How economists invented austerity .[embedded content] To many conservative and neoliberal politicians and economists, there seems to be a spectre haunting the United States and Europe today — Keynesian ideas on governments pursuing policies raising effective demand and supporting employment. Some of the favourite arguments used among these Keynesophobics to fight it are the ‘doctrine of sound finance’ and the need for austerity. Is this witless crusade against economic reason new? Not at all. If mainstream economists had not had such a debonair attitude to the history of economic thought they would for sure have encountered Michal Kalecki’s classic 1943 article — basically giving the same answer to the questions posed as yours truly — and Clara Mattei

Topics:

Lars Pålsson Syll considers the following as important: Economics

This could be interesting, too:

Lars Pålsson Syll writes Schuldenbremse bye bye

Lars Pålsson Syll writes What’s wrong with economics — a primer

Lars Pålsson Syll writes Krigskeynesianismens återkomst

Lars Pålsson Syll writes Finding Eigenvalues and Eigenvectors (student stuff)

How economists invented austerity

.

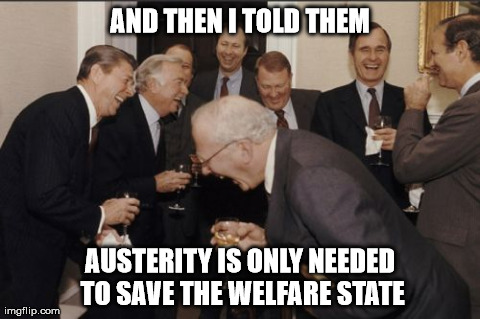

To many conservative and neoliberal politicians and economists, there seems to be a spectre haunting the United States and Europe today — Keynesian ideas on governments pursuing policies raising effective demand and supporting employment.  Some of the favourite arguments used among these Keynesophobics to fight it are the ‘doctrine of sound finance’ and the need for austerity.

Some of the favourite arguments used among these Keynesophobics to fight it are the ‘doctrine of sound finance’ and the need for austerity.

Is this witless crusade against economic reason new? Not at all. If mainstream economists had not had such a debonair attitude to the history of economic thought they would for sure have encountered Michal Kalecki’s classic 1943 article — basically giving the same answer to the questions posed as yours truly — and Clara Mattei — do eighty years later …

It should be first stated that, although most economists are now agreed that full employment may be achieved by government spending, this was by no means the case even in the recent past. Among the opposers of this doctrine there were (and still are) prominent so-called ‘economic experts’ closely connected with banking and industry. This suggests that there is a political background in the opposition to the full employment doctrine, even though the arguments advanced are economic. That is not to say that people who advance them do not believe in their economics, poor though this is. But obstinate ignorance is usually a manifestation of underlying political motives …

Clearly, higher output and employment benefit not only workers but entrepreneurs as well, because the latter’s profits rise. And the policy of full employment outlined above does not encroach upon profits because it does not involve any additional taxation. The entrepreneurs in the slump are longing for a boom; why do they not gladly accept the synthetic boom which the government is able to offer them? It is this difficult and fascinating question with which we intend to deal in this article …

We shall deal first with the reluctance of the ‘captains of industry’ to accept government intervention in the matter of employment. Every widening of state activity is looked upon by business with suspicion, but the creation of employment by government spending has a special aspect which makes the opposition particularly intense. Under a laissez-faire system the level of employment depends to a great extent on the so-called state of confidence. If this deteriorates, private investment declines, which results in a fall of output and employment (both directly and through the secondary effect of the fall in incomes upon consumption and investment). This gives the capitalists a powerful indirect control over government policy: everything which may shake the state of confidence must be carefully avoided because it would cause an economic crisis. But once the government learns the trick of increasing employment by its own purchases, this powerful controlling device loses its effectiveness. Hence budget deficits necessary to carry out government intervention must be regarded as perilous. The social function of the doctrine of ‘sound finance’ is to make the level of employment dependent on the state of confidence.

Michal Kalecki Political aspects of full employment

[Note: Clara Mattei’s The Capital Order (The University of Chicago Press, 2022) is a book yours truly appreciates in many ways as a critical study of the historical background of austerity policies in the UK and Italy. Regarding the ‘early’ Keynes, I don’t have much to object to, but overall, I find the image she portrays of Keynes from the 1930s onwards rather misleading.]