Still lingering effects of "debt ceiling!" now causing a sudden collapse in Reserve Assets as Treasury seeks to quickly increase the General Account to 0b...Treasury could have done a better job in August post the suspension of the "debt ceiling!" ... by increasing net issuance sooner and more evenly on a weekly basis... instead these morons have delivered EVEN MORE chaos... and have had to do a special repo operation for some institutions that apparently have become deficient in reserve balances they need to operate... Snip from Mike below documenting yesterday's sudden TGA increase (thus reserve reduction) of b... Idiots running the thing...

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

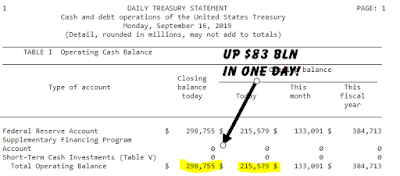

Still lingering effects of "debt ceiling!" now causing a sudden collapse in Reserve Assets as Treasury seeks to quickly increase the General Account to $350b...

Treasury could have done a better job in August post the suspension of the "debt ceiling!" ... by increasing net issuance sooner and more evenly on a weekly basis... instead these morons have delivered EVEN MORE chaos... and have had to do a special repo operation for some institutions that apparently have become deficient in reserve balances they need to operate...

Snip from Mike below documenting yesterday's sudden TGA increase (thus reserve reduction) of $83b...

Idiots running the thing...