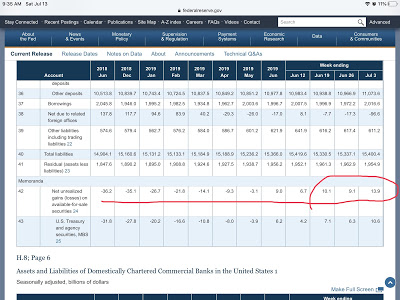

Cut below from the H.8 highlighting nsa Urealized Gains on Available for Sale Securities have already turned positive during the current debt ceiling induced bond rally.If Fed reduces the policy rate this month/year then this gain should perhaps increase an additional 10s of $B based on the magnitude of last year losses you can see here when Fed was doing a quarterly series of 0.25% increases.Rate cuts this year should have perhaps the opposite effect and then we can observe the changes induced in risk asset prices which should ideally increase if we get big unrealized gains here due to a reversal in interest rate policy...

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Cut below from the H.8 highlighting nsa Urealized Gains on Available for Sale Securities have already turned positive during the current debt ceiling induced bond rally.

If Fed reduces the policy rate this month/year then this gain should perhaps increase an additional 10s of $B based on the magnitude of last year losses you can see here when Fed was doing a quarterly series of 0.25% increases.

Rate cuts this year should have perhaps the opposite effect and then we can observe the changes induced in risk asset prices which should ideally increase if we get big unrealized gains here due to a reversal in interest rate policy...