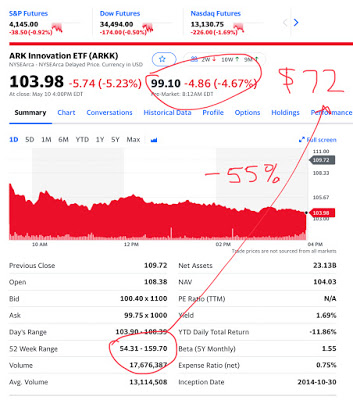

Popular Tech ETF... The Fed’s CCAR regulations have the ‘big five” (JPM, C, WFC, BAC, GS) price setters somehow hedged down to a 55% equity price reduction so for this thing that’s the level from its recent high of about 0... probably significant support down at that level (if it gets there) ... currently down about 35% from recent high so 20% above there now...

Topics:

Mike Norman considers the following as important:

This could be interesting, too:

Robert Vienneau writes Austrian Capital Theory And Triple-Switching In The Corn-Tractor Model

Mike Norman writes The Accursed Tariffs — NeilW

Mike Norman writes IRS has agreed to share migrants’ tax information with ICE

Mike Norman writes Trump’s “Liberation Day”: Another PR Gag, or Global Reorientation Turning Point? — Simplicius

Popular Tech ETF... The Fed’s CCAR regulations have the ‘big five” (JPM, C, WFC, BAC, GS) price setters somehow hedged down to a 55% equity price reduction so for this thing that’s the $72 level from its recent high of about $160... probably significant support down at that level (if it gets there) ... currently down about 35% from recent high so 20% above there now...