Dave Fishwick, a self made multimillionaire who started the Bank of Dave, probably identified with conservative values but when he went to the Conservative Party Conference they wouldn't let him in, why, because they stand for the ruling elite, the top bankers who don't want small community savings and loans banks like The Bank of Dave bringing in competition?Many small businessman vote Conservative thinking that because they have nice houses they are part of the gentry, but the Tory Party doesn't care about them. Look at this report. The Royal Bank of Scotland bankrupted small viable businesses on purpose to make massive profits amounting in the £billions. The Tory Party have the Financial Conduct Authority report but have decided to do nothing. In capitalism the big fish eat the little

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Many small businessman vote Conservative thinking that because they have nice houses they are part of the gentry, but the Tory Party doesn't care about them. Look at this report. The Royal Bank of Scotland bankrupted small viable businesses on purpose to make massive profits amounting in the £billions. The Tory Party have the Financial Conduct Authority report but have decided to do nothing. In capitalism the big fish eat the little fish all the way down to the bottom. KV

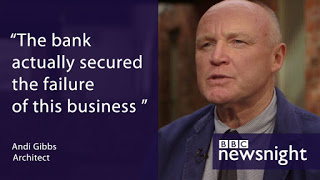

“More like an abattoir”

“Gibbs lost his business, his home, his marriage and, I think it is fair to say, almost his sanity. His crime: nothing more than being an entrepreneur who banked with RBS,” said Clive Lewis.

More Here -“Far from being an intensive care unit, it was more like an abattoir, where they were stripped and taken apart,” said Clive Lewis.