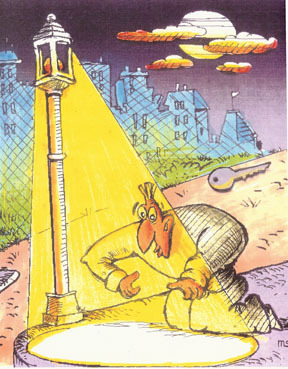

Of course, most macroeconomists know that to use a representative agent is a flagrantly illegitimate method of ignoring real aggregation issues. They keep on with their business, nevertheless, just because it significantly simplifies what they are doing. It reminds — not so little — of the drunkard who has lost his keys in some dark place and deliberately chooses to look for them under a neighbouring street light just because it is easier to see there …