The wide conviction of the superiority of the methods of the science has converted the econometric community largely to a group of fundamentalist guards of mathematical rigour. It is often the case that mathemical rigour is held as the dominant goal and the criterion for research topic choice as well as research evaluation, so much so that the relevance of the research to business cycles is reduced to empirical illustrations. To that extent, probabilistic formalization has trapped econometric business cycle research in the pursuit of means at the expense of ends. Once the formalization attempts have gone significantly astray from what is needed for analysing and forecasting the multi-faceted characteristics of business cycles, the research community should hopefully make

Topics:

Lars Pålsson Syll considers the following as important: Statistics & Econometrics

This could be interesting, too:

Lars Pålsson Syll writes Keynes’ critique of econometrics is still valid

Lars Pålsson Syll writes The history of random walks

Lars Pålsson Syll writes The history of econometrics

Lars Pålsson Syll writes What statistics teachers get wrong!

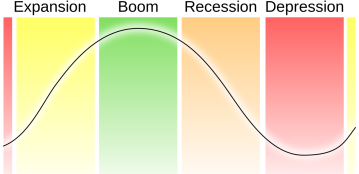

The wide conviction of the superiority of the methods of the science has converted the econometric community largely to a group of fundamentalist guards of mathematical rigour. It is often the case that mathemical rigour is held as the dominant goal and the criterion for research topic choice as well as research evaluation, so much so that the relevance of the research to business cycles is reduced to empirical illustrations. To that extent, probabilistic formalization has trapped econometric business cycle research in the pursuit of means at the expense of ends.

Once the formalization attempts have gone significantly astray from what is needed for analysing and forecasting the multi-faceted characteristics of business cycles, the research community should hopefully make appropriate ‘error corrections’ of its overestimation of the power of a priori postulated models as well as its underestimation of the importance of the historical approach, or the ‘art’ dimension of business cycle research.