Kids knowing more about scientific methods than economists Limiting model assumptions in economic science always have to be closely examined since if we are going to be able to show that the mechanisms or causes that we isolate and handle in our models are stable in the sense that they do not change when we “export” them to our “target systems”, we have to be able to show that they do not only hold under ceteris paribus conditions and a fortiori only are of limited value to our understanding, explanations or predictions of real economic systems. Our admiration for technical virtuosity should not blind us to the fact that we have to have a cautious attitude towards probabilistic inferences in economic contexts. Science should help us penetrate to the

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Kids knowing more about scientific methods than economists

Limiting model assumptions in economic science always have to be closely examined since if we are going to be able to show that the mechanisms or causes that we isolate and handle in our models are stable in the sense that they do not change when we “export” them to our “target systems”, we have to be able to show that they do not only hold under ceteris paribus conditions and a fortiori only are of limited value to our understanding, explanations or predictions of real economic systems.

Our admiration for technical virtuosity should not blind us to the fact that we have to have a cautious attitude towards probabilistic inferences in economic contexts. Science should help us penetrate to the causal process lying behind events and disclose the causal forces behind what appears to be simple facts. We should look out for causal relations, but econometrics can never be more than a starting point in that endeavour, since econometric (statistical) explanations are not explanations in terms of mechanisms, powers, capacities or causes. Firmly stuck in an empiricist tradition, econometrics is only concerned with the measurable aspects of reality. But there is always the possibility that there are other variables – of vital importance and although perhaps unobservable and non-additive, not necessarily epistemologically inaccessible – that were not considered for the model. Those who were can hence never be guaranteed to be more than potential causes, and not real causes. A rigorous application of econometric methods in economics really presupposes that the phenomena of our real world economies are ruled by stable causal relations between variables. A perusal of the leading econom(etr)ic journals shows that most econometricians still concentrate on fixed parameter models and that parameter-values estimated in specific spatio-temporal contexts are presupposed to be exportable to totally different contexts. To warrant this assumption one, however, has to convincingly establish that the targeted acting causes are stable and invariant so that they maintain their parametric status after the bridging. The endemic lack of predictive success of the econometric project indicates that this hope of finding fixed parameters is a hope for which there really is no other ground than hope itself.

Real world social systems are not governed by stable causal mechanisms or capacities. The kinds of “laws” and relations that econometrics has established, are laws and relations about entities in models that presuppose causal mechanisms being atomistic and additive. When causal mechanisms operate in real world social target systems they only do it in ever-changing and unstable combinations where the whole is more than a mechanical sum of parts. If economic regularities obtain they do it (as a rule) only because we engineered them for that purpose. Outside man-made “nomological machines” they are rare, or even non-existant. Unfortunately that also makes most of the achievements of econometrics – as most of contemporary endeavours of mainstream economic theoretical modeling – rather useless.

Let’s take an example to illustrate my point. Say we have a diehard neoclassical model (assuming the production function is homogeneous of degree one and unlimited substitutability) such as the standard Cobb-Douglas production function (with A a given productivity parameter, and k the ratio of capital stock to labor, K/L) y = Akα , with a constant investment λ out of output y and a constant depreciation rate δ of the “capital per worker” k, where the rate of accumulation of k, Δk = λy– δk, equals Δk = λAkα– δk. In steady state (*) we have λAk*α = δk*, giving λ/δ = k*/y* and k* = (λA/δ)1/(1-α). Putting this value of k* into the production function, gives us the steady state output per worker level y* = Ak*α= A1/(1-α)(λ/δ))α/(1-α). Assuming we have an exogenous Harrod-neutral technological progress that increases y with a growth rate g (assuming a zero labour growth rate and with y and k a fortiori now being refined as y/A and k/A respectively, giving the production function as y = kα) we get dk/dt = λy – (g + δ)k, which in the Cobb-Douglas case gives dk/dt = λkα– (g + δ)k, with steady state value k* = (λ/(g + δ))1/(1-α) and capital-output ratio k*/y* = k*/k*α = λ/(g + δ). If using a model with output and capital given net of depreciation, we have to change the final expression into k*/y* = k*/k*α = λ/(g + λδ). Let’s say we have δ = 0.03, λ = 0.1 and g = 0.03 initially. This gives a capital-output ratio of around 3. If g falls to 0.01 it rises to around 7.7. We reach analogous results if we use a basic CES production function with an elasticity of substitution σ > 1. With σ = 1.5, the capital share rises from 0.2 to 0.36 if the wealth-income ratio goes from 2.5 to 5, which according to some economists is what actually has happened in rich countries during the last forty years.

What do we learn from this modelling exercise? Not much. Being able to show that you can get these results using one or another of the available standard neoclassical growth models is of course — from a realist point of view — of very limited value. As usual: the really interesting thing is how in accord with reality are the assumptions you make and the numerical values you put into the model specification.

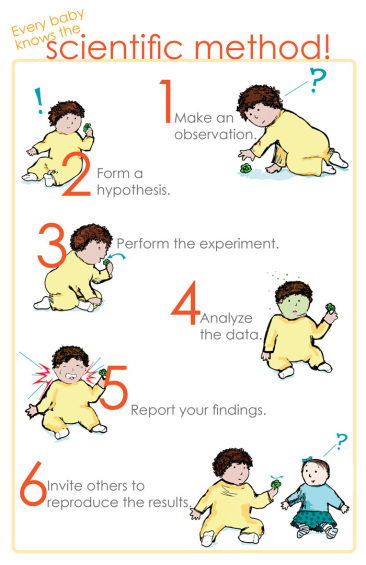

Kids — somehow — seem to be more in touch with real science than can-opener-assuming economists …

A physicist, a chemist, and an economist are stranded on a desert island. One can only imagine what sort of play date went awry to land them there. Anyway, they’re hungry. Like, desert island hungry. And then a can of soup washes ashore. Progresso Reduced Sodium Chicken Noodle, let’s say. Which is perfect, because the physicist can’t have much salt, and the chemist doesn’t eat red meat.

But, famished as they are, our three professionals have no way to open the can. So they put their brains to the problem. The physicist says “We could drop it from the top of that tree over there until it breaks open.” And the chemist says “We could build a fire and sit the can in the flames until it bursts open.”

Those two squabble a bit, until the economist says “No, no, no. Come on, guys, you’d lose most of the soup. Let’s just assume a can opener.”