Non-ergodic economics, expected utility theory and the Kelly criterion (wonkish) Suppose I want to play a game. Let’s say we are tossing a coin. If heads come up, I win a dollar, and if tails come up, I lose a dollar. Suppose further that I believe I know that the coin is asymmetrical and that the probability of getting heads (p) is greater than 50% — say 60% (0.6) — while the bookmaker assumes that the coin is totally symmetric. How much of my bankroll (T), should I optimally invest in this game? A strict neoclassical utility-maximizing economist would suggest that my goal should be to maximize the expected value of my bankroll (wealth), and according to this view, I ought to bet my entire bankroll. Does that sound rational? Most people would answer no

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

Non-ergodic economics, expected utility theory and the Kelly criterion (wonkish)

Suppose I want to play a game. Let’s say we are tossing a coin. If heads come up, I win a dollar, and if tails come up, I lose a dollar. Suppose further that I believe I know that the coin is asymmetrical and that the probability of getting heads (p) is greater than 50% — say 60% (0.6) — while the bookmaker assumes that the coin is totally symmetric. How much of my bankroll (T), should I optimally invest in this game?

Suppose I want to play a game. Let’s say we are tossing a coin. If heads come up, I win a dollar, and if tails come up, I lose a dollar. Suppose further that I believe I know that the coin is asymmetrical and that the probability of getting heads (p) is greater than 50% — say 60% (0.6) — while the bookmaker assumes that the coin is totally symmetric. How much of my bankroll (T), should I optimally invest in this game?

A strict neoclassical utility-maximizing economist would suggest that my goal should be to maximize the expected value of my bankroll (wealth), and according to this view, I ought to bet my entire bankroll.

Does that sound rational? Most people would answer no to that question. The risk of losing is so high, that already after a few games played — the expected time until my first loss arises is 1/(1-p), which in this case is equal to 2.5 — with a high likelihood would be losing and thereby becoming bankrupt. The expected-value maximizing economist does not seem to have a particularly attractive approach.

So what’s the alternative? One possibility is to apply the so-called Kelly strategy — after the American physicist and information theorist John L. Kelly, who in the article A New Interpretation of Information Rate (1956) suggested this criterion for how to optimize the size of the bet — under which the optimum is to invest a specific fraction (x) of wealth (T) in each game. How do we arrive at this fraction?

So what’s the alternative? One possibility is to apply the so-called Kelly strategy — after the American physicist and information theorist John L. Kelly, who in the article A New Interpretation of Information Rate (1956) suggested this criterion for how to optimize the size of the bet — under which the optimum is to invest a specific fraction (x) of wealth (T) in each game. How do we arrive at this fraction?

When I win, I have (1 + x) times more than before, and when I lose (1 – x) times less. After n rounds, when I have won v times and lost n – v times, my new bankroll (W) is

The bankroll increases multiplicatively – “compound interest” – and the long-term average growth rate for my wealth can then be easily calculated by taking the logarithms of (1), which gives

(2) log (W/ T) = v log (1 + x) + (n – v) log (1 – x).

If we divide both sides by n we get

(3) [log (W / T)] / n = [v log (1 + x) + (n – v) log (1 – x)] / n

The left-hand side now represents the average growth rate (g) in each game. On the right-hand side the ratio v/n is equal to the percentage of bets that I won, and when n is large, this fraction will be close to p. Similarly, (n – v)/n is close to (1 – p). When the number of bets is large, the average growth rate is

(4) g = p log (1 + x) + (1 – p) log (1 – x).

Now we can easily determine the value of x that maximizes g:

(5) d [p log (1 + x) + (1 – p) log (1 – x)]/d x = p/(1 + x) – (1 – p)/(1 – x) =>

p/(1 + x) – (1 – p)/(1 – x) = 0 =>

(6) x = p – (1 – p)

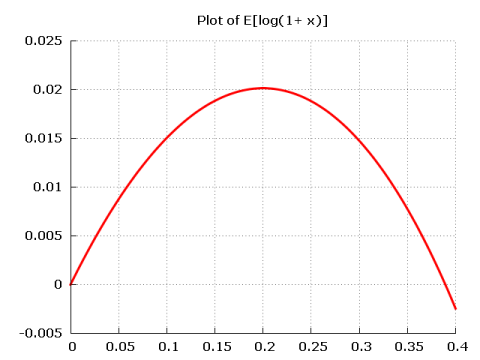

Since p is the probability that I will win, and (1 – p) is the probability that I will lose, the Kelly strategy says that to optimize the growth rate of your bankroll (wealth) you should invest a fraction of the bankroll equal to the difference of the likelihood that you will win or lose. In our example, this means that I have in each game to bet the fraction of x = 0.6 – (1 – 0.6) ≈ 0.2 — that is, 20% of my bankroll. Alternatively, we see that the Kelly criterion implies that we have to choose x so that E[log(1+x)] — which equals p log (1 + x) + (1 – p) log (1 – x) — is maximized. Plotting E[log(1+x)] as a function of x we see that the value maximizing the function is 0.2:

The optimal average growth rate becomes

(7) 0.6 log (1.2) + 0.4 log (0.8) ≈ 0.02.

If I bet 20% of my wealth in tossing the coin, I will after 10 games on average have 1.0210 times more than when I started (≈ 1.22).

This game strategy will give us an outcome in the long run that is better than if we use a strategy building on the neoclassical economic theory of choice under uncertainty (risk) — expected value maximization. If we bet all our wealth in each game we will most likely lose our fortune, but because with low probability we will have a very large fortune, the expected value is still high. For a real-life player — for whom there is very little to benefit from this type of ensemble average — it is more relevant to look at the time average of what he may be expected to win (in our game the averages are the same only if we assume that the player has a logarithmic utility function). What good does it do me if my tossing the coin maximizes an expected value when I might have gone bankrupt after four games played? If I try to maximize the expected value, the probability of bankruptcy soon gets close to one. Better then to invest 20% of my wealth in each game and maximize my long-term average wealth growth!

On a more economic-theoretical level, the Kelly strategy highlights the problems concerning the neoclassical theory of expected utility that I have raised before (e. g. Why expected utility theory is wrong).

When applied to the neoclassical theory of expected utility, one thinks in terms of a “parallel universe” and asks what the expected return of an investment, calculated as an average over the “parallel universe” is. In our coin toss example, it is as if one supposes that various “I” are tossing a coin and that the loss of many of them will be offset by the huge profits one of these “I” does. But this ensemble average does not work for an individual, for whom a time average better reflects the experience made in the “non-parallel universe” in which we live.

The Kelly strategy gives a more realistic answer, where one thinks in terms of the only universe we actually live in, and asks what is the expected return of an investment, calculated as an average over time.

Since we cannot go back in time – entropy and the “arrow of time ” make this impossible – and the bankruptcy option is always at hand (extreme events and “black swans” are always possible) we have nothing to gain from thinking in terms of ensembles.

Actual events follow a fixed pattern of time, where events are often linked in a multiplicative process (as e. g. investment returns with “compound interest”) which is basically non-ergodic.

Instead of arbitrarily assuming that people have a certain type of utility function – as in the neoclassical theory – the Kelly criterion shows that we can obtain a less arbitrary and more accurate picture of real people’s decisions and actions by basically assuming that time is irreversible. When the bankroll is gone, it’s gone. The fact that in a parallel universe, it could conceivably have been refilled, is of little comfort to those who live in the one and only possible world that we call the real world.

Our coin toss example can be applied to more traditional economic issues. If we think of an investor, we can basically describe his situation in terms of our coin toss. What fraction (x) of his assets (T) should an investor – who is about to make a large number of repeated investments — bet on his feeling that he can better evaluate an investment (p = 0.6) than the market (p = 0.5)? The greater the x, the greater the leverage. But also — the greater the risk. Since p is the probability that his investment valuation is correct and (1 – p) is the probability that the market’s valuation is correct, it means the Kelly strategy says he optimizes the rate of growth on his investments by investing a fraction of his assets that is equal to the difference in the probability that he will “win” or “lose”. In our example this means that he at each investment opportunity is to invest the fraction of x = 0.6 – (1 – 0.6), i.e. about 20% of his assets. The optimal average growth rate of investment is then about 11% (0.6 log (1.2) + 0.4 log (0.8)).

Kelly’s criterion shows that because we cannot go back in time, we should not take excessive risks. High leverage increases the risk of bankruptcy. This should also be a warning for the financial world, where the constant quest for greater and greater leverage – and risks – creates extensive and recurrent systemic crises. A more appropriate level of risk-taking is a necessary ingredient in a policy to come to curb excessive risk-taking.

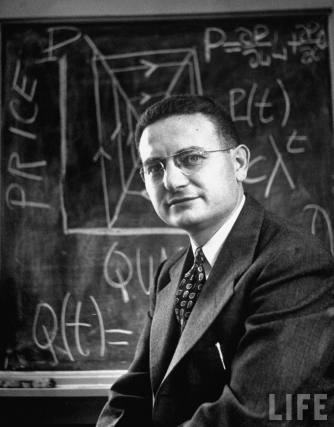

Paul Samuelson famously claimed that the ‘ergodic hypothesis’ is essential for advancing economics from the realm of history to the realm of science.

Paul Samuelson famously claimed that the ‘ergodic hypothesis’ is essential for advancing economics from the realm of history to the realm of science.

But is it really tenable to assume that ergodicity is essential to economics?

The answer can only be no!

Like so many other mainstream economists Samuelson was a formalist committed to mathematical economics. Where did this methodological stance take him? Nowhere I would argue. It is one thing to come up with ‘minimally realist’ models of ‘possibly true’ worlds.’ And something completely different to give us relevant truths about real-world systems. Just giving us a set of possible truths doesn’t suffice. We are looking for how-actually explanations and not how-possibly explanations. The model world is not the real world. Model worlds may well be ergodic. Real-world economies are not. So how then, could one possibly learn anything economically relevant and interesting using an ergodic model that obviously badly misrepresent the world in which we live? Providing us with knowledge of possibilities is not enough. Genuine understanding and explanation demand knowledge of causes, not knowledge of possibilities. Although mathematics may teach us — without empirical knowledge — why a mother cannot evenly divide her twenty-three apples among three children without cutting any of the apples, we have to remember that most relevant economic problems and issues are of a much more complex and different nature. In real-world economies, purely mathematical explanations do not take us anywhere.

Samuelson’s elaborations on revealed preference theory show this in an illuminating way. The very raison d’être for developing revealed preference theory in the 1930s and 1940s was to be able to ascertain people’s preferences by observation of their actual behaviour on markets and not having to make unobservable psychological assumptions or rely on any utility concepts. This turned out to be impossible. Samuelson et consortes had to assume unchanging preferences, which, of course, was in blatant contradiction to the attempt of building a consumer and demand theory without non-observational concepts. Preferences are only revealed from market behaviour when specific theoretical constraining assumptions are made. Without making those assumptions there are no valid inferences to make from observing people’s choices on a market.

But still, a lot of mainstream economists consider the approach offered by revealed preference theory great progress. As people like Robinson, Georgescu-Roegen, and Kornai have shown, this is, however, nothing but an illusion. Revealed preference theory does not live up to what it claims to offer. As part of the economist’s toolkit, it is of extremely limited use.

If we want to be able to explain the behaviour and choices people make, we have to know something about people’s beliefs, preferences, uncertainties, and understandings. Revealed preference theory does not provide us with any support whatsoever in accomplishing that.

So why did Samuelson basically fail in his theoretical endeavours?

One reason is that he did not — like most mainstream economists that have followed in his footsteps — seriously reflect on the fact that limiting model assumptions in economic science always have to be closely examined since if we are going to be able to show that the mechanisms or causes that we isolate and handle in our models are stable in the sense that they do not change when we ‘export’ them to our ‘target systems,’ we have to be able to show that they do not only hold under ceteris paribus conditions and a fortiori only are of limited value to our understanding, explanations or predictions of real economic systems.

Another reason is that he confused epistemology and ontology. The validity of the inferential models we as scientists use ultimately depends on the assumptions we make about the entities to which we apply them. Applying a relevant modelling strategy presupposes far-reaching ontological presuppositions. If we are prepared to assume that societies and economies are like urns filled with coloured balls in fixed proportions, then fine. But — really — who could earnestly believe in such an utterly ridiculous analogy? We are not mainly interested in what could be true, but what is true. In a world full of ‘unknown unknowns’ and genuine non-ergodic uncertainty, urns are of little avail.

The ‘ergodicity hypothesis’ provides a totally wrong-headed picture of the processes that operate in real-world economies. Ergodicity is not relevant for studying actual economic processes. It doesn’t actually explain anything about what goes on in real-world economies. How it could be claimed by Paul Samuelson and other mainstream economists to be essential for advancing economics to the realm of science is beyond comprehension.