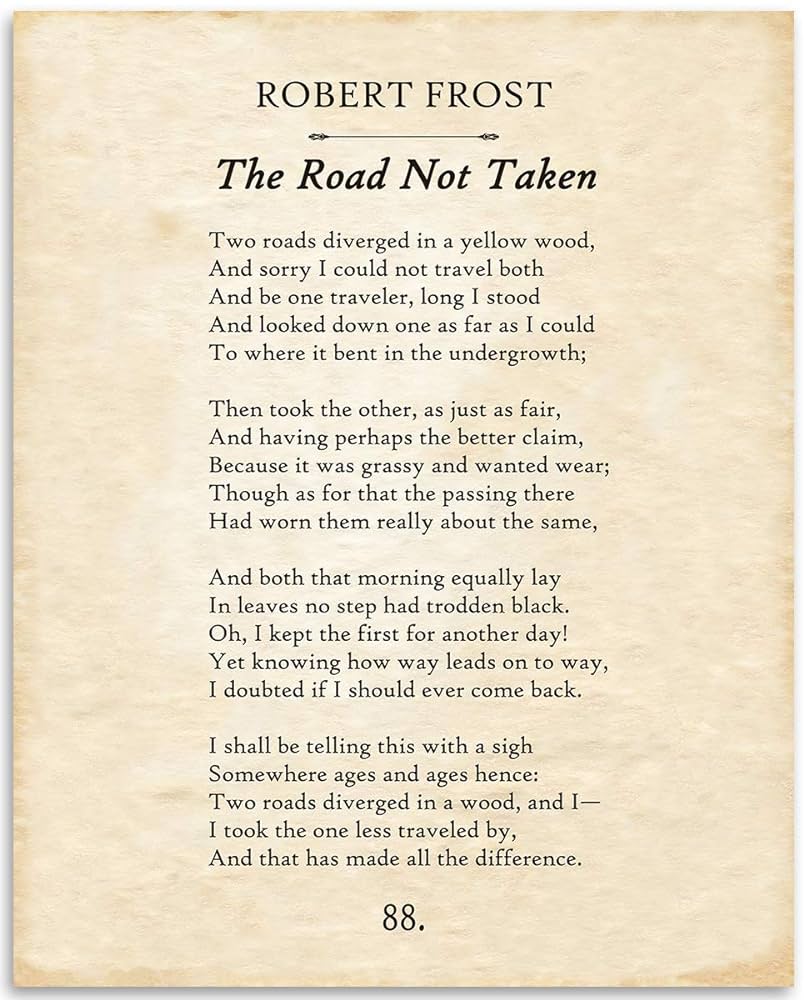

The Road Not Taken We all heterodox economists who have chosen the road ‘less traveled by’ know that this choice comes at a price. Fewer opportunities to secure ample research funding or positions at prestigious institutes or universities. Nevertheless, yours truly believes that very few of us regret our choices. One doesn’t bargain with one’s conscience. No amount of money or prestige in the world can replace the feeling of looking in the mirror and liking what one sees. My friend Axel Leijonhufvud (1933-2022) was such an academic who dared to choose a road ‘less traveled by’ among economists: The orthodox Keynesianism of the time did have a theoretical explanation for recessions and depressions. Proponents saw the economy as a self-regulating

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

The Road Not Taken

We all heterodox economists who have chosen the road ‘less traveled by’ know that this choice comes at a price. Fewer opportunities to secure ample research funding or positions at prestigious institutes or universities. Nevertheless, yours truly believes that very few of us regret our choices. One doesn’t bargain with one’s conscience. No amount of money or prestige in the world can replace the feeling of looking in the mirror and liking what one sees.

My friend Axel Leijonhufvud (1933-2022) was such an academic who dared to choose a road ‘less traveled by’ among economists:

The orthodox Keynesianism of the time did have a theoretical explanation for recessions and depressions. Proponents saw the economy as a self-regulating machine in which individual decisions typically lead to a situation of full employment and healthy growth. The primary reason for periods of recession and depression was because wages did not fall quickly enough. If wages could fall rapidly and extensively enough, then the economy would absorb the unemployed. Orthodox Keynesians also took Keynes’ approach to monetary economics to be similar to the classical economists.

Leijonhufvud got something entirely different from reading the General Theory. The more he looked at his footnotes, originally written in puzzlement at the disparity between what he took to be the Keynesian message and the orthodox Keynesianism of his time, the more confident he felt. The implications were amazing. Had the whole discipline catastrophically misunderstood Keynes’ deeply revolutionary ideas? Was the dominant economics paradigm deeply flawed and a fatally wrong turn in macroeconomic thinking? And if this was the case, what was Keynes actually proposing?

Leijonhufvud’s “Keynesian Economics and the Economics of Keynes” exploded onto the academic stage the following year; no mean feat for an economics book that did not contain a single equation. The book took no prisoners and aimed squarely at the prevailing metaphor about the self-regulating economy and the economics of the orthodoxy. He forcefully argued that the free movement of wages and prices can sometimes be destabilizing and could move the economy away from full employment.

A must-read (not least because of the interview videos where Leijonhufvud gets the opportunity to comment on the ‘madness’ of modern mainstream macroeconomics)!

If macroeconomic models — no matter what ilk — build on microfoundational assumptions of representative actors, rational expectations, market clearing and equilibrium, and we know that real people and markets cannot be expected to obey these assumptions, the warrants for supposing that conclusions or hypothesis of causally relevant mechanisms or regularities can be bridged, are obviously non-justifiable. Trying to represent real-world target systems with models flagrantly at odds with reality is futile. And if those models are New Classical or ‘New Keynesian’ makes very little difference.

So, indeed, there really is something about the way macroeconomists construct their models nowadays that obviously doesn’t sit right.

Fortunately — when you’ve got tired of the kind of macroeconomic apologetics produced by ‘New Keynesian’ macroeconomists — there are still some real Keynesian macroeconomists to read. One of them is Axel Leijonhufvud.