Summary:

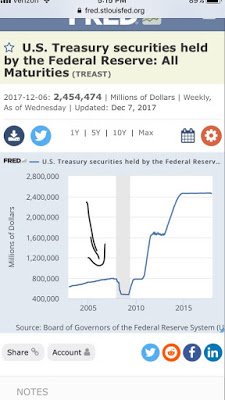

You can see here that as early as November 2007 the Fed created the initial credit contraction by quickly reducing the rate at which they were purchasing Treasury securities by 0B per some measure of time while keeping the total amount of system reserves constant: Quickly tossed the task of dealing that amount over to the depository institutions to then have to finance. This started the whole thing till eventually they shut the whole system of finance down by adding reserve assets at the rate of approx 0B/month in September 2008.

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

You can see here that as early as November 2007 the Fed created the initial credit contraction by quickly reducing the rate at which they were purchasing Treasury securities by 0B per some measure of time while keeping the total amount of system reserves constant: Quickly tossed the task of dealing that amount over to the depository institutions to then have to finance. This started the whole thing till eventually they shut the whole system of finance down by adding reserve assets at the rate of approx 0B/month in September 2008.

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

You can see here that as early as November 2007 the Fed created the initial credit contraction by quickly reducing the rate at which they were purchasing Treasury securities by $300B per some measure of time while keeping the total amount of system reserves constant:

Quickly tossed the task of dealing that amount over to the depository institutions to then have to finance. This started the whole thing till eventually they shut the whole system of finance down by adding reserve assets at the rate of approx $100B/month in September 2008.