Capture from Thursday's DTS showing TGA down to 7b that first day of the month of August... net B draw down of the account that day ... set a "debt ceiling!" low here previous low during the recent "debt ceiling!" interval was 9B set in late May which preceded the big June >6% rally in equity prices...Doesn't look like Treasury could have made it through September 1st or at least not safely unless govt didn't raise the debt ceiling Friday... hence Mnuchin/Trump sense of urgency on getting the budget deal done before summer recess....Treasury has said they want the TGA back up to 0B by end of September about 8 weeks from now... so thats 0B of depository reserve asset reduction in the banking system by then.. about B of reserve reduction per week for 8 weeks...This rate

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

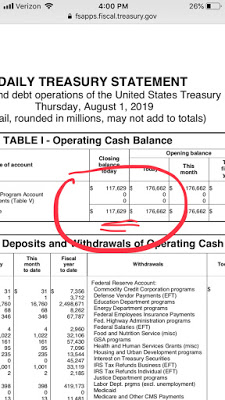

Capture from Thursday's DTS showing TGA down to $117b that first day of the month of August... net $60B draw down of the account that day ... set a "debt ceiling!" low here previous low during the recent "debt ceiling!" interval was $139B set in late May which preceded the big June >6% rally in equity prices...

Doesn't look like Treasury could have made it through September 1st or at least not safely unless govt didn't raise the debt ceiling Friday... hence Mnuchin/Trump sense of urgency on getting the budget deal done before summer recess....

Treasury has said they want the TGA back up to $350B by end of September about 8 weeks from now... so thats $230B of depository reserve asset reduction in the banking system by then.. about $30B of reserve reduction per week for 8 weeks...

This rate and monthly magnitude of reserve reduction is probably unprecedented... previous "QT" maximum rate of reserve reduction was about $50b per month...

Perhaps that is why the Fed stopped the QT the same 2 months earlier than planned ... lets hope so. ... as that would have reduced total system reserves over the same period by another $70B... might have created a situation where they reduced depository reserve assets by $300b over 8 weeks... again probably unprecedented and perhaps chaos inducing in bank regulatory processes and market for US Treasury securities...

It looks like we now get to see what happens to risk asset prices as depositories experience a perhaps unprecedented reduction in non-risk reserve assets of about $230B in 8 weeks...