Summary:

This is funny ever more figurative language from the unqualified here: "Translation: the bond vigilantes are back, only this time it is not to push rates higher, but to make sure the Fed wins the race to the bottom, even as the biggest asset bubble of all time gets even bigger, creating a "huge risk" that in just a few months the Fed will be forced to intervene and to stop the ensuing melt up or risk losing all credibility. Goldman Finally Capitulates, Sees Rate Cuts In July And September https://t.co/0MVmdBj01V — zerohedge (@zerohedge) June 20, 2019 Okay now we are being told the "vigilantes!" are back BUT.. this time they don't threaten to make the bonds to go DOWN in price they instead are threatening to make the bonds go UP in price!!!LOL! What a bunch of dialectic trained Art

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

This is funny ever more figurative language from the unqualified here: "Translation: the bond vigilantes are back, only this time it is not to push rates higher, but to make sure the Fed wins the race to the bottom, even as the biggest asset bubble of all time gets even bigger, creating a "huge risk" that in just a few months the Fed will be forced to intervene and to stop the ensuing melt up or risk losing all credibility. Goldman Finally Capitulates, Sees Rate Cuts In July And September https://t.co/0MVmdBj01V — zerohedge (@zerohedge) June 20, 2019 Okay now we are being told the "vigilantes!" are back BUT.. this time they don't threaten to make the bonds to go DOWN in price they instead are threatening to make the bonds go UP in price!!!LOL! What a bunch of dialectic trained Art

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

This is funny ever more figurative language from the unqualified here:

"Translation: the bond vigilantes are back, only this time it is not to push rates higher, but to make sure the Fed wins the race to the bottom, even as the biggest asset bubble of all time gets even bigger, creating a "huge risk" that in just a few months the Fed will be forced to intervene and to stop the ensuing melt up or risk losing all credibility.

Goldman Finally Capitulates, Sees Rate Cuts In July And September https://t.co/0MVmdBj01V— zerohedge (@zerohedge) June 20, 2019

Okay now we are being told the "vigilantes!" are back BUT.. this time they don't threaten to make the bonds to go DOWN in price they instead are threatening to make the bonds go UP in price!!!

LOL! What a bunch of dialectic trained Art Degree morons!!!!

|

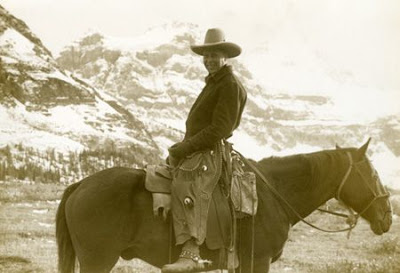

| (Figurative image included to try to help morons understand hypocrisy. -Ed.) |