Summary:

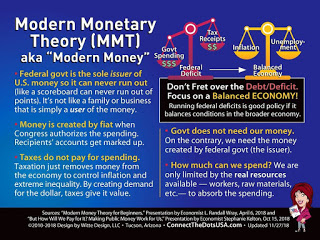

When MMT started to gain acceptance in some parts of the mainstream, the neoclassical economists fiercely fought back, but now it looks like they are finally losing the debate. More and more people are now prepared to give it a try because they think it looks feasible. 7. Conclusion MMT proponents must feel that their moment has arrived at last. The core elements of their proposal are being more widely accepted by mainstream economists and now, with COVID, being put into practice. Big deficits are being rolled out everywhere, partly funded by central bank money creation. Debt hawks and inflation alarmists have largely gone silent, and the bond-market vigilantes are no-where to be seen. The MMT promise of free funding for deficits has turned out to be almost true because

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

When MMT started to gain acceptance in some parts of the mainstream, the neoclassical economists fiercely fought back, but now it looks like they are finally losing the debate. More and more people are now prepared to give it a try because they think it looks feasible. 7. Conclusion MMT proponents must feel that their moment has arrived at last. The core elements of their proposal are being more widely accepted by mainstream economists and now, with COVID, being put into practice. Big deficits are being rolled out everywhere, partly funded by central bank money creation. Debt hawks and inflation alarmists have largely gone silent, and the bond-market vigilantes are no-where to be seen. The MMT promise of free funding for deficits has turned out to be almost true because

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

7. Conclusion

MMT proponents must feel that their moment has arrived at last. The core elements of their proposal are being more widely accepted by mainstream economists and now, with COVID, being put into practice. Big deficits are being rolled out everywhere, partly funded by central bank money creation. Debt hawks and inflation alarmists have largely gone silent, and the bond-market vigilantes are no-where to be seen. The MMT promise of free funding for deficits has turned out to be almost true because interest rates are so low and expected to remain so for the foreseeable future. Their view that inflation is caused by running the economy ‘too hot’, rather than by excessive money creation, is now more widely accepted.

Eureka Report