You can see the type of slope ($/time) needed to really cause a big crash by looking at the last 2 they did in the graphs below... by “big crash” I mean one of the substantial 30% to 40% reductions in equity index asset prices (not to mention the associated real chaos) we have been getting once in a while over last couple of decades whenever they add large amounts of reserves in a short period of time and the depositories don’t have the regulatory capital to support it...The one last year was about a 0B increase in these Assets in about 3-4 weeks which was accompanied by a free fall in equity index prices into March 25th...

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

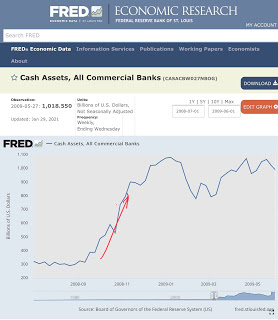

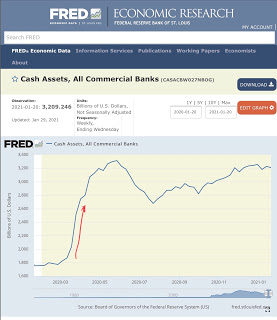

You can see the type of slope ($/time) needed to really cause a big crash by looking at the last 2 they did in the graphs below... by “big crash” I mean one of the substantial 30% to 40% reductions in equity index asset prices (not to mention the associated real chaos) we have been getting once in a while over last couple of decades whenever they add large amounts of reserves in a short period of time and the depositories don’t have the regulatory capital to support it...

The one last year was about a $700B increase in these Assets in about 3-4 weeks which was accompanied by a free fall in equity index prices into March 25th...