Microfoundations — neither law nor true Simon Wren-Lewis is one of many mainstream economists that staunchly defends the idea that having microfoundations for macroeconomics moves macroeconomics forward. A couple of years ago he wrote this: I think the two most important microfoundation led innovations in macro have been intertemporal consumption and rational expectations … [T]he adoption of rational expectations was not the result of some previous empirical failure. Instead it represented, as Lucas said, a consistency axiom … I think macroeconomics today is much better than it was 40 years ago as a result of the microfoundations approach. On this kind of argumentation I would like to add the following comments: (1) The fact that Lucas introduced

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Microfoundations — neither law nor true

Simon Wren-Lewis is one of many mainstream economists that staunchly defends the idea that having microfoundations for macroeconomics moves macroeconomics forward. A couple of years ago he wrote this:

I think the two most important microfoundation led innovations in macro have been intertemporal consumption and rational expectations … [T]he adoption of rational expectations was not the result of some previous empirical failure. Instead it represented, as Lucas said, a consistency axiom …

I think macroeconomics today is much better than it was 40 years ago as a result of the microfoundations approach.

On this kind of argumentation I would like to add the following comments:

(1) The fact that Lucas introduced rational expectations as a consistency axiom is not really an argument as to why we should accept it as an acceptable assumption in a theory purporting to explain real macroeconomic processes (see e. g. Robert Lucas, rational expectations, and the understanding of business cycles).

(2) “Now virtually any empirical claim in macro is contestable,” Wren-Lewis writes. Yes, but so is virtually also any claim in micro (see e. g. When the model is the message – modern neoclassical economics).

(3) To the two questions “Can the microfoundations approach embrace all kinds of heterogeneity, or will such models lose their attractiveness in their complexity?” and “Does sticking with simple, representative agent macro impart some kind of bias?” I would unequivocally answer yes (I have given the reasons why e. g. in David Levine is totally wrong on the rational expectations hypothesis).

(4) “Are alternatives to microfoundations modelling methodologically coherent?” Well, I don’t know. But one thing I do know, is that the kind of miocrofoundationalist macroeconomics that New Classical economists in the vein of Lucas and Sargent and the ‘New Keynesian’ economists in the vein of Mankiw et consortes are pursuing are not methodologically coherent (as I have argued e. g. in What is (wrong with) economic theory?). And that ought to be rather embarrassing for those ilks of macroeconomists to whom axiomatics is the hallmark of science tout court.

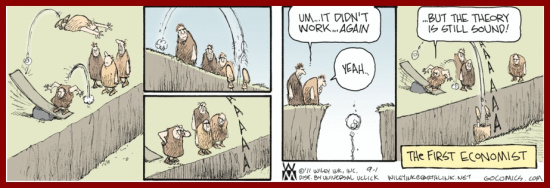

As Paul Krugman once remarked — “what we call ‘microfoundations’ are not like physical laws. Heck, they’re not even true.”